Bank of America Corp (NYSE: BAC) stock price has declined about 5% since January, but it remains Warren Buffett's favorite bank stock. Buffett's Berkshire Hathaway recently purchased more than 22 million additional shares of Bank of America, raising its position in the stock to more than 1 billion shares.

Also, hedge funds are increasing their holdings of BAC stock. Over the past few months, various hedge funds have purchased an additional 20 million shares of Bank of America stock.

Investors looking for the best financial stocks to buy on the dip may want to consider BAC stock.

The difficult economic climate has led to the failure of several banks. This has caused many investors to rethink their exposure to financial stocks. While Buffett has recently dropped several financial stocks from Berkshire's portfolio, the successful billionaire investor continues to show strong confidence in BAC stock.

Read on to find out why elite investors like Buffett's Berkshire, Vanguard and BlackRock are confident in BAC stock while dumping other bank stocks.

Bank of America Stock (NYSE: BAC) News

1. Bank of America Earnings Beat Estimates

The bank reported second-quarter earnings that not only improved from the year-ago period, but also beat Wall Street's expectations. It posted EPS of $0.88, versus the $0.84 expected and the $0.73 reported a year ago. The bank benefited from high interest rates as its revenue from loans rose sharply.

2. Bank of America to Open Branches in More States

The bank plans to open consumer branches in four new states as it seeks to expand its footprint and close the gap with its rival JPMorgan. BAC is targeting Alabama, Nebraska, and New Orleans for the new retail branches. The expansion drive will bring the bank to a total of nine additional states. That would give Bank of America a retail presence in 39 states. JPMorgan has a retail presence in 49 states.

3. Bank of America to Invest $500 Million in Minority-Led Funds

The bank has decided to more than double its commitment to funds led by women and minority entrepreneurs. It has increased its commitment from $200 million to $500 million. Despite their potential, women and minority-led businesses are typically under-resourced. BAC will help by providing these businesses with the capital they need to thrive.

Bank of America (NYSE: BAC) Overview

Bank of America is a multinational financial services provider. The company has a market cap of more than $250 billion. In addition to banking services such as checking and savings accounts and loans, the bank also offers wealth management and investment services. It is headquartered in Charlotte, North Carolina.

Founded in 1904, Bank of America was initially called Bank of Italy. It changed its name sometime in the 1930s. It is worth noting that Bank of America has evolved over the years through mergers and acquisitions and that some parts of the company date back to the 1780s. An Italian-American banker Amadeo Giannini founded Bank of America.

Bank of America CEO Brian Moynihan has been with the bank for many years, rising through the ranks to become its top executive. Moynihan studied history and law in college.

Bank of America is the second largest bank by assets behind JPMorgan Chase (NYSE: JPM).

Bank of America's Top 5 Shareholders

BAC stock is a favorite of many institutional investors. These are some of the major Bank of America shareholders and their stakes in the company:

|

Shareholder |

Stake |

|

Berkshire Hathaway |

13% |

|

Vanguard Group |

7.3% |

|

BlackRock Fund Advisors |

3.8% |

|

SSgA Funds Management |

3.6% |

|

Fidelity Management |

2.3% |

Key Milestones in Bank of America's History

|

Year |

Milestone |

|

1909 |

Bank of America opens its first branch outside of San Francisco. |

|

1929 |

Bank of America surpasses 450 banking offices in California. |

|

1977 |

Bank of America launches card network Visa. |

|

1983 |

Bank of America expands outside of California with the acquisition of Washington-based Seafirst. |

|

1992 |

Bank of America acquires Security Pacific Corporation in what became the banking industry's largest ever acquisition at that time. |

Bank of America's Business Model

Bank of America is a giant financial provider with footprints in several dozen countries and a range of business lines. Its clients include individual consumers, large corporations and government entities. As a result, the bank has multiple revenue sources.

How Bank of America Makes Money

The company offers banking, asset management, investments, and a range of other financial services. It makes money from interest on loans and fees. Banking is the company's largest source of income, accounting for more than 60% of total revenue.

