I. Introduction

A. The importance of chip stocks

Chip stocks, also known as semiconductor stocks, are vital to technology and investments. These stocks represent companies involved in designing, manufacturing, and distributing computer chips, essential components powering electronic devices such as smartphones, computers, cars, and more.

Here's the thing: The importance of chip stocks stems from several factors. Firstly, the ever-increasing demand for electronic devices drives the need for more advanced and efficient chips. As technology evolves, companies must constantly innovate and produce cutting-edge semiconductor solutions to meet consumer demands. Secondly, the widespread integration of technology across various industries, including automotive, healthcare, and artificial intelligence, highlights chips' crucial role in powering these sectors. The growth of emerging technologies like the Internet of Things (IoT) , AI and 5G further amplifies the importance of chips, as they serve as the backbone for these transformative advancements.

B. AMD vs Nvidia Comparison

- Graphics Processing Units (GPUs):

Nvidia has long been recognized as a leader in GPU technology. Their GeForce graphics cards are highly regarded for their exceptional performance and advanced features, making them a preferred choice for gaming enthusiasts and professionals in video editing and 3D rendering. Nvidia's GPUs excel in ray tracing, artificial intelligence (AI), and machine learning (ML), empowering users with superior visual experiences and computational capabilities.

On the other hand, AMD's Radeon graphics cards offer strong competition in the GPU market. They are known for their competitive pricing and value proposition, making them an attractive option for budget-conscious consumers. AMD's GPUs are well-suited for gaming and content creation, delivering impressive performance and supporting features like AMD FreeSync for smoother gameplay.

- Central Processing Units (CPUs):

AMD has gained significant traction in the CPU market with its Ryzen processors. These CPUs offer excellent multi-threaded performance, making them ideal for tasks that heavily rely on parallel processing, such as video editing, 3D modeling, and software development. AMD's Ryzen processors often provide better value for money than their Intel counterparts, making them popular among enthusiasts and mainstream users.

On the other hand, Nvidia is primarily focused on GPU technology and does not compete directly in the CPU market. However, they have entered the realm of data center computing by acquiring ARM, a leading CPU architecture company. This move potentially positions Nvidia to compete with AMD and Intel.

- Market Reach and Partnerships:

Nvidia has established strong partnerships across various industries. Their GPUs are widely adopted in gaming, data centers, and professional sectors. Additionally, Nvidia's technology powers autonomous vehicles through its DRIVE platform, making them a key player in the automotive industry.

AMD has also made significant strides, particularly in the gaming console market. Sony's PlayStation and Microsoft's Xbox utilize custom AMD chips, allowing the company to reach a broad consumer base. Furthermore, AMD's CPUs and GPUs are found in a wide range of laptops and desktops from various manufacturers, further expanding their market reach.

C. AMD vs Nvidia: The Current AI Battle

Nvidia, a leader in GPU technology, has been at the forefront of AI advancements for years. Their GPUs, particularly those in the GeForce and datacenter-focused Tesla lines, have become the first choice for AI training and inference tasks. Nvidia's CUDA parallel computing platform and software ecosystem have also played a key role in enabling developers to leverage the power of GPUs for AI applications.

While traditionally strong in CPU technology, AMD has recently made significant strides in AI acceleration. Their efforts are centered around the AMD Instinct series, which includes the MI300 accelerators. Nvidia, on the other hand, makes the H100 GPUs. These products aim to provide efficient and scalable AI performance in data centers, supercomputers, and enterprise environments.

H100 vs. MI300

The Nvidia H100 and AMD MI300 are head-to-head competitors in the AI accelerator space. The H100, based on Nvidia's powerful Ampere architecture, delivers exceptional AI performance with its Tensor Cores and large memory capacity. It is designed to handle demanding workloads and complex AI models efficiently.

On the other hand, the AMD MI300 is built on the CDNA architecture, which focuses on delivering high-performance computing capabilities for AI workloads. The MI300 boasts many compute units, high memory bandwidth, and advanced features like Infinity Fabric, enabling it to tackle intensive AI tasks effectively.

While both accelerators strive to excel in AI acceleration, they have unique features that cater to different user requirements. Nvidia's H100 emphasizes the company's established dominance in the GPU space, offering powerful performance and a robust software ecosystem. AMD's MI300, on the other hand, represents the company's commitment to providing competitive AI acceleration solutions by leveraging its expertise in CPU technology and scalable computing capabilities.

