Every day, there are new developments in the field of biotechnology, pushing the frontiers of modern medicine further forward. The biotechnology space is one that currently has lots of major players; however, none is grabbing the headlines as much as Amgen Inc. The company has been hard at work, and if recent news and developments are any indication, Amgen stock is definitely one to watch.

Amgen recently announced that its still-in-development drug, Olpasiran, has shown very promising results in Lp reduction. According to data obtained, this drug remained effective in trial patients nearly a year after the last dose.

Also, Amgen has recently published its second-quarter earnings, showing very strong financial performance. According to this release, Amgen's total revenues have increased by an impressive 6%, and the company has enjoyed a sales volume growth of 11%.

All of the above points to the fact that Amgen stock is one to watch for both investors and traders. However, before we delve deep into the financials, let's take a quick look at Amgen Inc.

Amgen Inc.'s Overview

Credit: iStock

Amgen Inc. was founded in 1890 by George Rathmann and some other scientists. Currently, the company has its headquarters in Thousand Oaks, California, USA. Amgen Inc. is a biotechnology firm focused on discovering, developing, manufacturing, and delivering human therapeutics.

The company focuses on research in several areas, such as oncology, cardiovascular, inflammation, nephrology, and neuroscience. The current CEO of Amgen Inc. is Robert A. Bradway, a Harvard University graduate who has been with Amgen since 2006.

Amgen Inc. is backed by several investors, some of which include The Vanguard Group, Inc. (8.678%), SSgA Funds Management, Inc. (3.349 %), BlackRock Fund Advisors (2.894 %), PRIMECAP Management Co. (2.590 %), and Invesco Capital Management LLC (2.209 %).

Key Milestones

- In 1983, Amgen Inc. successfully completed its IPO, raising nearly $40 million.

- In 1985, Amgen became a pioneer in the field of genetic engineering, becoming the first successfully engineer Granulocyte-Colony Stimulating Factor (G-CSF).

- In January 1992, Amgen debuted on the S&P 500 list and, months later, on the Fortune 500 list.

- At the end of 1992, Amgen Inc. became the first biotech company to record over $1 billion in sales.

- In 2005, Amgen recorded a 55% increase in annual sales.

- In November 2019, Amgen announced that it had acquired Otezla® (apremilast).

- On August 24, 2020, Amgen's history of robust financial success and healthcare influence got it added to the Dow Jones Industrial Average.

Amgen Inc's Business Model and Products/Services

Amgen primarily generates revenue through the discovery, development, manufacturing, and commercialization of human therapeutics. Their income streams can be broken down into:

- Product Sales: Selling patented biopharmaceutical products directly to healthcare providers, pharmacies, and other healthcare institutions.

- Licensing and Partnerships: Partnering with other pharmaceutical and biotech companies to develop new therapies, often receiving upfront payments, milestone payments, and royalties.

- Research Grants: The company occasionally receives grants for specific research projects from governmental and private organizations.

Main Products and Services

Amgen Inc. has a vast portfolio of medicines for treating and managing serious illnesses. Some of these include the following:

- Aimovig for treating migraines. According to a particular study, over 70% of people using Aimovig have reported that it was very effective in providing them with relief from migraines.

- Aranesp for anemia. A report from the FDA showed that after a 24-week study, Aranesp was able to achieve a hemoglobin concentration of 11-13 g/dL in over 80% of the 75 study participants.

- Corlanor for chronic heart failure. During its trial, Corlanor's introduction led to a huge 18% drop in cardiovascular hospitalization or death risk for patients.

Now, let's talk about the financial aspect of things.

Amgen Inc.'s Financials, Growth, and Valuation Metrics

Credit: iStock

Amgen Inc. currently has a market capitalization of 137.31 billion USD. For the June 30, 2023 quarter, Amgen Inc. reported a net income of $1.379 billion, marking a year-over-year uptick of 4.71%. The company's revenue reached $6.986 billion during the same timeframe, a 5.94% year-over-year growth.

Over the past five years, Amgen Inc.'s revenue has grown from $23,747 million in 2018 to $26,323 in 2022. As of June 30, 2023, the firm's net profit margin is 30.02%, with an EBITDA margin of 49.05%. Amgen Inc. also currently has a Return on Equity (ROE) of 164.15%.

In the last quarter, Amgen Inc.'s gross profit increased to $5,173 million from $4,385 million. The company's total liabilities increased to $83,488 million for the same period from $83,372 million.

Key Financial Ratios and Metrics

AMGN stock currently has a P/E ratio of 14.45. Key competitors like Bristol Myers Squibb (BMY) and GSK (GSK) have P/Es of 8.15 and 9.73, respectively. Amgen's higher P/E ratio of 14.45 compared to Bristol Myers Squibb's 8.15 and GSK's 9.73 indicates that investors are willing to pay a premium for Amgen's earnings.

