ETF anticipation and institutional adoption propel cryptocurrency to new heights

Bitcoin's (BTC) recent resurgence and the anticipation of Bitcoin ETF approval are indicative of a significant shift in the cryptocurrency landscape. Several key factors and insights can be gleaned from this situation, suggesting a positive outlook for Bitcoin and its impact on the broader financial market.

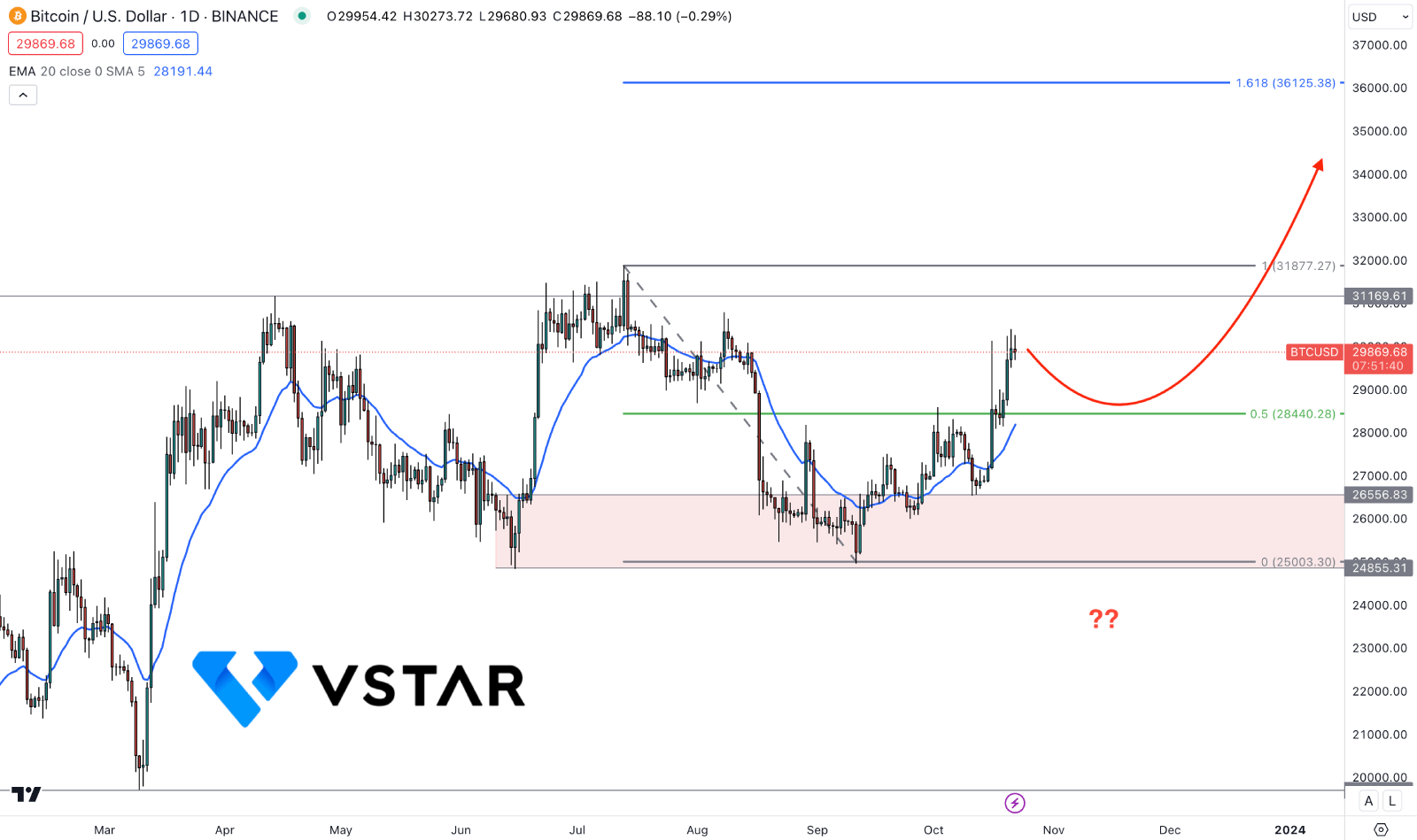

First, the recent price movements in Bitcoin are reminiscent of historical developments in the financial world, particularly the launch of the first Gold ETF. Bitcoin's rally, briefly surpassing $35K and pushing past a critical resistance point of $31K, is attributed to BlackRock's listing of its Bitcoin ETF, indicating growing interest from institutional investors. This listing has prompted a surge in the price of Bitcoin, which is currently trading above $34K.

This surge is seen as a preview of the potential impact of ETF approval. Many of these expectations have already been priced into Bitcoin since it reached $25Kin February. The narrowing discount gap on the Grayscale Bitcoin Trust (GBTC) suggests that some investors who bought at a 40% discount may be looking to sell at current prices.

Bitcoin's dominance in the market has increased, drawing market share away from Ethereum and stablecoins. The shift towards Bitcoin as a "flight to quality" during economic uncertainties is reminiscent of the role gold played in the past. Bitcoin is increasingly being viewed as a modern equivalent of gold, providing a safe haven for investors.

Bitcoin ETFs

The emergence of Bitcoin ETFs is seen as a key driver of this confidence in the cryptocurrency. The fact that BlackRock has advanced its Bitcoin ETF application and appeared on the Depository Trust & Clearing Corp. website indicates a high level of preparation and optimism.

The rapid increase in Bitcoin's price in a short period, driving it above $35K, demonstrates the renewed interest in the cryptocurrency. This level hasn't been seen since May 2022 when the crypto industry faced significant challenges. The recent positive sentiment is largely attributed to the prospect of Bitcoin ETFs, which are expected to make it easier for a broader pool of investors to access the cryptocurrency.

While Grayscale currently operates the largest exchange-traded Bitcoin product, the structure of a trust has limitations. However, recent developments, including a court's criticism of the SEC's rejection of Grayscale's ETF application, suggest a changing regulatory environment that may favor Bitcoin ETFs.

Potential Risks

The surge in Bitcoin's price led to significant liquidations of derivative positions, highlighting the potential risks associated with rapid price movements. The market report from Galaxy Digital also highlights the significance of the options market, with options dealers needing to adjust their positions as Bitcoin's price changes.

In conclusion, Bitcoin's recent rally and the anticipation of Bitcoin ETFs suggest a positive outlook for the cryptocurrency market. The convergence of interest from institutional investors, regulatory developments, and a shifting perception of Bitcoin as a safe haven asset indicate that Bitcoin's role in the financial world is evolving. However, it's essential to remain cautious of the inherent volatility in the cryptocurrency market, especially as ETF approval processes continue to unfold.

Source: tradingview.com