- Bank of America exhibited a competitive price return of +29% over 12 months, slightly underperforming the S&P 500 (+31%) but outperforming its benchmark, SPDR S&P Bank ETF (+24%).

- Despite slight underperformance in price returns, BAC yielded a +40% total return (price + dividend), surpassing both S&P 500 and the ETF.

- Strong financial performance, evidenced by robust earnings and revenue growth, underscores BAC's resilience and growth potential.

- Challenges include managing net interest income (NII) sensitivity to interest rates and predicting earnings amidst rate uncertainties, potentially impacting market valuations.

The article dissects Bank of America's (NYSE: BAC) investment performance against market benchmarks and explores its fundamentals. Moreover, it delves into the strategic progress fueling the bank's growth engine and adversities amidst macro conditions and interest rate uncertainties.

BAC Stock Investment Performance

Over the last 12 months, Bank of America (NYSE: BAC) has delivered competitive price returns of +29% against the S&P 500's +31%. Despite a slight underperformance against the market, the stock has outperformed its benchmark, SPDR S&P Bank ETF (KBE), which delivered a +24% price return over the period.

Source: tradingview.com

However, considering the total return, Bank of America stock has decisively outperformed the market and the benchmark. BAC yielded a +40% total return (price + dividend) against the S&P 500's +32% and SPDR S&P Bank ETF's +31% total return. The performance makes stocks a considerable investment in the banking space.

Source: morningstar.com

Bank of America Fundamentals Supporting Valuations

Strong Financial Performance

Bank of America's robust financial performance serves as a cornerstone for its growth potential, with key metrics such as earnings growth and revenue expansion indicating the bank's resilience and ability to capitalize on market opportunities.

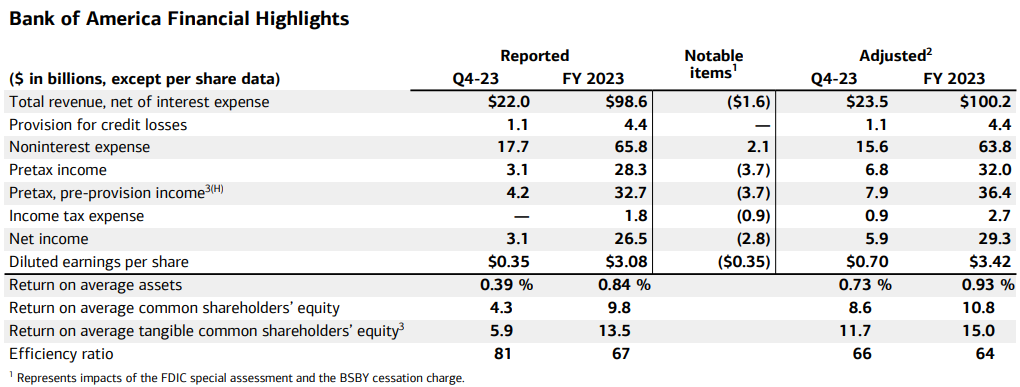

Source: Press Release_4Q23

Earnings Growth:

Bank of America's earnings growth trajectory is a critical indicator of its financial health and operational efficiency. In 2023, the bank reported a net income of $26.5 billion after tax, with adjusted net income reaching $29.3 billion after tax. These figures represent significant increases compared to previous years, underscoring the bank's ability to generate sustainable profits amidst evolving market conditions.

The growth in earnings is further highlighted by the earnings per share (EPS) metric, which stood at $3.42 for 2023, reflecting a 7% increase over the previous year. This growth is particularly noteworthy as it demonstrates the bank's ability to enhance shareholder value through effective capital allocation and operational performance.

Moreover, the consistency in earnings growth over the years reflects Bank of America's ability to navigate economic cycles and deliver value to its stakeholders. By continuously optimizing its revenue streams, managing expenses, and mitigating risks, the bank reinforces investor confidence and lays a solid foundation for future growth initiatives.

Revenue Growth:

Bank of America's revenue growth is a key driver of its financial performance, with diversified income streams contributing to sustained top-line expansion. In 2023, the bank reported a 5% increase in adjusted full-year revenue, driven by a 9% improvement in net interest income (NII) and robust asset management fees.