Bank of America's Major Business Segments

The bank operates through three major business segments, which house eight business lines. These are the bank's major business segments:

- For People:This unit provides retail banking and other financial services to American consumers and small businesses. It consists of four business lines, including wealth management and private banking services for wealthy people.

- For Companies:Consisting of three business lines, this segment serves large clients from around the world, including companies with at least $5 million in annual revenue. The other client targets of this unit are municipalities and government agencies.

- For Institutions:You can think of this segment as the bank's wholesale arm. It serves clients in the financial services business. This includes hedge funds, pension funds, and everything in between. The unit offers debt, equity, commodities, and forex services.

Bank of America's Financials

Investors usually study financial statements to try to identify the best stock to buy. If you're considering Bank of America as the best bank stock to buy now, it helps to explore the company's financial performance.

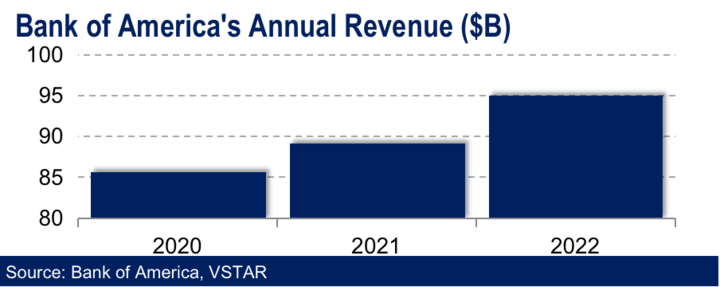

1. Bank of America's Revenue

In 2022, the bank reported $95 billion in revenue, which increased from revenue of $89.1 billion in 2021. It reported revenue of $85.5 billion in 2020. The chart below shows Bank of America's annual revenue trend.

The bank is off to a strong start in 2023. Its revenue rose 11% year over year to $25.2 billion in the second quarter. This followed a 13% revenue increase in the first quarter. Analysts expect Bank of America's revenue to grow more than 6% to more than $100 billion in 2023.

2. Bank of America's Net income

The bank has been consistently profitable for many years. Its profit rose 19% year-over-year to $7.4 billion in the second quarter of 2023, building on the 15% profit increase in the first quarter.

In 2022, Bank of America reported a net income of $27.5 billion. The profit was $32 billion in 2021 and $17.9 billion in 2020.

While Bank of America is consistently profitable, its profit figures can fluctuate from year to year. Such fluctuations can be caused by changes in the economic and regulatory conditions.

The bank's trailing 12-month return on equity is 12%.

3. Bank of America's Profit Margins

The bank's operating profit margin improved from 38.1% in 2021 to 53.8% in 2022, which was an improvement from 22.2% in 2020. Not only has the bank maintained its operating margin above 20% for the past 5 years, but the metric has also improved in each of the past 3 years.

4. Bank of America's Cash Position and Balance Sheet Condition

This company is flush with cash. It had more than $1 trillion in cash and short-term investments at the end of June. This is up from just over $890 billion at the end of March.

The bank's balance sheet is also in great shape. The balance sheet shows more than $3.1 trillion in assets and manageable debt of just $286 billion.

BAC Stock Analysis

1. Bank of America Stock Valuation

BAC stock currently trades at a forward P/E ratio of 9.86, a forward P/S ratio of 2.53 and a forward P/B ratio of 0.90. See below how Bank of America's valuation metrics compare to those of its big bank peers.

|

Forward P/E |

Forward P/S |

P/B ratio |

|

|

Bank of America |

9.86 |

2.53 |

0.90 |

|

JPMorgan |

11.64 |

3.02 |

1.46 |

|

Wells Fargo |

10.36 |

2.15 |

0.94 |

|

U.S. Bancorp |

8.85 |

2.09 |

1.14 |

|

Citigroup |

8.19 |

1.14 |

0.44 |

As you can see, BAC stock has a better forward P/E valuation than JPMorgan and Wells Fargo stock. Moreover, Bank of America has the best PB ratio of all the big banks featured except Citigroup.

