Introduction

AstraZeneca PLC is a leading pharmaceutical company known globally for its diverse portfolio of innovative medicines and vaccines for various diseases and conditions. Recently, AstraZeneca stock has garnered attention due to its involvement in developing and distributing one of the most widely used COVID-19 vaccines in partnership with Oxford University. However, the stock has also encountered challenges and controversies, including supply issues, safety concerns, and legal disputes regarding its COVID-19 vaccine contracts and deliveries.

AstraZeneca PLC’s Overview

AstraZeneca PLC, a multinational pharmaceutical company, traces its origins back to the merger of two prominent pharmaceutical firms, Astra AB and Zeneca Group PLC, in 1999. Headquartered in Cambridge, UK, the company boasts a global presence with operations spanning more than 100 countries and regions. AstraZeneca is fueled by a dedicated workforce of approximately 76,000 employees, committed to its mission of developing and providing life-changing medicines and vaccines that enhance the health and well-being of countless individuals worldwide.

Guiding AstraZeneca's endeavors is Pascal Soriot, the chief executive officer since 2012. Soriot brings a wealth of experience to the role, with a background in veterinary medicine and a distinguished career encompassing key positions in renowned pharmaceutical companies like Roche and Sanofi. Under Soriot's leadership, AstraZeneca continues to drive innovation, research, and development, striving to make a positive impact on the lives of millions through the delivery of groundbreaking pharmaceutical solutions.

AstraZeneca PLC’s Business Model and Products/Services

Source: BBC

How AstraZeneca makes money

AstraZeneca's core business model revolves around the exploration, advancement, production, and commercialization of pioneering medications and vaccines designed to address a wide range of therapeutic areas. These encompass oncology, cardiovascular ailments, renal and metabolic diseases (CVRM), respiratory disorders, immunology, neuroscience, infections, and rare conditions.

The company's revenue stems from the sale of its products and services to an extensive network of healthcare providers, governments, wholesalers, distributors, pharmacies, hospitals, clinics, and patients. Moreover, AstraZeneca also generates income through licensing fees, royalties, collaborations, co-promotions, and the divestment of its products or assets to external parties.

In terms of geographical revenue distribution, AstraZeneca boasts a well-rounded presence across four key regions. Its primary revenue driver lies in North America, predominantly the United States. Europe, which includes Russia and Turkey, serves as another significant market for the company. AstraZeneca has also prioritized its expansion efforts in emerging markets, encompassing countries like China, Brazil, India, Mexico, and more. Additionally, Japan holds strategic importance for AstraZeneca as it contributes to the company's revenue diversification strategy.

Main Products/Services

AstraZeneca boasts a diverse portfolio of products and services, addressing various unmet medical needs and holding strong market positions. Key products include:

● Tagrisso: Best-selling oral medicine for treating non-small cell lung cancer (NSCLC) with specific genetic mutations, generating sales of $4.3 billion in 2020.

● Imfinzi: Injectable medicine stimulating the immune system to combat NSCLC, bladder cancer, and small cell lung cancer. Achieved sales of $2 billion in 2020.

● Farxiga: Leading oral medicine for type 2 diabetes mellitus (T2DM), heart failure (HF), and chronic kidney disease (CKD), with sales of $1.9 billion in 2020.

● Crestor: Widely prescribed oral medicine for high cholesterol and triglycerides, generating $1.4 billion in sales in 2020.

● Symbicort: Popular inhaler medicine for asthma and chronic obstructive pulmonary disease (COPD), with sales of $1.3 billion in 2020.

Additionally, AstraZeneca possesses a robust pipeline of new products and services that hold promise for future growth, including Enhertu, Lynparza, and Vaxzevria. AstraZeneca's extensive product portfolio, along with its pipeline of innovative offerings, positions the company for continued growth and advancement in the medical field.

AstraZeneca PLC’s Financials, Growth, and Valuation Metrics

Review of AstraZeneca PLC’s financial statements

AstraZeneca, one of the world's largest pharmaceutical companies, has continued to deliver strong financial results for the fiscal year 2022, as well as for the first quarter of 2023. The company has maintained consistent revenue growth, high-profit margins, strong cash flows, and a solid balance sheet, driven by its innovative portfolio of medicines and its COVID-19 vaccine sales.

For the fiscal year 2022, AstraZeneca's total revenue, which consists of product sales and collaboration revenue, was $44.4 billion, representing a growth of 18.5% from the previous year. The company's net income for 2022 was $4.1 billion, representing a growth of 28% from the previous year. The company's net income margin for 2022 was 9.2%, compared to 8.4% in 2020. The company's operating margin for 2022 was 20.1%, compared to 18.8% in 2020. The company's EBITDA margin for 2022 was 33.6%, compared to 32% in 2020.