The growth in NII, a core component of the bank's revenue, reflects favorable interest rate environments and effective balance sheet management. Despite facing headwinds such as slowing NII in the latter part of the year, Bank of America's ability to maintain positive revenue growth underscores its resilience and adaptability in dynamic market conditions.

Additionally, the contribution of asset management fees to revenue growth highlights the bank's success in capitalizing on fee-based income opportunities. By offering a comprehensive suite of wealth management services and investment products, Bank of America strengthens its position as a trusted financial advisor and enhances its revenue diversification efforts.

Overall, the bank's ability to drive revenue growth through a combination of net interest income and fee-based income streams positions it favorably for sustained financial performance and value creation.

Robust Balance Sheet Management

Capital Strength:

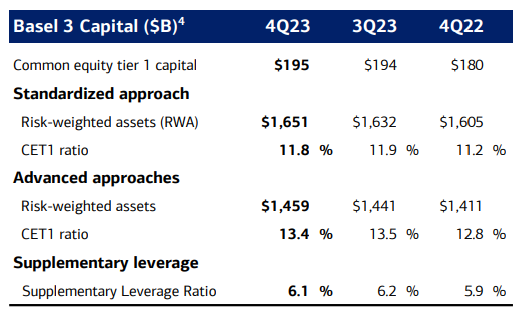

Bank of America's capital strength is a cornerstone of its stability and resilience, providing a solid foundation for its lending activities and risk management practices. As of the Q4 of 2023, the bank reported a Common Equity Tier 1 (CET1) capital ratio of 11.8%, surpassing regulatory requirements and highlighting its robust capital position.

Source: Presentation Materials_4Q23

The CET1 ratio serves as a key measure of a bank's capital adequacy and ability to absorb losses during periods of financial stress. By maintaining a CET1 ratio above regulatory thresholds, Bank of America demonstrates its commitment to prudent capital management and risk mitigation.

Moreover, the bank's strong capital position enhances investor confidence, facilitates access to funding markets, and supports sustainable growth initiatives. With ample capital reserves, Bank of America is well-positioned to seize market opportunities, pursue strategic acquisitions, and navigate economic downturns without compromising its financial stability.

Liquidity Management:

Bank of America's liquidity management practices are geared towards ensuring sufficient funding to meet operational needs, regulatory requirements, and unexpected contingencies. As of the Q4 of 2023, the bank reported high levels of liquidity, with global liquidity sources amounting to $933 billion, reflecting its commitment to maintaining ample liquidity buffers.

Additionally, the bank's strong liquidity position enables it to support lending activities, facilitate client transactions, and respond to market disruptions effectively. By maintaining robust liquidity buffers, Bank of America reinforces its reputation as a trusted financial institution capable of meeting the needs of clients and stakeholders under various market conditions.

Asset Quality and Risk Management:

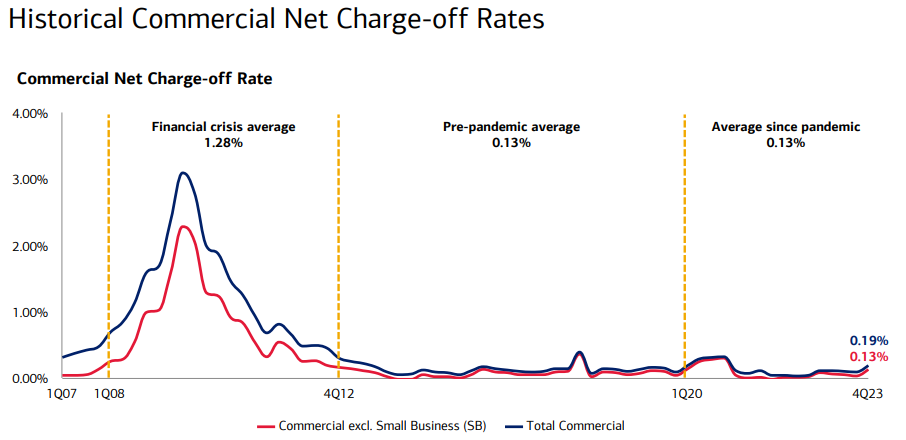

Bank of America reported total credit reserves of $30.5 billion, reflecting its prudent approach to managing credit risk amid economic uncertainties and market volatilities. Bank of America's focus on asset quality and risk management is instrumental in preserving the integrity of its balance sheet and mitigating credit-related losses. The bank employs rigorous credit underwriting standards, risk monitoring processes, and portfolio diversification strategies to manage credit risk effectively.