2. BAC Stock Trading Information

Bank of America stock is listed on the NYSE under the ticker symbol "BAC".

Regular trading in BAC stock begins at 9:30 a.m. ET and ends at 4 p.m. However, you can begin trading BAC stock as early as 4 a.m. in the premarket sessions. You can continue trading BAC stock until 8:00 p.m. by taking advantage of the extended trading hours in the after-hours session.

Nearly 50 million shares of Bank of America trade hands each day, making it one of the most active financial stocks in the market.

3. Bank of America Stock Split History

The bank has split its stock three times since the IPO. The first BAC stock split was a 2-for-1 in November 1986. The second BAC stock split was also a 2-for-1 in February 1997. The bank implemented another 2-for-1 stock split in August 2004. It is not known when the next BAC stock split will occur.

After the three Bank of America stock splits, an original position of 1,000 shares in the company has grown to 8,000 shares.

Companies typically split their stock to make it more accessible to retail investors by lowering the share price. As a result, stock splits can increase demand for a stock and raise its price by making it more affordable to small investors.

4. BAC Stock Dividend Yield

Bank of America has paid dividends consistently for many years. The company has a quarterly dividend distribution schedule, so it pays dividends four times a year.

In 2022, it paid an annual dividend of $0.86 per share, which increased from $0.78 in 2021. Bank of America has paid increasing annual dividends for 14 consecutive years.

BAC stock currently offers a dividend yield of 3%, which is above the industry average of 2.11%.

5. BAC Stock Performance

Currently trading at $32, BAC stock is down about 5% since the beginning of the year. The stock has traded in a range of $26 to $39 over the past year. At the current price, the stock is up more than 23% from its 52-week low and is trading at a 20% discount to its 52-week high.

6. BAC Stock Forecast

Assessing Bank of America stock predictions can help you decide whether BAC stock is a good long-term investment.

About two dozen analysts have issued price forecasts and ratings for BAC stock. The average BAC stock price forecast of $37 implies an upside of 15%. The highest BAC stock price target of $52 implies an upside of more than 60%. The BAC stock price target of $28 implies a downside of about 10%.

The consensus analyst rating on Bank of America stock is a buy.

7. Bank of America Stock Short Interest

While the market is generally bullish on the outlook for Bank of America stock, a tiny group of investors has been betting against BAC stock.

About 70 million shares of Bank of America stock have been sold short, representing about 1% of the bank's outstanding shares. While this indicates a low level of short interest in Bank of America stock, it is worth noting that the number of shares sold short is nearly twice the stock's average daily volume. Therefore, if short sellers rush to close their positions all at once, a short squeeze could occur - albeit briefly. And that could drive up BAC stock price.

8. BAC Stock Technical Analysis

As you can see in the chart above, BAC stock hit its 52-week low in March and quickly rallied as investors decided it had become too cheap to ignore.

While BAC stock has had several ups and downs since then, you can see that the stock has been making higher lows in recent months.

In July, the stock broke above a long-standing resistance point at $30. The stock has regained much of the ground it lost earlier in the year. While the stock faces resistance at $33, it has established strong support at $31.

With the stock still trading well below its December 2022 high of $50, there is momentum to push it higher.

Bank of America's Opportunities and Challenges

Bank of America's Opportunities

While Bank of America is already one of the largest banks with billions of dollars in revenue and profits, it still has room to grow. Here are some of the bank's growth opportunities:

1. International Markets

Bank of America operates in about 38 countries. But with 200 countries in the world, there is still plenty of room for the bank to expand internationally. The World Bank estimates that there are 1.4 billion unbanked adults worldwide. Many of these people are in emerging markets in Latin America, Asia and Africa.

While Bank of America has a presence in a few dozen countries, the U.S. market still accounts for the vast majority of its revenue. Therefore, entering additional markets can allow the bank to both develop additional revenue streams and reduce its dependence on the U.S. market.

