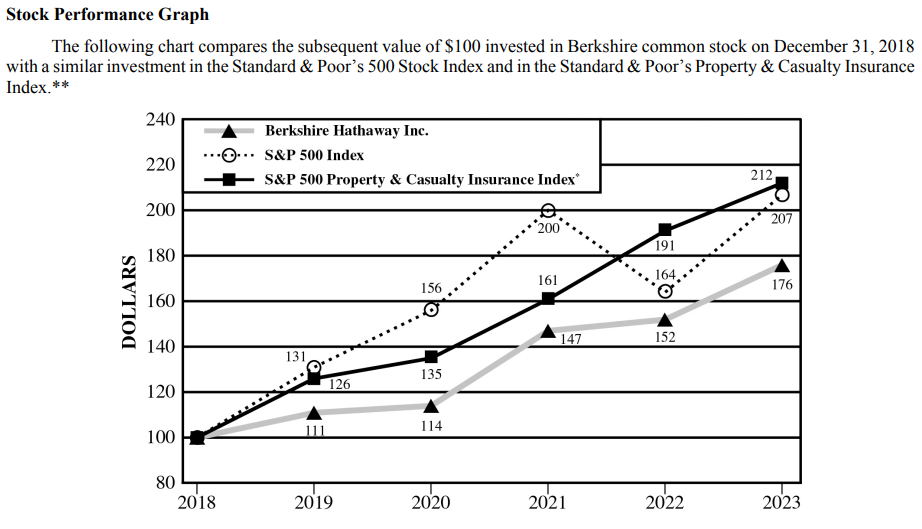

- Berkshire's insurance underwriting segment rebounds significantly: After-tax earnings surged to $5.4 billion in 2023 from a $30 million loss in 2022, showcasing resilience and strategic acumen.

- Steady growth in insurance investment income: After-tax earnings soared to $9.6 billion in 2023, marking a 47.5% increase year-over-year, driven by adept investment strategies.

- Diversified revenue streams fortify financial resilience: Despite challenges, earnings from operating businesses increased by 2.0% in 2023, buoyed by strategic maneuvers and acquisitions.

- Strategic investments and acquisitions drive growth: Notable acquisitions, including an increased interest in Pilot Travel Centers, underscore Berkshire's vision and financial astuteness.

Explore the resurgence of Berkshire's insurance underwriting, the steady rise in investment income, and confrontations with operational hurdles. With a microscope on 2023 performance data, learn the fundamental pillars propelling Berkshire's growth in 2024.

Source: BRK Annual Report

Solid Performance in Insurance Underwriting

Berkshire Hathaway's prowess in insurance underwriting serves as a fundamental strength driving its rapid growth potential. The company has consistently demonstrated resilience and profitability in this segment, evident in its financial performance over the past three years.

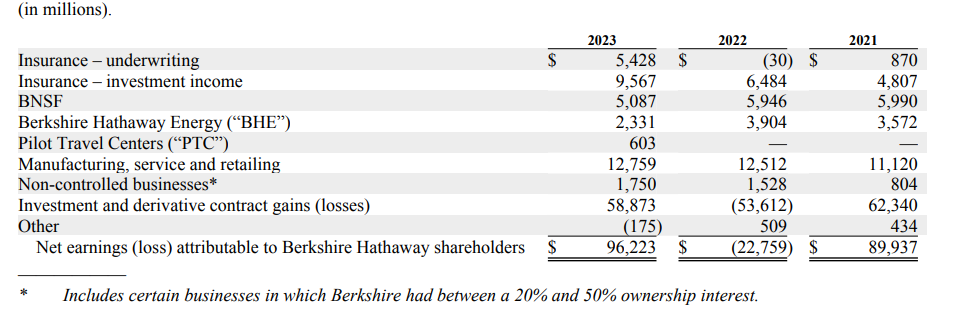

In 2023, Berkshire's insurance underwriting segment reported after-tax earnings of $5.4 billion, marking a considerable turnaround from losses of $30 million in 2022 and earnings of $870 million in 2021. This impressive recovery underscores Berkshire's ability to navigate challenges and capitalize on opportunities within the insurance industry.