Moreover, the bank maintains solid asset quality, with net charge-offs moving higher but remaining favorable compared to historic averages. As of Q4, Bank of America reported consumer net charge-off rates of 0.80% and commercial Net charge-off rates of 0.19% (0.13% excluding Small Business-SB), reflecting prudent risk management practices and a well-managed loan portfolio.

Source: Presentation Materials_4Q23

The bank's proactive approach to credit risk assessment, including stress testing and scenario analysis, enables it to identify potential vulnerabilities and take preemptive measures to mitigate risks.

Strategic Growth Initiatives

Digital Transformation:

As of Q4 2023, Bank of America reported significant growth in digital engagement, with over 46 million active digital banking users and approximately 37.9 million mobile banking users. The bank continues to invest in digital capabilities, user interface enhancements, and mobile app functionalities to drive higher adoption rates and promote self-service banking among its customer base.

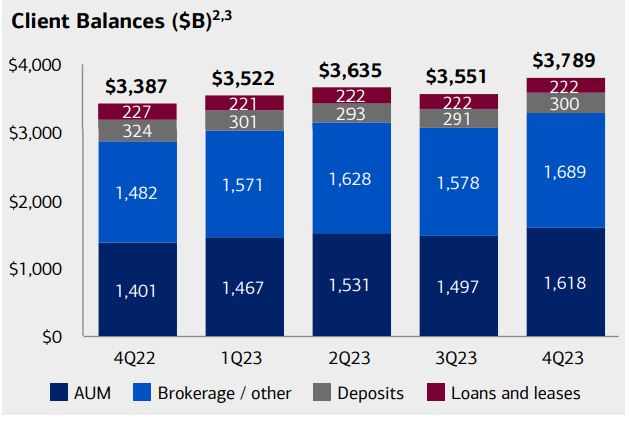

Furthermore, Bank of America reported total client balances of $3.8 trillion, reflecting the success of its client-centric strategy in attracting and retaining assets across various business lines. The bank's comprehensive suite of products and services, combined with personalized advisory support and digital tools, enhances the overall client experience and strengthens customer loyalty.

Source: Presentation Materials_4Q23

Furthermore, Bank of America's focus on relationship banking enables cross-selling opportunities, product diversification, and revenue growth across its customer base.

Client Base Growth Strategy

Consumer Banking:

Bank of America's Consumer Banking division remains a cornerstone of its membership growth strategy, characterized by consistent net addition of checking accounts and robust client engagement. In 2023, the bank added 600,000 net new checking accounts, marking the 20th consecutive quarter of net additions. The quality of these checking accounts is underscored by the fact that 92% of them are primary accounts within client households, reflecting deep customer relationships.

The bank's emphasis on digital transformation and innovation has bolstered customer engagement levels, with record digital customer engagement and satisfaction scores reported in 2023. Bank of America's industry-leading digital platforms have facilitated seamless account opening processes, enhanced accessibility to banking services, and personalized customer experiences, driving customer acquisition and retention efforts.

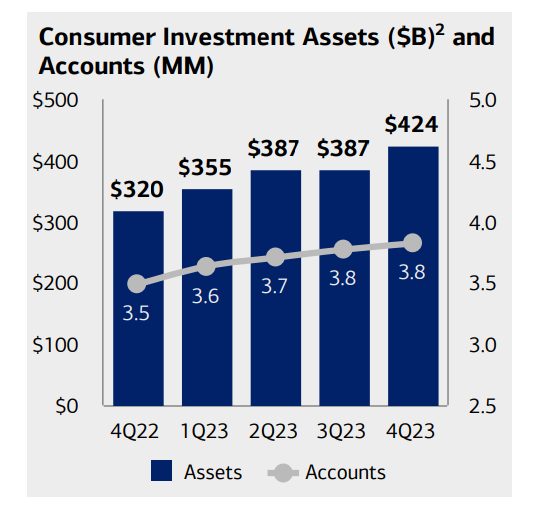

Furthermore, Bank of America's Consumer Banking segment has witnessed significant growth in investment balances, with consumer clients' investment balances reaching a record $424 billion in 2023. This highlights the bank's success in cross-selling investment products and wealth management services to its consumer banking clientele, further strengthening customer relationships and driving revenue growth.