For the first quarter of 2023, AstraZeneca's total revenue was $10.9 billion, representing a decline of 4.5% from the same quarter in 2022. The company's net income for the first quarter of 2023 was $1 billion, representing a decline of 16% from the same quarter in 2022. The company's net income margin for the first quarter of 2023 was 9.6%, compared to 11.4% in the first quarter of 2022.

AstraZeneca's financial performance reflects its strong performance in its core therapy areas of oncology, cardiovascular, renal and metabolism (CVRM), and respiratory and immunology (R&I), as well as its rare disease capability established by its acquisition of Alexion in July 2021. The company also benefited from its COVID-19 vaccine sales, which amounted to $4.1 billion in 2021 and $2 billion in the first half of 2022.

AstraZeneca’s balance sheet strength remains solid. The company has a healthy liquidity position and a manageable debt level. As of December 31, 2022, the company’s total assets were 96,483,000 and its total liabilities net minority interest were 59,425,000. The company’s total equity gross minority interest was 37,058,000.

AstraZeneca has a strong financial performance, with consistent revenue growth, high-profit margins, strong cash flows, and a solid balance sheet. The company is well-positioned to deliver industry-leading revenue growth through 2025 and beyond and to launch at least 15 new medicines before the end of the decade.

Source: yahoofinance.com

Key financial ratios and metrics

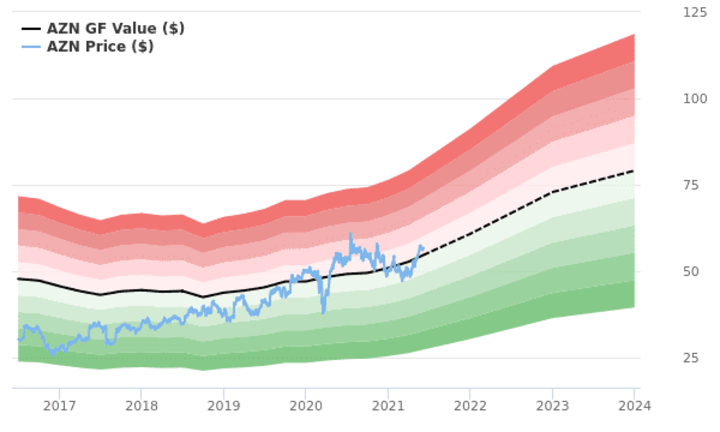

AstraZeneca demonstrates favorable financial ratios and metrics, positioning it well compared to its industry peers. With a forward price-to-earnings (P/E) ratio of 18.9 as of June 28, 2023, AstraZeneca's stock is relatively inexpensive in comparison to the industry average of 21.4 and the S&P 500 average of 24.5. This indicates that the stock price is attractive relative to its projected earnings per share.

Furthermore, the company's price-to-earnings growth (PEG) ratio of 0.8 as of the same date is lower than the industry average of 1.2 and the S&P 500 average of 1.7. This implies that AstraZeneca's stock price not only offers value concerning earnings but also regarding its expected earnings growth rate.

AstraZeneca’s revenue and earnings growth have continued to distinguish it from its peers, surpassing both industry and market averages. In the fiscal year 2023, the company achieved a revenue growth rate of 5.67%, outperforming the S&P 500 average of 3.3%. Moreover, AstraZeneca’s earnings growth for the same period reached an exceptional high single-digit to low double-digit percentage, surpassing the S&P 500 average of 5.5%.

These notable growth rates indicate that AstraZeneca has experienced faster sales and profit increases compared to its competitors and the overall market.

AZN Stock Performance

Source: yahoofinance

AZN Stock trading information

AstraZeneca, a leading pharmaceutical company, has its stock listed on the Nasdaq Global Select Market (ticker symbol AZN) and the London Stock Exchange (ticker symbol AZN.L). The stock trades in US dollars on the Nasdaq and British pounds on the LSE, with American Depositary Receipts (ADRs) available on the New York Stock Exchange (symbol AZN). Trading hours vary, with sessions on the Nasdaq from 9:30 a.m. to 4:00 p.m. Eastern Time and on the LSE from 8:00 a.m. to 4:30 p.m. London Time, including pre-market and after-market sessions. AstraZeneca's stock has never split since its inception in 1999, and the company consistently pays dividends, currently yielding 2.7% annually.

