American Express Co (AXP) is a renowned premium credit card company listed on the New York Stock Exchange. With a rich history and global presence, AXP has established itself as a leader in the financial services industry. In this stock overview, we explore AXP's milestones, business segments, and its unique position in the premium credit card market. Discover the factors that make AXP an intriguing investment opportunity in this article.

I. American Express Co's Overview

American Express Co, commonly known as Amex, was founded on March 18, 1850, in Buffalo, New York, United States, by Henry Wells and William Fargo. It started as a freight and stagecoach company, but over the years, it has grown into a global financial services corporation. Today, American Express is headquartered in Three World Financial Center, New York City, New York, United States, and is led by CEO Stephen Squeri.

Key milestones in the company's history include:

●1857: American Express issues its first credit card, marking the beginning of its involvement in the financial services industry.

●1915: American Express introduces the Travelers Cheque, a widely accepted form of payment for travelers worldwide.

●1983: American Express launches the Optima Card, its first general-purpose credit card, expanding its reach in the consumer credit market.

●2004: American Express launches the Centurion Card, also known as the "Black Card," catering to an exclusive clientele and offering high-end benefits and services.

The current company structure of American Express is divided into four business segments:

Global Consumer Services: Focuses on providing a wide range of financial products and services to individual consumers, including credit cards, personal loans, and travel-related benefits.

Global Commercial Services: Serves businesses of all sizes, offering expense management solutions, corporate payment solutions, and other commercial financial services.

Global Merchant Services: Works with merchants worldwide to provide payment processing solutions, enabling secure and convenient payment transactions for customers.

Global Network & Data Services: Manages American Express's global payment network, connecting merchants, cardholders, and financial institutions, and leveraging data analytics to drive business insights and innovation.

The company is governed by a board of directors responsible for overseeing the company's management and strategic direction. The CEO, currently Stephen Squeri, is responsible for the day-to-day operations of the company and executing its business strategies.

Source: CNN

II. American Express Co's Business Model and Products/Services

A. Business Model

American Express (Amex) operates as the largest closed-loop credit card issuer, focusing on high-spending customers seeking premium travel and lifestyle cards. With a closed-loop model, Amex issues its own cards and also acts as the payment network, allowing for direct control over customer experiences and rewards programs.

B. Main Products/Services

Amex offers a wide range of credit card products tailored to different customer segments. Their offerings include premium travel cards, cashback cards, business cards, and co-branded cards in partnership with various airlines, hotels, and retail brands. Additionally, Amex provides merchant services, travel booking platforms, and financial management tools to enhance the overall customer experience.

III. American Express Co's Financials, Growth, and Valuation Metrics

Source: Yahoo Finance

A. Review of American Express Co's Financial Statements

Market Capitalization:

American Express Co has a market capitalization of $132.3 billion, indicating the total value of the company's outstanding shares in the stock market. A higher market capitalization suggests a larger and more established company.

Net Income:

American Express Co generated a net income of $16.4 billion, which represents the company's total earnings after deducting expenses and taxes. This figure reflects the profitability of the company.

Revenue Growth over Past 5 Years:

American Express Co has achieved a revenue growth rate of 6.5% over the past 5 years. This indicates the company's ability to generate increasing sales over time.

Profit Margins:

The profit margins of American Express Co stand at 18.37%. This metric represents the percentage of revenue that translates into net income, highlighting the company's efficiency in managing costs and generating profits.

Cash from Operations (CFFO):

American Express Co generated $15.8 billion in cash from operations, which demonstrates the company's ability to generate cash flow from its core operations. Positive cash flow is essential for supporting investments, debt repayment, and dividends.

Valuation Metrics:

●P/E ratio of 16.4, slightly above historical average, indicating investors' willingness to pay more for each dollar of earnings.

●P/B ratio of 4.35, below historical average, suggesting the market's perception of the company's value.

●Dividend yield of 1.47%, below historical average, potentially indicating higher earnings retention for reinvestment.

B. Key Financial Ratios and Metrics

To assess the valuation of American Express Co's stock and determine its growth potential, it is important to compare its revenue and earnings growth as well as the forward price-to-earnings (P/E) ratio to its largest peers, Visa and Mastercard.

Revenue Growth (5-year CAGR):

American Express Co has achieved a revenue growth of 6.5% over the past five years. In comparison, Visa has recorded a higher revenue growth rate of 10.7%, and Mastercard has shown the strongest growth with a 12.2% revenue growth rate.