Source: Presentation Materials_4Q23

Global Wealth Management:

Bank of America's Global Wealth Management division plays a pivotal role in attracting high-net-worth individuals (HNWIs) and affluent clients, contributing to overall membership growth and revenue diversification. In 2023, the division added more than 40,000 net new relationships across Merrill Lynch and The Private Bank, underscoring its ability to attract and retain affluent clientele.

The bank's wealth management advisors focus on delivering personalized financial solutions and comprehensive wealth management services tailored to the unique needs and objectives of high-net-worth clients. With an average Merrill account size exceeding $1 million at opening and significantly higher average account sizes in The Private Bank, Bank of America's Global Wealth Management division caters to the sophisticated financial needs of affluent clientele.

Furthermore, Bank of America's wealth management advisors have been instrumental in driving banking product adoption among wealth management clients, opening 150,000 new banking accounts for wealth management clients in 2023. This holistic relationship approach not only deepens client engagement but also expands the bank's product penetration within the affluent segment, driving incremental revenue growth.

Global Banking:

In 2023, Bank of America added approximately 2,500 new Commercial and Business Banking clients, more than double the number added in the previous year, underscoring the division's strong client acquisition momentum. The bank's relationship managers play a crucial role in deepening client relationships, providing financing solutions, treasury services, and strategic advice to clients with diverse local and global banking needs.

Moreover, Bank of America's expansion into new markets and investment in relationship management teams have supported membership growth initiatives within the Global Banking segment. By leveraging its extensive product capabilities, global network, and industry expertise, Bank of America continues to attract and retain corporate and institutional clients, driving revenue growth and market leadership in the global banking space.