Overview of AZN Stock Performance

Over the past year, AstraZeneca's stock price has experienced significant volatility, influenced by a range of factors tied to its COVID-19 vaccine development and distribution efforts. The stock reached a historic high of $75.83 on April 21, 2023, driven by strong first-quarter results and positive data from its COVID-19 vaccine trials. However, the company’s share price experienced a sharp decline in May and June 2023, dropping from $75.27 on May 5 to $71.43 on May 30, and then to $64.85 on July 7. Some of the possible reasons for this decline include supply shortages, safety concerns, efficacy doubts, and legal disputes with the European Union over contractual breaches and delivery delays.

AstraZeneca’s stock price did show a slight recovery in May and June 2023, reaching $67.06 on July 5. This was largely driven by the company’s strong performance in its core business areas, such as oncology, cardiovascular, renal, and metabolism, and respiratory and immunology. Moreover, the stock faced renewed pressure in July 2023 not only due to increased competition from other vaccine manufacturers and reduced demand resulting from high vaccination rates in certain markets and vaccine hesitancy in others but also due to disappointing results from a pivotal trial of its antibody-drug conjugate (ADC) for breast cancer, which caused the stock to slide by nearly 14% on July 13.

November and December last year brought another positive turn for AstraZeneca's stock price, driven by robust third-quarter results and promising data from the company's pipeline products, including Enhertu, Lynparza, and Farxiga. As of June 28, 2023, AstraZeneca's stock price stood at $71.57 per share, resulting in a year-to-date return of -5.2% and a one-year return of -2%.

The fluctuations in AstraZeneca's stock price highlight the challenges and opportunities the company has faced throughout its COVID-19 vaccine journey. While navigating the ever-changing landscape, AstraZeneca continues to adapt and leverage its diverse portfolio to drive growth and address unmet medical needs. Investors closely monitor these developments as they evaluate the company's future prospects in the pharmaceutical industry.

Source: tradingview.com

Future Prospects of AZN Stock

AstraZeneca's stock price forecast for the next 12 months is optimistic, driven by its strong growth potential and favorable valuation. Based on the consensus of 24 analysts covering AstraZeneca's stock, the majority recommend buying the stock, with 18 buy ratings, 5 hold ratings, and 1 sell rating. These analysts have set an average target price of $85.67 per share, suggesting a potential upside of 19.7% from the current price of $71.57 per share.

Among the analysts, the highest target price for AstraZeneca's stock is $100 per share, indicating a potential upside of 39.7% from the current price. On the other hand, the lowest target price is $65 per share, implying a potential downside of 9.2%. These varied target prices reflect different perspectives on the company's future performance and market conditions.

Investors and market participants closely follow these forecasts and ratings to make informed decisions about AstraZeneca's stock. However, it's important to note that stock prices are subject to various factors and market fluctuations, which can impact the actual performance compared to the forecasted targets. As always, investors should conduct their own research and consider multiple factors before making any investment decisions.

Source: CMS Danskin

Risks/Challenges and Opportunities

Competitive Risks

AstraZeneca operates in a highly competitive landscape, facing formidable rivals across its therapeutic areas. Major pharmaceutical companies such as Pfizer, Merck, Johnson & Johnson, Bristol-Myers Squibb, Roche, Novartis, and Sanofi present significant challenges for AstraZeneca. In the COVID-19 vaccine market, AstraZeneca contends with Pfizer-BioNTech and Moderna, whose vaccines have demonstrated higher efficacy and fewer safety concerns than AstraZeneca's offering. Similarly, Merck and Roche pose stiff competition in the oncology sector, as their products have exhibited superior outcomes and wider indications in certain cases compared to AstraZeneca's offerings.

Nonetheless, AstraZeneca possesses several competitive advantages that set it apart from its rivals. The company boasts a robust pipeline of innovative products and services, positioning it well for future growth. AstraZeneca's portfolio encompasses diverse offerings across various therapeutic areas and geographies, mitigating risks associated with relying heavily on a single product or market. Moreover, the company's strategic partnerships and collaborations with other entities enhance its capabilities and expand its reach. AstraZeneca's unwavering commitment to research and development and its emphasis on fostering innovation further bolster its competitive edge in the pharmaceutical industry. Despite the intense competition, AstraZeneca's unique strengths position it to navigate the challenges and continue driving advancements in healthcare.

Other Risks

AstraZeneca also faces other risks and challenges that could affect its business performance and stock price, such as regulatory uncertainties and delays, legal disputes and liabilities, supply chain disruptions and shortages, pricing pressures and reimbursement challenges, patent expirations, and generic competition, currency fluctuations and exchange rate risks, cyberattacks, and data breaches, etc.