Source: BRK Annual Report

One key factor contributing to Berkshire's success in 2023 was the relatively low losses from considerable catastrophe events during the year. Additionally, improved underwriting results at GEICO, driven by premium rate increases and lower claims frequencies, played a crucial role in boosting earnings. It's worth noting that underwriting losses in 2022 were partly attributed to accelerating claims costs at GEICO and considerable catastrophe event losses.

Moreover, Berkshire's adoption of ASU 2018-12 positively impacted earnings, contributing to the increase in underwriting earnings by $60 million in 2022 and $142 million in 2021. This demonstrates the company's proactive approach to adopting accounting standards to enhance financial outcomes.

Steady Growth in Insurance Investment Income

Another key strength of Berkshire Hathaway lies in its steady growth in insurance investment income. Over the past three years, the company has consistently delivered solid performance in this segment, reflecting its sound investment strategies and ability to capitalize on market opportunities.

In 2023, Berkshire reported a notable increase in after-tax earnings from insurance investment income, amounting to $9.6 billion, representing a 47.5% increase compared to the previous year. Similarly, in 2022, earnings from this segment grew by 34.9% compared to the prior year. These impressive growth rates underscore Berkshire's proficiency in optimizing its investment portfolio to generate substantial returns.

The primary driver behind this growth is higher short-term interest rates, which resulted in considerable increases in earnings from short-term investments. Berkshire's ability to adapt its investment strategy to changing market conditions highlights its agility and proactive approach to wealth management.

Diversified Revenue Streams in Operating Businesses

Berkshire Hathaway's diversified portfolio of operating businesses is a key driver of its rapid growth potential. The company's operating businesses span various industries, including manufacturing, services, retailing, utilities, and energy, providing a robust foundation for revenue generation and profitability.

Despite facing challenges such as the COVID-19 pandemic, geopolitical conflicts, and supply chain disruptions, Berkshire's operating businesses have demonstrated resilience and adaptability. In 2023, earnings from manufacturing, service, and retailing businesses increased by 2.0% compared to the previous year and by 12.5% compared to 2021.

This growth was driven by various factors, including increases at certain industrial products manufacturers and services businesses, as well as the impact of Alleghany's non-insurance businesses acquired in 2022. Additionally, Berkshire's ongoing efforts to optimize operational efficiency and capitalize on market opportunities have contributed to the growth of its operating businesses.

Considerable Investment and Derivative Contract Gains

Berkshire Hathaway's considerable investment and derivative contract gains play a crucial role in supporting its rapid growth potential. Over the past three years, the company has reported substantial gains from investments in equity securities and derivative contracts, contributing significantly to its overall financial performance.

In 2023, Berkshire reported investment and derivative contract gains of $58.9 billion, marking a remarkable turnaround from losses of $53.6 billion in 2022. These gains predominantly derived from investments in equity securities and included considerable net unrealized gains from market price changes.

Despite inherent volatility, Berkshire's investment gains underscore its proficiency in capital allocation and investment management. The company's disciplined approach to investing, guided by Warren Buffett's value investing principles, has enabled it to identify attractive investment opportunities and generate superior returns over the long term.

Furthermore, Berkshire's strategic investments in companies like Pilot Travel Centers ("PTC") and its ability to capitalize on acquisition opportunities contribute to its investment success. The acquisition of an additional interest in PTC in 2023 and subsequent consolidation of its results of operations reflect Berkshire's strategic focus on expanding its investment portfolio and driving value creation.

Solid Financial Position and Capital Allocation

Berkshire Hathaway's robust financial position and prudent capital allocation strategies are fundamental strengths that support its rapid growth potential. The company maintains considerable liquidity and a solid capital base, providing it with the flexibility to pursue growth opportunities and withstand economic uncertainties.

As of December 31, 2023, Berkshire's shareholders' equity stood at $561.3 billion, reflecting a substantial increase of $87.8 billion compared to the previous year. This growth was driven by after-tax investment gains of approximately $58.9 billion, highlighting the importance of prudent capital allocation in driving shareholder value.