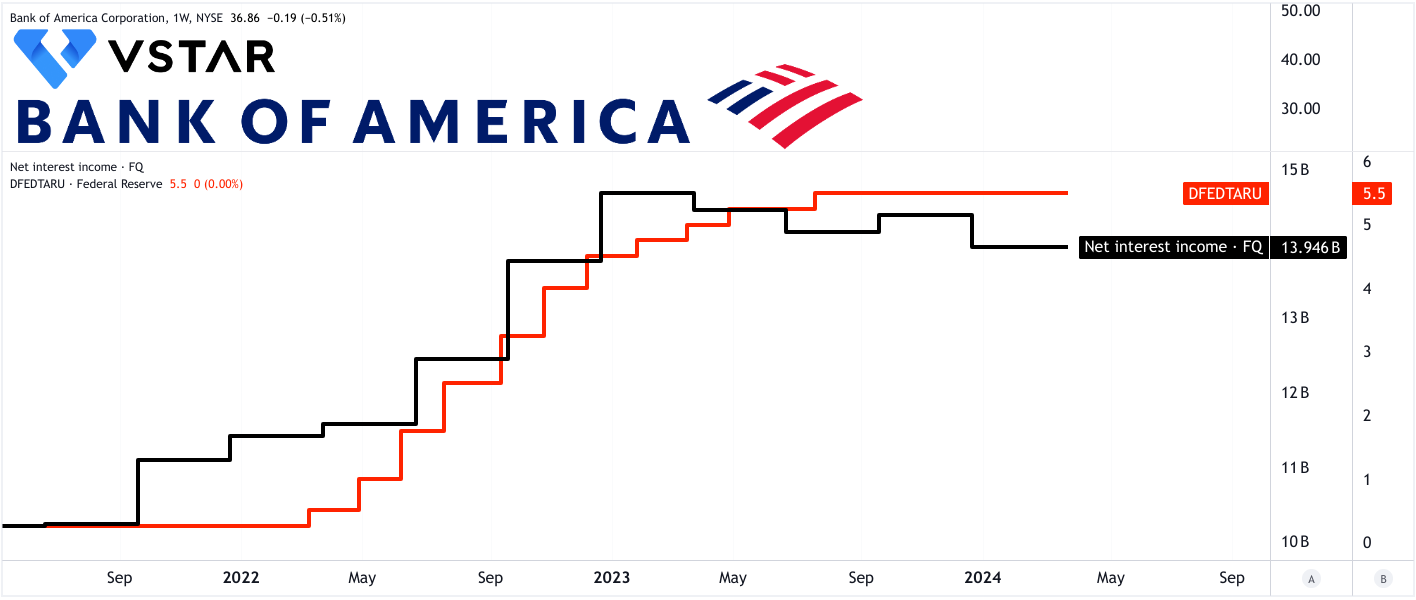

Major Downside

Bank of America faces a fundamental weakness in its net interest income (NII) performance, specifically concerning its sensitivity to interest rate movements and the challenges it encounters in managing deposit costs. Throughout 2023, the bank experienced notable fluctuations in NII, with the Q4 demonstrating a decline of $400 million compared to the previous quarter, despite the benefit of higher rates on asset yields. This weakness in NII poses significant obstacles to Bank of America's growth potential and financial stability.

Source: tradingview.com

The dependence on the interest rate environment presents a major challenge for Bank of America. While higher interest rates may positively impact asset yields, they also exert pressure on deposit costs. The bank struggles to manage these costs effectively, leading to a decline in NII despite the benefit from increased asset yields. This sensitivity to interest rate movements underscores the importance of accurately forecasting and adapting to changes in the interest rate environment.

Moreover, Bank of America's forward view acknowledges uncertainties in the interest rate curve, complicating its ability to predict NII performance accurately. Fluctuations in the forward curve, including changes in the number of projected rate cuts, further exacerbate these uncertainties. As a result, the bank faces challenges in developing strategies to mitigate the impact of interest rate fluctuations on its NII.

The challenges in managing deposit costs represent another specific weakness for Bank of America. Despite efforts to control pricing, the bank continues to experience pressure on deposit margins. Higher rates lead to increased costs associated with attracting and retaining deposits, further eroding NII margins. This difficulty in managing deposit costs is compounded by the ongoing normalization of credit and the impact of higher rates on deposit pricing.

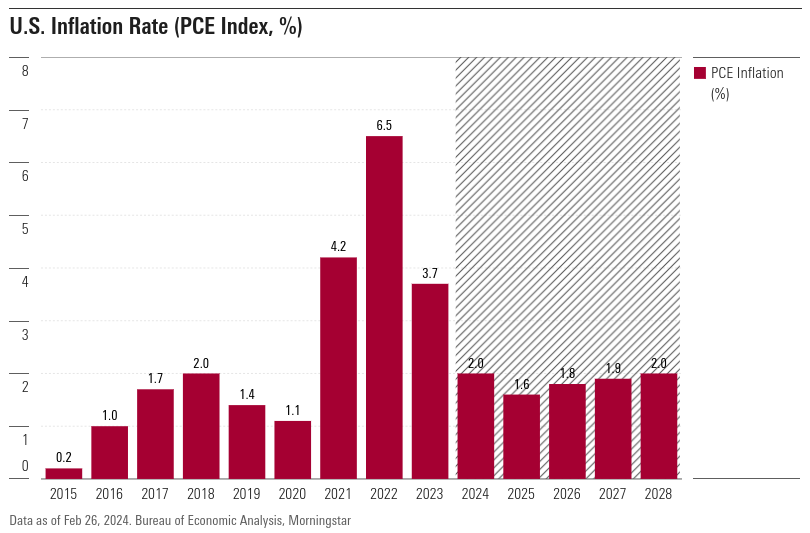

Source: morningstar.com

From a broader perspective, the Fed may change its hawkish stance on interest rates in 2024, as it is expected that the inflation rate may come back to the Fed's target range of 2%. This may lead to systematic rate cuts by the Fed, which in turn will hurt Bank of America's NII and valuations.