2. Wealth Management Services

Bank of America's wealth management business caters to high net worth individuals and offers a range of services. The U.S. has the largest number of ultra high net worth individuals - those with more than $50 million in assets.

The number of wealthy people worldwide is growing, with significant increases in the Middle East and Asian countries such as China and India. Knight Frank forecasts that the global population of ultra-high net worth individuals will grow by nearly 30% by 2027.

This represents a growing pool of potential clients for Bank of America's wealth management services. Expanding into international markets would allow the bank to take greater advantage of this opportunity.

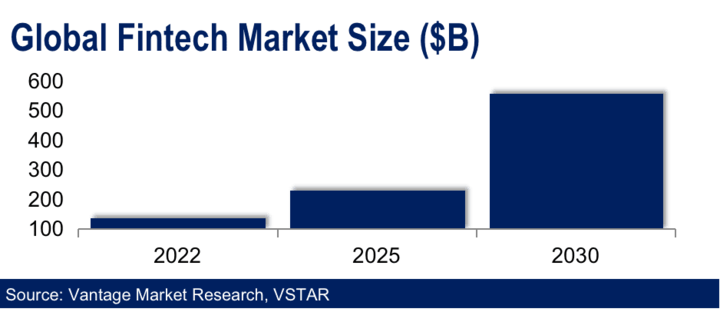

3. Fintech Services

The demand for technology-based financial services (fintech) is growing. According to Vantage Market Research, the global fintech market is expected to grow from $133 billion in 2022 to more than $550 billion by 2030.

While Bank of America has launched several fintech products, there are still many opportunities for the bank to explore in this space. For example, there are impressive opportunities in areas such as digital wallets, online stock and crypto trading, and digital credit cards.

Pursuing opportunities in this space can allow the bank to both grow and diversify its revenue streams.

4. AI Technology

Bank of America can apply artificial intelligence technology in several impactful ways across its operations. For example, it could use AI technology to automate various functions to improve its customer experience and operational efficiency.

In addition, the bank could use AI to develop new products and create additional revenue streams. It could also use AI to enhance its existing products to make them more appealing, which can increase customer loyalty and generate more revenue.

Bank of America's Risks and Challenges

1. Tight Regulations

The financial sector is highly regulated, both in the United States and abroad. As a major financial institution, Bank of America is subject to a variety of domestic and international regulatory requirements. Increased regulatory requirements may slow the Bank's growth, increase its compliance costs and adversely affect its profitability.

2. Interest Rate Fluctuations

Banks are generally sensitive to changes in interest rates, and Bank of America is no exception. Interest on loans accounts for a large portion of banks' profits. The lending business is more profitable when interest rates are high. But a low interest rate environment reduces the profit opportunity for banks in the lending business.

3. Cybersecurity Threats

As Bank of America works to modernize its operations, it is building a significant digital footprint. While this offers many benefits, it also presents a number of challenges. For example, it exposes the bank to cybersecurity threats. A hack of Bank of America's digital systems could disrupt the bank's normal operations, cause significant financial losses, and lead to reputational damage.

4. Intense Competition

The financial services industry is highly competitive. Bank of America faces competitive pressures not only from traditional banks, but also from credit unions and fintech providers. The following are some of Bank of America's major competitors and the threats they pose:

|

Competitor |

Threat |

|

JPMorgan |

JPMorgan is Bank of America's largest competitor in the consumer and commercial banking market. With retail branches in 49 states, JPMorgan has a deeper retail footprint in the U.S. than Bank of America. |

|

Citigroup |

Bank of America and Citigroup are fierce competitors in the U.S. consumer banking market. The banks also compete overseas to provide global financial services, wealth management, and investment products. |

|

Wells Fargo |

Wells Fargo is Bank of America's other big rival in the consumer banking market in areas such as checking and savings accounts, credit cards, and home loans. |

|

Cash App |

Cash App from Square parent Block competes with Bank of America in the peer-to-peer (P2P) money transfer market. The bank offers P2P services through Zelle. Its other rival in this space is PayPal's Venmo. |

Bank of America's Competitive Advantages

1. Solid Financial Position

In addition to a strong balance sheet, the Bank maintains a solid capital base. This means that the Bank can meet increasingly stringent regulatory capital requirements without facing restrictions that could hamper its operations. In addition, the Bank's strong financial position puts it in a much better position than many of its competitors to weather adverse economic conditions.