Also, AMGN stock has a P/S ratio of 5.20. Bristol Myers Squibb (BMY) and GSK (GSK) have P/S ratio values of 2.92 and 2.25, respectively. This means that the market has higher revenue expectations for Amgen.

When evaluated against its peer group, AMGN offers solid value. Its P/E ratio of 17.2x is more attractive than the sector average of 23.8x. Currently, AMGN stock is trading at $256.71, 20% below its fair value estimate, implying that it is undervalued.

AMGN Stock Performance Analysis

As mentioned earlier, Amgen Inc. went public in 1983. The company's stock is primarily traded on the NASDAQ Stock Exchange under the ticker symbol "AMGN." Amgen stock is traded in the United States and is denominated in U.S. dollars (USD).

Standard trading hours for AMGN stock on NASDAQ are from 9:30 a.m. to 4:00 p.m. Eastern Time (ET). Pre-market trading usually takes place between 4:00 a.m. and 9:30 a.m. ET and after-hours trading from 4:00 p.m. to 8:00 p.m. ET.

AMGN Stock Splits: Amgen stock has undergone a total of five stock splits, with the most recent one being a two-for-one split that occurred in November 1999. This means that for every share an investor owned prior to the stock split, they received an additional share. Note that this stock split had a cumulative multiple of x48, so one AMGN stock share owned prior to August 1990 (the first stock split) is currently equal to 48 shares today.

AMGN Dividend: Currently, owning an Amgen stock yields a $2.13 quarterly dividend amount and an annual dividend yield of 3.32%.

AMGN Stock Price Performance since its IPO

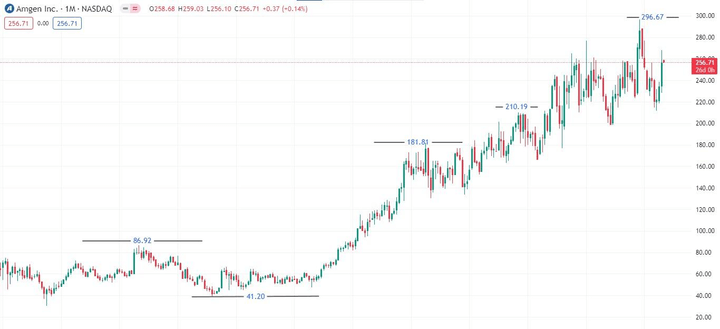

Credit: TradingView

Since its IPO, Amgen stock has been on a massive bullish movement that looks set to continue. Amgen's stock price rapidly rose to the 86.92 level before ranging and dipping to the 41.20 price level. After this, however, Amgen stock resumed its bullish movement in a move that saw it create and break new all-time highs at 181.81 and 210.19 before reaching its current all-time high of 296.67.

Amgen stock price is currently around the 256.71 level, but if the recent trend is any indication, that could change very soon.

Key Drivers of AMGN Stock Price

There are several factors that could impact Amgen stock price. Some of these include the following:

- Product Pipeline: One of the major drivers of Amgen's stock price is its pipeline of upcoming drugs and therapies. Positive results from clinical trials or new FDA approvals can significantly boost investor confidence and stock value.

- Revenue and Earnings Reports: Quarterly and annual financial results, especially unexpected earnings growth, directly impact stock prices. Strong sales of key products can serve as catalysts for Amgen stock appreciation.

- Mergers and Acquisitions: Strategic acquisitions or partnerships can also quickly expand Amgen's portfolio and market reach, thereby driving Amgen biotech stock prices

Amgen Stock Forecast

Credit: TradingView

As earlier mentioned, Amgen stock price is currently around 256.71, trading off of the support at 228.21. This support is expected to hold. However, the immediate resistance level at 268.24 will likely be taken out, and the price will target the next resistance level at 276.84.

If both resistance levels are broken, this will clearly indicate that the bullish movement has returned to full swing.

Is AMGN Stock a Buy, Sell, or Hold?

According to a panel of 25 financial analysts, the consensus for Amgen stock is to hold. A 12-month price forecast for Amgen stock offered by 17 analysts projects a median target of 260.00, a bullish high of $310.00, and a low of $175.00.

Challenges and Opportunities

Amgen Inc. operates in a very competitive industry, and as such, the company faces several potential challenges. Most of these challenges come from competitors like GSK and Bristo Myers Squibb. For example, GSK's extensive portfolio in vaccines, consumer healthcare, and pharmaceuticals directly threatens Amgen's market share. Also, GSK has a strong global presence and has been investing heavily in R&D.

On the other hand, BMY is particularly strong in oncology, an area where Amgen also has significant interests. BMY's acquisition of Celgene further strengthens its position, offering a more diversified portfolio that could encroach upon Amgen's market share.

However, despite all these, Amgen still retains the competitive advantage. Amgen has one of the industry's most robust drug pipelines, with multiple therapies in various stages of development and clinical trials. Also, Amgen has strong financials, allowing for significant R&D investments and strategic acquisitions that can serve as a barrier to competition.