Source: seekingalpha.com

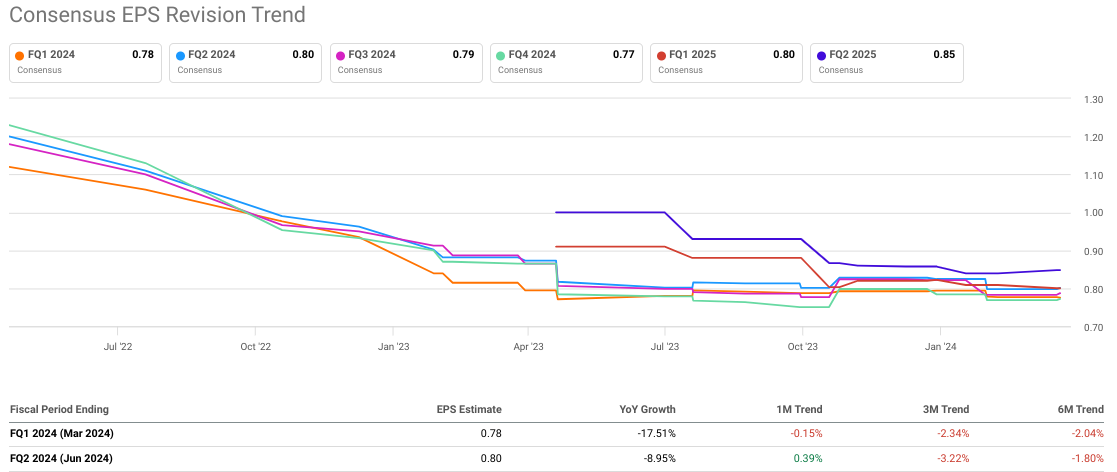

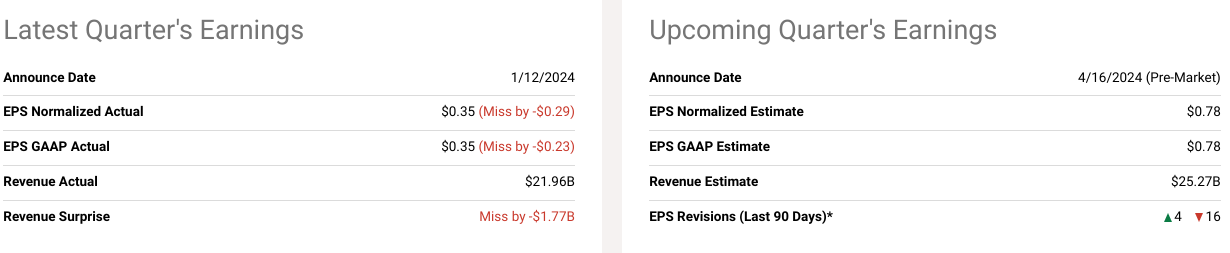

The consensus EPS estimates are also in the same direction. These estimates signal a rapid drop in EPS in the upcoming quarters. This is a negative development for the bank's market valuations. The expected YoY drop in EPS in Q1 and Q2 2024 of near 18% and 9% projects the bank's dropping bottomline. The bank has already missed Wall Street expectations for Q4 2023. This can be the scenario for the upcoming earnings. Logically, another sequential topline and bottom miss may create a considerable drop in the stock price.