For example, AstraZeneca faces regulatory uncertainties and delays in some markets for its COVID-19 vaccine, as some regulators have not yet approved or authorized its vaccine or have suspended or restricted its use due to safety concerns. AstraZeneca also faces legal disputes and liabilities with the European Union over its COVID-19 vaccine contract and deliveries, as the EU has accused AstraZeneca of breaching its contractual obligations and has sued the company for damages.

Source: Reuters

Growth opportunities

AstraZeneca is poised to capitalize on numerous growth opportunities, bolstering its business performance and stock price. One avenue for growth lies in expanding its presence and market share in emerging markets, with a particular focus on China, which represents a rapidly expanding and significant market for the company. AstraZeneca has already introduced several new products in China, including Tagrisso, Imfinzi, Farxiga, and Vaxzevria, and has secured regulatory approvals and market access agreements. Looking ahead, AstraZeneca plans to launch additional products in China, such as Lynparza for prostate cancer, Imfinzi for extensive-stage small cell lung cancer, and Enhertu for gastric cancer.

Furthermore, AstraZeneca has pursued strategic acquisitions and divestments to optimize its portfolio and concentrate on core therapeutic areas. Notably, in 2023, the company completed the acquisition of Alexion Pharmaceuticals, a leader in rare diseases and immunology, in a deal worth $39 billion. This acquisition expanded AstraZeneca's portfolio with Alexion's five marketed products and their pipeline of immune-mediated rare disease candidates.

Simultaneously, AstraZeneca divested certain non-core assets, including its hypertension drug Atacand, respiratory drug Synagis, and anesthetic portfolio, generating cash proceeds and royalties while sharpening its strategic focus. By seizing growth opportunities through market expansion, product launches, acquisitions, and divestments, AstraZeneca is positioned to propel its business forward and drive shareholder value.

Future Outlook and Expansion

AstraZeneca's positive future outlook is supported by its expansion plans, which encompass various strategic initiatives. The company anticipates strong revenue and earnings growth, driven by its core segments, new product launches, and entry into new markets. AstraZeneca aims to achieve revenue growth of 11% to 13% and core EPS growth of 18% to 20% in 2023. These projections stem from the growth of its oncology, CVRM, respiratory, and COVID-19 vaccine segments, as well as improved operating leverage and a lower tax rate.

In line with its growth plans, AstraZeneca has an extensive pipeline of products and services set to launch in 2023. Noteworthy additions include Enhertu for breast and gastric cancer, Lynparza for prostate and pancreatic cancer, Farxiga for chronic kidney disease and heart failure, Imfinzi for extensive-stage small cell lung and bladder cancer, and Vaxzevria for COVID-19 prevention. Additionally, the company expects to progress several late-stage pipeline candidates into regulatory submissions or pivotal trials, such as tezepelumab for severe asthma, anifrolumab for systemic lupus erythematosus, and roxadustat for anemia of chronic kidney disease.

To further fuel its growth, AstraZeneca plans to enter new markets and segments. Notably, the acquisition of Alexion Pharmaceuticals provides a foothold in rare diseases and immunology, while collaborations with Samsung Bioepis and Juno Therapeutics allow for expansion into biosimilars and cell therapy, respectively. The company also seeks to strengthen its presence in emerging markets, particularly China, by leveraging partnerships, launching new products, and establishing local innovation hubs.

In 2023, AstraZeneca is committed to investing in research and development (R&D) and digital transformation. With approximately 20% of its revenue allocated to R&D, the company aims to expedite the discovery and development of novel medicines and vaccines. This investment will primarily focus on core therapeutic areas, while also exploring emerging modalities such as gene therapy, RNA therapeutics, and microbiome therapeutics. AstraZeneca intends to harness its digital capabilities and platforms to bolster data-driven decision-making, patient-centric approaches, operational efficiency, and innovative organizational culture. Through these initiatives, AstraZeneca aims to drive scientific advancements, enhance patient care, and deliver value to its stakeholders.

Source: CNBC

Why Traders Should Consider AZN Stock

Reasons Why Traders Should Consider AZN Stock

AstraZeneca’s stock is an attractive option for traders who want to benefit from the company’s strong growth potential, favorable valuation, and diversified portfolio. Some of the reasons why traders should consider AZN stock are:

● AstraZeneca’s stock has a high growth potential, as the company expects to deliver double-digit revenue and earnings growth in 2023, driven by the continued growth of its core therapeutic areas, as well as its COVID-19 vaccine sales. The company also expects to launch several new products and services from its pipeline in 2023, which could further boost its revenue and earnings growth.