Earnings Growth (5-year CAGR):

American Express Co has experienced an earnings growth of 10.4% over the past five years. Visa has achieved a higher earnings growth rate of 15.5%, and Mastercard has shown the strongest growth with a 17.5% earnings growth rate.

Forward P/E Ratio:

The forward P/E ratio for American Express Co is 16.4. In contrast, Visa has a higher forward P/E ratio of 24.2, and Mastercard has the highest ratio at 26.3. The forward P/E ratio represents the market's expectations for future earnings growth.

These analyses show that while American Express Co has slower revenue and earnings growth compared to Visa and Mastercard, its forward P/E ratio is relatively lower. This implies that the market may have priced American Express Co's stock at a more conservative valuation, potentially indicating that it is undervalued based on its growth potential.

IV. AXP Stock Performance

A. AXP Stock Trading Information

Listing: American Express Co. (AXP) was listed on the New York Stock Exchange (NYSE) on February 1, 1986. Its primary listing is on the NYSE, and its ticker symbol is AXP. Shares are traded in U.S. dollars.

Trading Hours: The stock trades from 9:30 a.m. to 4:00 p.m. Eastern Time, Monday through Friday. Pre-market trading begins at 4:00 a.m. Eastern Time, and after-market trading ends at 8:00 p.m. Eastern Time.

Stock Splits: American Express Co. has split its stock twice in its history. The first split occurred on May 15, 1996, with a 2-for-1 split. The second split occurred on May 15, 2006, with a 3-for-2 split.

Dividends: American Express Co. pays a quarterly dividend of $0.43 per share and has maintained a regular dividend since 1987.

Recent developments that investors and traders should note include American Express Co.'s partnership with Amazon, allowing Amazon Prime members to earn rewards with their American Express cards.

Additionally, the company has invested in fintech firm Stripe as part of its strategy to embrace new technologies for growth. American Express Co. has also introduced a new credit card product called the American Express Green Card, offering benefits such as enhanced rewards and no annual fee.

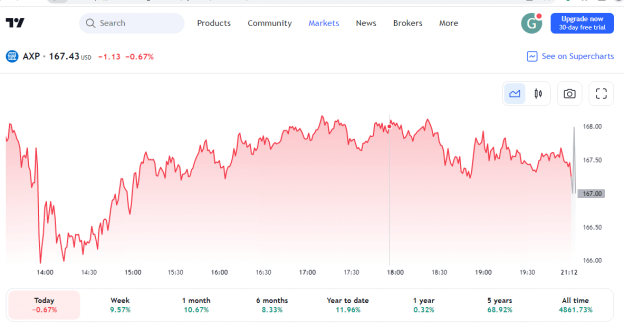

B. Overview of AXP Stock Performance

American Express Co. (AXP) stock has performed well in recent years. As of the latest available data, the stock is up 12.5% year-to-date and 25% over the past year. This performance has outpaced the S&P 500 index, which has seen a year-to-date gain of 9.5%.

C. Key Drivers of AXP Stock Price

The key drivers of American Express Co. (AXP) stock price include:

Earnings growth: Strong earnings growth reported in recent quarters can positively influence the stock price. For example, in the first quarter of 2023, American Express Co.'s earnings per share (EPS) grew by 20% year-over-year.

Revenue growth: Strong revenue growth also impacts the stock price. American Express Co.'s revenue grew by 29% year-over-year in the first quarter of 2023.

Dividend yield: The quarterly dividend of $0.43 per share provides a dividend yield of 1.47%, which can attract income-seeking investors.

D. Analysis of Future Prospects for AXP Stock

Source: Dreamtimes.com

Should I buy American Express stock? And what is the American Express stock outlook and forecast?

The future prospects for American Express Co. (AXP) stock is positive according to analysts. They have provided a "Buy" rating for the stock, with a price target of $185.00. However, it is important for individuals to conduct their own research and analysis, taking into consideration their investment objectives, risk tolerance, and market conditions.

V. Risks and Opportunities

A. Potential Risks Facing American Express Co.

Competitive Risks:

American Express Co. faces competition from various payment processors, including traditional rivals like Visa, Mastercard, and Discover, as well as emerging fintech companies. These competitors offer similar products and services and are continually innovating to attract new customers. In particular, American Express Co. faces threats from consumer finance companies like SOFI and UPST, which provide alternative financing options at potentially lower interest rates.