Source: seekingalpha.com

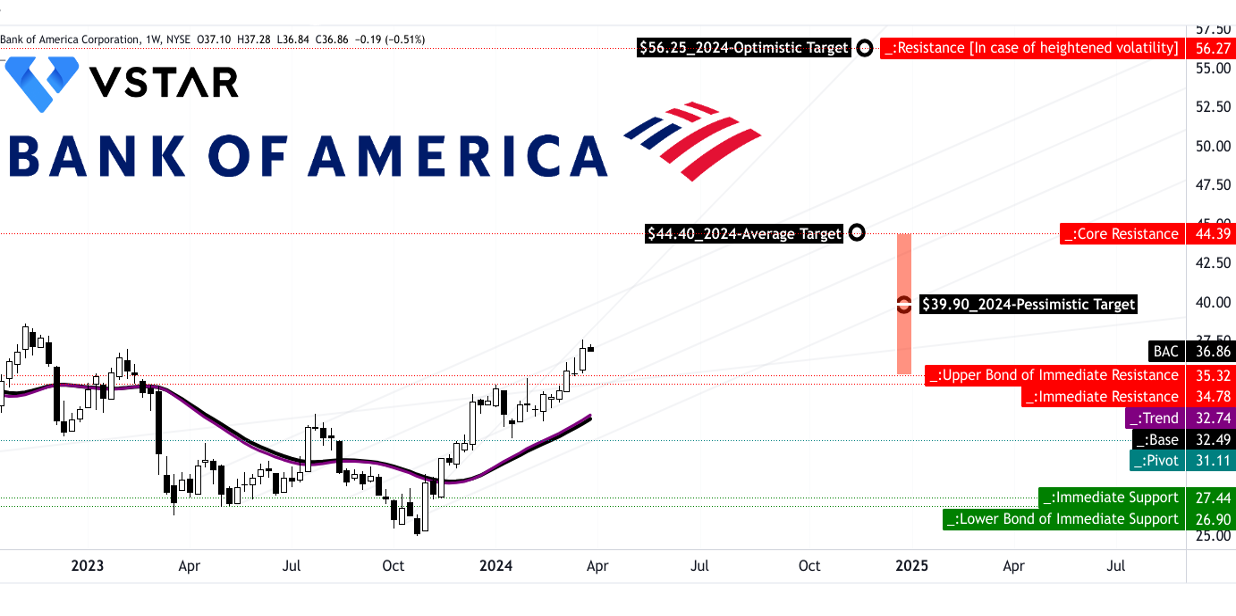

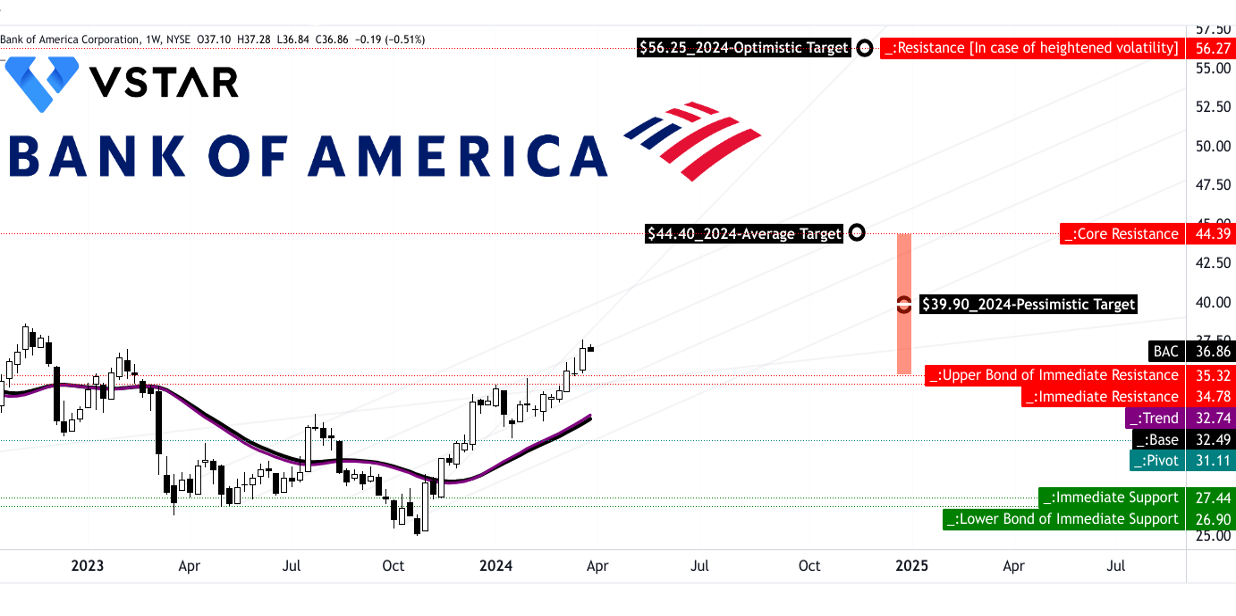

BAC Stock Forecast: Technical Take

Based on the current stock price momentum (6M) and Fibonacci levels, the stock may hit $56.25. However, based on a conservative stance, $44.40 can be considered a price target for the year. From a pessimistic perspective, $39.90 is the target. These projections are projected over the stock's 'change in polarity' patterns.