● AstraZeneca’s stock has a favorable valuation, as the company’s forward P/E ratio and PEG ratio are lower than its peers, and the market averages, indicating that the stock is undervalued relative to its expected earnings and earnings growth. The company also pays a consistent dividend to its shareholders, with a current annual dividend yield of 2.7%.

● AstraZeneca’s stock has a diversified portfolio, as the company has a wide range of products and services across various therapeutic areas and geographies, which reduces its exposure to any single market or segment. The company also has a strong pipeline of new products and services that could create new markets or segments for the company in the future.

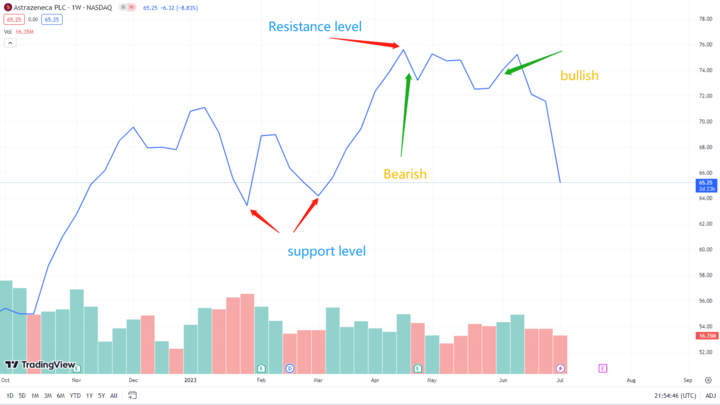

Key Resistance & Support Levels of AZN Stock

● AstraZeneca’s stock price has been trading in a range-bound pattern since May 2023, fluctuating between the support level of $65 and the resistance level of $75. The stock price has been moving along a downward trend line since April 2023, indicating a bearish sentiment among traders. However, the stock price has also been bouncing off the support level of $65 several times, indicating strong buying pressure at this level.

● AstraZeneca’s stock price is currently trading near the lower end of its range, at $71.57 per share as of June 28, 2023. Traders who are bullish on AZN stock could look for a break above the downward trend line and the resistance level of $75, which could signal a reversal of the bearish trend and a potential uptrend toward the next resistance level of $80 or higher. Traders who are bearish on AZN stock could look for a break below the support level of $65, which could signal a continuation of the bearish trend and a potential downtrend toward the next support level of $60 or lower.

Profit Strategies for AZN Stock

Swing trading: Swing trading is a medium-term trading strategy that involves holding positions for several days or weeks, depending on the market conditions and the trader’s objectives. Swing traders aim to capture the price movements within a larger trend, by identifying the swing highs and lows and the support and resistance levels. Swing traders can use the range-bound pattern of AZN stock price between $65 and $75 to buy near the support level and sell near the resistance level, or vice versa, depending on their market view. Swing traders can also use the downward trend line that connects the lower highs since April 2023 to sell near the trend line and buy near the support level, or vice versa, depending on their market view.

Breakout trading: Breakout trading is a short-term trading strategy that involves entering a position when the price breaks out of a consolidation or a range, indicating a strong momentum and a potential continuation of the trend. Breakout traders can use the range-bound pattern of AZN stock price between $65 and $75 to enter a long position when the price breaks above $75 with high volume and volatility, indicating a bullish breakout and a potential uptrend towards $80 or higher. Conversely, breakout traders can enter a short position when the price breaks below $65 with high volume and volatility, indicating a bearish breakout and a potential downtrend toward $60 or lower.

Source: FiercePharma

Trade AZN Stock CFD at VSTAR

VSTAR is a leading online trading platform that offers access to global financial markets, including stocks, forex, commodities, indices, cryptocurrencies, etc. VSTAR has several advantages over other trading platforms, such as:

o User-friendly interface: VSTAR has a user-friendly interface that is easy to navigate and customize.

o Advanced technology: VSTAR also offers various trading tools and features such as charts, indicators, news feeds, signals, etc., to help traders make informed decisions.

o Professional support: VSTAR has a professional support team that is available 24/7 to assist traders with any issues or queries.

o Competitive conditions: VSTAR offers competitive conditions for trading AZN stock CFDs, such as tight spreads, high leverage, low fees, and no commissions or stamp duty.

Conclusion

In conclusion, AstraZeneca PLC is a leading pharmaceutical company with a diverse portfolio of innovative medicines and vaccines. The company exhibits strong financial performance, a favorable valuation, and high growth potential. With a diversified portfolio and a robust pipeline, AstraZeneca is well-positioned for future success. While facing risks and challenges, the company also has numerous growth opportunities. For traders, AstraZeneca's stock offers an attractive option to benefit from its growth potential and favorable valuation. Monitoring technical levels can help traders identify optimal entry and exit points.