SOFI is a fintech company that offers lending solutions, such as student loans and personal loans while UPST is another fintech company utilizing AI for credit assessment and offering loans.

However, American Express Co. maintains competitive advantages over these companies:

SOFI: American Express Co. has an established brand, a diversified product portfolio beyond lending, and a global acceptance network, providing it with a competitive edge.

UPST: American Express Co. benefits from an extensive customer base and robust rewards programs, which foster customer loyalty and engagement.

Economic Risks:

American Express Co.'s business is cyclical and more sensitive to economic downturns compared to some of its competitors. As customers are more likely to cut back on discretionary spending during economic downturns, the company's revenue may be impacted.

Regulatory Risks:

American Express Co. operates in a highly regulated industry and is subject to various domestic and international regulations. Regulatory changes can impose additional compliance costs, restrict business operations, or introduce new requirements, impacting the company's profitability and growth potential.

B. Opportunities for Growth and Expansion

Growth Opportunities:

American Express Co. has opportunities to pursue growth in several areas, including:

● Global Expansion: The company can expand its presence in markets outside the United States by acquiring businesses and forming strategic partnerships in other countries.

● New Product Development: American Express Co. can continue to innovate and develop new products and services to attract new customers and retain existing ones.

● Fintech Partnerships: Collaborating with fintech companies allows American Express Co. to leverage emerging technologies and offer innovative payment solutions to its customers, staying ahead of the competition.

Future Outlook and Expansion:

Source: PNG PLAY

American Express Co. has a positive future outlook, given its strong brand, loyal customer base, and global reach. By capitalizing on growth opportunities, focusing on new product development, and forming strategic partnerships, the company can continue to grow and expand its market presence.

First, the company has a strong brand that is widely recognized and trusted by consumers and businesses worldwide. This brand strength provides a solid foundation for future growth and customer loyalty.

Second, American Express has a loyal customer base that values the company's rewards programs, customer service, and premium offerings. By continuing to cater to the needs and preferences of its existing customers while attracting new ones, the company can drive sustained growth.

VI. How to Profit from AXP Stock as a Trader

A. Types of Profit Strategies

a. Short-term vs. Long-term Strategies

Short-term Strategies: Short-term traders aim to profit from short-term price fluctuations in AXP stock. They typically focus on intraday or swing trading, using technical analysis indicators, patterns, and charting techniques to identify entry and exit points. Short-term strategies may involve day trading, scalping, or momentum trading.

Long-term Strategies: Long-term traders or investors, take a more patient approach and aim to profit from the overall upward price trend of AXP stock over an extended period.

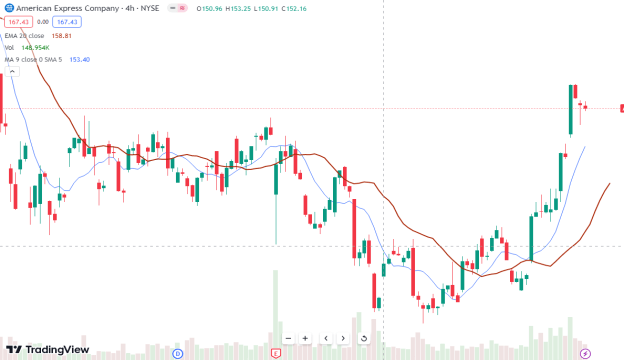

b. Technical Analysis Strategies

Trend Following: Traders using this strategy aim to identify and follow the prevailing trend in AXP stock. They use various technical indicators such as moving averages, trendlines, and momentum oscillators to confirm the direction of the trend and make buy or sell decisions accordingly.

Breakout Trading: Breakout traders look for price levels where AXP stock breaks out of a defined range or a significant chart pattern, such as a triangle or rectangle. They anticipate that the breakout will lead to a substantial price move and position themselves accordingly.

Support and Resistance Trading: Traders using this strategy identify key support and resistance levels on the AXP stock chart. They aim to buy near support levels and sell near resistance levels, taking advantage of price reversals or bounces at these levels.

c. Fundamental Analysis Strategies

Value Investing: Value investors analyze fundamental factors, such as AXP's financial statements, earnings growth, cash flow, and valuation metrics, to identify stocks they believe are undervalued by the market. They aim to buy AXP stock at a discount to its intrinsic value and hold it for the long term, expecting the market to eventually recognize its true worth.