Berkshire's common stock repurchase program, as amended, underscores its commitment to enhancing shareholder value while ensuring financial strength and liquidity. The program allows Berkshire to repurchase its Class A and Class B shares at prices below intrinsic value, as conservatively determined by Warren Buffett. This approach reflects Berkshire's disciplined approach to capital allocation and its focus on maximizing long-term shareholder returns.

Furthermore, Berkshire's ample cash reserves and investments in U.S. Treasury Bills provide it with a solid foundation for pursuing growth opportunities and weathering economic downturns. The company's conservative approach to debt management and its emphasis on maintaining financial strength and redundant liquidity further enhance its ability to support rapid growth and capitalize on strategic opportunities.

Strategic Investments and Acquisitions

Berkshire Hathaway's strategic investments and acquisitions are key drivers of its rapid growth potential. The company has a long history of making successful investments in companies across various industries, driving value creation and enhancing shareholder returns.

In 2023, Berkshire made considerable investments and acquisitions, including the acquisition of an additional interest in Pilot Travel Centers ("PTC") and the subsequent consolidation of its results of operations. These strategic moves align with Berkshire's diversified business strategy and contribute to expanding its presence in key sectors.

The acquisition of PTC reflects Berkshire's focus on investing in companies with solid growth prospects and sustainable competitive advantages. By increasing its ownership stake in PTC, Berkshire can capture a larger share of the company's earnings and drive long-term value creation.

Decreasing Profitability in Key Operating Segments

One considerable fundamental weakness of Berkshire Hathaway that may harm the company's rapid growth potential is the decreasing profitability in key operating segments, particularly in BNSF and Berkshire Hathaway Energy (BHE).

BNSF:

In 2023, BNSF reported after-tax earnings of $5.1 billion, representing a 14.4% decline from the previous year's earnings of $5.9 billion. This decline in profitability is notable and could adversely affect Berkshire Hathaway's overall financial performance.

The primary drivers behind this decline include lower overall freight volumes and higher non-fuel operating costs, partially offset by lower fuel costs. While lower fuel costs provide some relief, they are outweighed by the negative impact of reduced freight volumes and higher operating costs, resulting in decreased profitability for BNSF.

BHE:

Similarly, Berkshire Hathaway Energy reported after-tax earnings of $2.3 billion in 2023, reflecting a considerable decline of 40.3% compared to the previous year's earnings of $3.9 billion. This substantial decrease in profitability raises concerns about the performance of this key operating segment.

The decline in earnings from Berkshire Hathaway Energy is primarily attributable to lower earnings from U.S. regulated utilities, driven by increased wildfire loss estimates, as well as lower earnings from other energy businesses and real estate brokerage businesses. These factors collectively contribute to the overall decline in profitability for Berkshire Hathaway Energy in 2023.

Berkshire Hathaway Stock (NYSE: BRK.B) Technical Take

Source: tradingview.com

The Berkshire Hathaway stock price may hit $511 by the end of 2024. The projection is based on the stock's current momentum and Fibonacci retracement. Although the BRKB stock has encountered a minor resistance (at the midpoint of two major resistances).

After Buffett's letter, the price reversed back to the immediate resistance range. Now, this price range ($408.75–$406.15) serves as support. On the downside, the price may still have the potential to hit $388.25 (a pivot of the trend). As there is no breachish divergence in the relative strength index (RSI), the downside move may be limited (if it occurs).

On the upside, the BRK.B stock price may rise back to hit $453, which is a core resistance (as of now), but potential high volatility in H2 2024 may push the price further up to reach $511. The trend is still up and solid, as suggested by the trend line (purple) and RSI at 85 (highly overbought).

In conclusion, Berkshire Hathaway's strategic moves and solid fundamentals position it for growth, with a projected target of $511 by late 2024. Despite challenges in key segments, such as declining profitability in BNSF and Berkshire Hathaway Energy, the conglomerate's solid insurance underwriting, steady investment income, and diversified topline fortify its financial stance. Technical analysis indicates a bullish trajectory, signaling potential resistance at $453 and possible surges to $511.