Other Risks

Some other risks that could affect Amgen stock price include:

- Regulatory Risks: Stringent regulations in drug approvals and changes in healthcare policies can delay product launches and impact revenue.

- Patent Expiry: The expiration of key patents can open the door to generic competition, potentially causing significant revenue loss. This will, in turn, negatively affect Amgen's stock.

- Economic Downturn: Economic recessions or downturns can reduce healthcare spending, which may affect Amgen's sales and profit margins.

- Supply Chain Risks: As a global company, Amgen is susceptible to disruptions in its supply chain, whether due to geopolitical issues, natural disasters, or pandemics.

Credit: iStock

Growth Opportunities

Amgen Inc. has recently received FDA approval for the use of the drug Blincyto to treat adults and pediatric patients with CD19-positive B-cell precursor acute lymphoblastic leukemia (B-ALL). This grants the company access to a new market entirely. In addition to this, Amgen Inc. also has several promising growth opportunities. Some of these include:

- Telehealth Integration: The COVID-19 pandemic has accelerated the adoption of telehealth services. Amgen could potentially partner with telehealth providers to offer more comprehensive treatment plans, from diagnosis to medication delivery.

- Acquisitions and Partnerships: Strategic acquisitions, like purchasing smaller biotech firms with promising pipelines, could bolster Amgen's already robust portfolio. Partnerships with academic institutions for R&D can also be a long-term growth strategy.

Future Outlook and Expansion

- R&D Investment: Given its strong financial position, Amgen could further invest in R&D, especially in hot fields like gene editing or AI-based drug discovery. For example, a partnership with a tech company specializing in AI could accelerate drug discovery.

- Market Expansion: Amgen could also expand into new therapeutic areas or offer over-the-counter versions of certain medications. This will help them tap into a consumer base less familiar with prescription drugs.

- Emerging Markets: With an expanding middle class willing to spend more on healthcare, emerging markets like India and China offer a vast untapped customer base. Amgen could launch cost-effective versions of its successful drugs in these markets.

Trading Strategies for AMGN Stock

Credit: iStock

When it comes to trading AMGN stock, there are several strategies you can employ to ensure you remain profitable. Here, we'll explore some of the most effective AMGN stock trading strategies. So, without further delay, let's get right into it.

CFD Trading

CFD trading is one of the most preferred strategies by traders looking to invest in AMGN stock. This is because this particular trading strategy option comes with many benefits. Some advantages of CFD trading for AMGN stock include:

- Short Selling:CFD trading allows you to profit from falling AMGN stock prices by enabling short selling, which can be more challenging with traditional stock trading.

- Leverage: One of the significant advantages of trading AMGN stock through Contracts for Difference (CFDs) is the leverage offered. With CFDs, you can open an AMGN stock trading position with a fraction of the capital required for direct ownership.

- Cost Efficiency: CFDs often have lower transaction costs than traditional stock trading. This can be beneficial when trading AMGN stock.

Some other trading strategies for AMGN stock include the following:

- The Buy and Hold Strategy:If you believe in AMGN's long-term potential, this strategy is perfect for you. This approach allows you to weather market volatility and potentially benefit from price appreciation and dividends over time.

- Pairs Trading Strategy: This strategy involves pair trading AMGN stock. Here, you trade pairs by taking a long position in AMGN and a short position in a competitor like GSK or BMY. This strategy aims to profit when AMGN outperforms its competitor.

Trade AMGN Stock CFD with VSTAR

Of all the above strategies, the best one, offering maximum profitability and minimal risk, is the CFD strategy. However, to trade AMGN stock CFDs, you'll need to go through a CFD provider. This is where VSTAR comes in. There are numerous benefits to trading Amgen stock CFDs with VSTAR. Some of these are:

- Speed: Trading on VSTAR gives you access to lightning-fast trade executions, so you'll always have the edge in fast-paced market conditions.

- Competitive Spreads: VSTAR offers the most competitive spreads on the market. As a trader, this means you'll enjoy substantially lower trading costs when dealing with AMGN stock CFDs.

- Excellent Customer Support: VSTAR also provides an excellent customer support service that's always on hand and expertly trained to help you navigate any issues or questions.

- Educational Resources: Not everyone is a trading guru, and that's perfectly fine. This is why VSTAR offers several educational materials and tutorials aimed at helping you understand CFD trading.

In addition to all of the above, VSTAR hosts a podcast that provides answers and education on all things trading and investing. Here, you'll get to learn different aspects of trading and common pitfalls to avoid, among other things.

Conclusion

AMGN stock is currently in a very strong financial position, and all indicators point towards an even brighter future. From very strong financials to successful product pipelines and even backing by top investors, Amgen Inc. looks like a great investment opportunity from all angles

As explained above, there are several different strategies you can employ to optimize your profitability with Amgen stock. However, if you want a strategy that offers you the best possible investment returns, then CFD trading is perfect for you.

Ready to elevate your trading experience? Download VSTAR today and get started.