2. Strong Brand Recognition

In an industry where competitors offer much of the same services, brand position can make a big difference for a bank. Bank of America's history dates back to 1904. With more than 100 years in business, Bank of America has built a household name in the banking industry.

This strong brand position helps build customer trust in the bank. And trust contributes to customer loyalty, so the bank has built a large customer base and has a high customer retention rate.

3. Diversified Business Operation

The Bank's business operations include three business segments and eight business lines. The business lines include consumer banking, corporate banking, and investment management. Bank of America's operations are more diversified than those of many of its competitors.

Diversification means that the bank has multiple sources of revenue, which allows it to spread its risks. As a result, the bank can withstand adverse economic conditions in some markets better than many of its competitors.

4. Digital Solutions

Bank of America has invested heavily in technology innovation, both on its own and in partnership with other banks. As a result, the bank now offers a range of digital solutions that make life easier for its customers. For example, the bank's app includes features that allow users to manage their accounts, deposit checks, transfer money and pay bills from their mobile phones.

Bank of America and other banks teamed up to create Zelle, a peer-to-peer money transfer platform. Building on Zelle's success, the banks are working on a digital wallet product that connects to debit and credit cards.

Why Traders Should Consider BAC Stock

Bank of America (NYSE: BAC) is consistently profitable, financially stable, and a regular dividend payer. The company also has many competitive advantages and exciting growth opportunities. In addition, the stock trades at more favorable valuation metrics than many other major banking stocks.

BAC stock typically has a tight 52-week range. Therefore, the current steep pullback from the 52-week high and the 2022 high indicates that the stock has become cheap and could provide a decent profit opportunity.

BAC Stock Trading Strategies

Before you start trading Bank of America stock, you will want to determine the best trading strategy to pursue. You can approach BAC stock investing in several different ways, depending on your investment goals. Here are two common BAC stock trading strategies:

1. Long-Term Investment Strategy

This investing method involves buying Bank of America stock and holding it in your portfolio for at least one year. It works best for those with long investment horizons who can afford to wait several years for returns. However, this investment strategy typically requires a large initial investment and regular portfolio rebalancing.

2. Short-Term Investment Strategy

In short-term investing, the goal is to make a profit over a short period of time, such as a day or a week. While short-term investing in BAC stock can take different forms, the most popular strategy is to trade BAC stock CFDs.

The beauty of BAC stock CFD trading is that you can start with a small amount of money and still make huge profits by using leverage. In addition, CFD trading gives you greater flexibility in terms of trading duration. For example, you can set your trades to last from a few minutes to several weeks.

Trade BAC Stock CFD with VSTAR

VSTAR is an excellent CFD broker for beginners and pro traders alike, as you can see from its highly positive Trustpilot reviews. You can start trading BAC stock CFD on VSTAR with as little as $50 and use the platform's generous leverage to boost your position.

VSTAR provides a low-cost trading platform with its tight spreads and no-commission standard accounts. The broker is fully licensed and regulated, so you can rest assured that your funds are safe with VSTAR.

Consider opening your VSTAR account today to start trading BAC stock CFD. If you're new to CFD trading, the platform offers as much as $100,000 in a demo account to help you practice trading before you start investing real money.

Final Thoughts

You would be hard-pressed to find a better bank stock than BAC stock. Even in these crisis times for the banking industry, many elite investors are showing their confidence in Bank of America stock by snapping up more shares. BAC stock forecasts show that the stock has significant room to run.

You can hold Bank of America stock for long-term gains or trade BAC stock CFDs for short-term profits with VSTAR.