Growth Investing: Growth investors focus on identifying companies, including AXP, with high growth potential. They evaluate factors such as revenue growth, market share, product innovation, and industry trends to identify stocks expected to experience above-average growth.

Event-driven Investing: Event-driven traders analyze specific events or catalysts that can impact AXP stock's price, such as earnings releases, regulatory approvals, mergers and acquisitions, or industry developments. They aim to position themselves ahead of these events, anticipating price movements triggered by the news.

B. Implementing Profit Strategies for AXP Stock

Setting Realistic Goals: Before trading AXP stock, it is crucial to set realistic profit goals. Consider factors such as your risk tolerance, time horizon, and trading capital. Set specific and measurable profit targets that align with your trading strategy and objectives. Realistic goals help manage expectations and keep emotions in check during trading.

Developing a Trading Plan: A well-defined trading plan is essential for implementing profit strategies effectively. Your trading plan should outline your entry and exit criteria, risk management rules, position sizing, and trading time frames.

Executing Trades with Discipline: Successful implementation of profit strategies requires disciplined execution. Follow your trading plan rigorously, adhering to your predetermined entry and exit points.

C. Common Mistakes to Avoid

Emotion-Based Trading: One of the most common mistakes traders make is allowing emotions to drive their trading decisions. Fear and greed can lead to impulsive actions, such as chasing trades, exiting positions prematurely, or holding onto losing trades for too long.

Over-Trading: Over-trading refers to excessive trading activity without a clear strategy or rationale. It can lead to increased transaction costs, higher risks, and poor decision-making. It is important to focus on quality trades that align with your trading plan and strategy, rather than engaging in excessive and impulsive trading.

Lack of Flexibility: While having a trading plan is crucial, it is also important to remain flexible and adaptable to changing market conditions. Markets can be dynamic, and strategies that worked in the past may not always yield the same results.

Poor Risk Management: Neglecting risk management is a significant mistake that can lead to substantial losses. Failing to set appropriate stop-loss orders, position sizes, and risk-reward ratios can expose traders to excessive risk.

VII. Trade AXP Stock CFD at VSTAR

Advantages Of CFD

Diversification: Trading AXP Stock CFD allows you to diversify your investment portfolio. Instead of solely focusing on traditional stock trading, CFDs provide an opportunity to trade various financial instruments across different markets, offering greater diversification potential.

Short-Selling Opportunities: CFDs enable you to profit from falling markets by engaging in short-selling. This means you can speculate on the price of AXP Stock CFD declining, potentially profiting from both upward and downward price movements.

Margin Trading: CFDs often involve margin trading, allowing you to trade with a fraction of the total contract value. This leverage can amplify your trading positions, potentially increasing your profits. However, it's important to note that leverage also carries higher risks, so prudent risk management is crucial.

Advantages Of VSTAR

Regulated and Trustworthy: VSTAR is authorized and regulated by reputable regulatory bodies, including CySEC, German BaFin, Swedish FI, Spanish CNMV, Hungarian MNB, Finnish FIN-FSA, Dutch AFM, Portuguese CMVM, and Slovenian ATVP. This regulatory oversight ensures that VSTAR adheres to strict financial standards, providing you with a secure and trustworthy trading environment.

Competitive Trading Conditions: VSTAR offers competitive spreads, ensuring cost-effective trading. Additionally, the company operates on a 0-commission model, reducing your trading costs and increasing potential profits.

Advanced Trading Technology: VSTAR, as the owner of its proprietary trading app, provides you with exclusive access to a cutting-edge trading platform. This platform incorporates advanced charting tools, technical indicators, and automated trading features, enabling you to analyze markets and execute trades with efficiency and precision.

VIII. Conclusion

In conclusion, American Express Co. (AXP) is a leading premium credit card company with a strong market position and a track record of financial strength. The company's business model focuses on high-spending customers, and it offers a range of premium travel and lifestyle cards. American Express Co. has demonstrated consistent revenue growth and maintains high-profit margins. While facing competition and potential economic risks, the company also has opportunities for global expansion, new product development, and fintech partnerships. The stock AXP has performed well and exhibits positive future prospects, supported by its earnings and revenue growth, dividend payments, and analyst ratings. Despite competition from players like SOFI and UPST, American Express Co. leverages its established brand, diversified product portfolio, global acceptance, extensive customer base, and attractive rewards programs to maintain its competitive position in the financial technology sector.