Under the ongoing uptrend, as suggested by the trend line (purple), the stock price is already well above the horizontal price channel. Therefore, the price target at core resistance is attainable under the current macro conditions. On the downside, the immediate resistance zone of $35.32–$34.78 and pivot level of $31.11 can be considered vital support levels for the year.

Source: tradingview.com

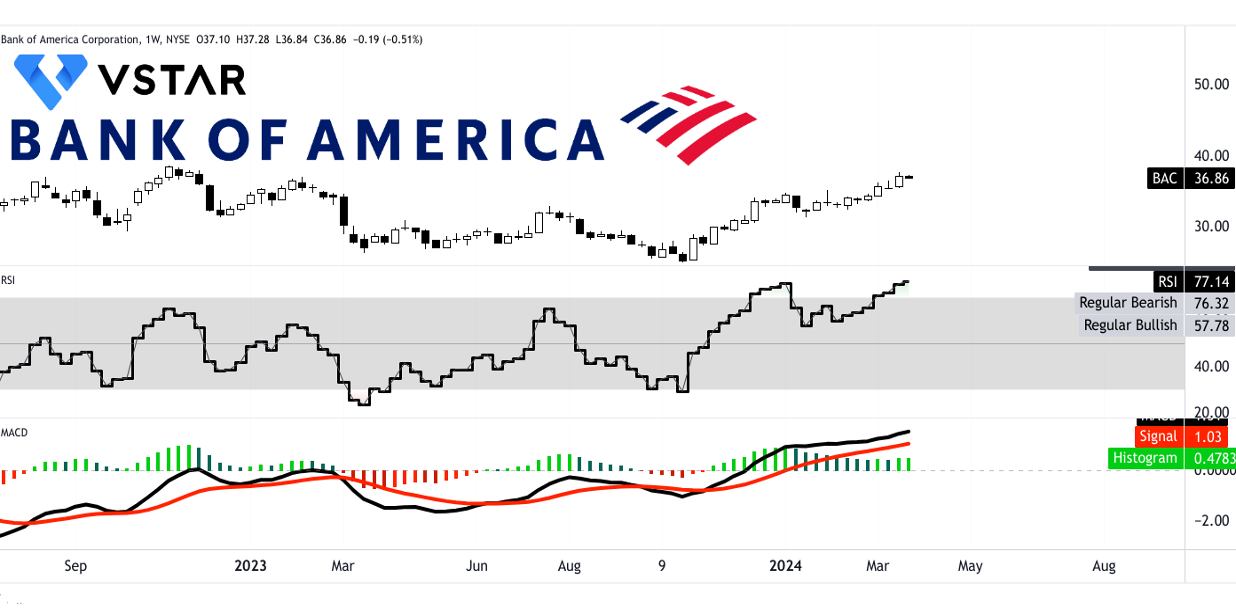

Looking at the relative strength index (RSI) and moving average convergence divergence (MACD), Bank of America stock price is currently following a markup phase. RSI (at 77) is above its regular bearish level of 76, which breeds the major possibility of a sideways price movement.

Meanwhile, there is no clear bearish divergence emerging, but a small correction can be expected (a minor possibility). The MACD line has been progressing above the signal line for around six months. However, momentum is getting weaker, as can be observed from the histogram.

In short, over the immediate resistance zone, BAC stock price may continue to be bullish with strong momentum. Notably, any correction below that level may push the price into bearish trajectory.

Source: tradingview.com

In conclusion, despite the dependency on NII exposes vulnerability to interest rate fluctuations. A potential Fed rate cut coupled with expected EPS declines pose downside risks to market valuations. Technically, the stock shows bullish momentum, with a projected target of $56.25. Yet, caution is warranted as resistance levels and weakening momentum indicators suggest potential corrections. In sum, while BAC exhibits strength, vigilance is crucial amidst looming uncertainties, particularly in interest rate trends and earnings outlooks.