II. Overview of Nvidia and AMD

A. A brief history of each company

Nvidia

- 1993 - Founded by Jensen Huang, Chris Malachowsky, and Curtis Priem with a vision to bring 3D graphics to the gaming and multimedia markets.

- 1999 - Released the GeForce card. It featured more advanced 3D graphics.

- 2004 - The company developed CUDA, a language similar to C++ for programming GPUs.

- 2006 - After introducing CUDA, Nvidia made a concerted effort to have the programming language taught in universities.

- 2008 - Nvidia introduced the Tegra line of systems-on-a-chip (SoC) that combined an Arm CPU with a scaled-down Nvidia GPU.

- 2017 - Nintendo adopted the Tegra for its handheld Switch console.

- 2019 - The company bought networking specialist Mellanox Technologies for $7 billion.

- 2020 - Nvidia attempted to acquire CPU designer Arm Holdings for $40 billion.

New Nvidia Graphics Cards

With the latest generation of Nvidia graphics cards, such as the RTX 30 series, Nvidia continues to push the boundaries of performance and features for enthusiasts, gamers, and creative professionals.

AMD

- 1969: Jerry Sanders and seven co-founders founded Advanced Micro Devices (AMD) as a semiconductor company in Sunnyvale, California.

- 1975: AMD launches its first product, the Am9300.

- 1982: AMD introduces the Am286, its first x86-compatible microprocessor.

- 1991: AMD unveils the Am386 microprocessor, its first fully 32-bit x86 processor.

- 1996: AMD releases the K5 processor, its first fifth-generation x86 microarchitecture.

- 1999: AMD introduces the Athlon processor, based on its K7 microarchitecture.

- 2003: AMD launches the Opteron processor, utilizing the AMD64 architecture.

- 2006: AMD acquires ATI Technologies.

- 2007: AMD releases the Phenom processor.

- 2011: AMD launches the Bulldozer microarchitecture.

- 2017: AMD introduces the Ryzen line of processors based on its Zen microarchitecture.

- 2019: AMD releases its third-generation Ryzen processors, the Ryzen 3000 series, based on the Zen 2 architecture.

- 2020: AMD launches its Ryzen 5000 series processors, based on the Zen 3 architecture.

- 2021: AMD unveils its Ryzen 5000G series processors with integrated graphics.

- 2022: AMD introduces its Zen 4 microarchitecture, powering its fifth-generation Ryzen processors.

New AMD GPU

AMD recently announced its new RDNA 3-based GPUs, the Radeon RX 7900 XT and RX 7900 XTX graphics cards, which will be released later this year and are expected to compete with Nvidia's new RTX 40-series GPUs.

Nvidia vs AMD GPU

The competition between Nvidia and AMD GPUs continues to heat up, with Nvidia's new RTX 40-series graphics cards battling AMD's upcoming RDNA 3-based Radeon RX 7900 XT and XTX models for high-end gaming performance supremacy.

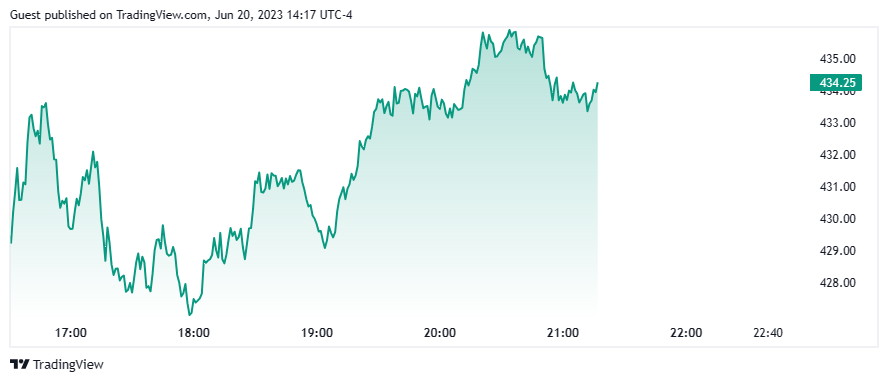

B. AMD vs Nvidia: Overview of their current market standings

Source: TradingView

As you can see in the chart above, NVIDIA Corporation (NVDA) is currently trading at $308.98 per share with a market capitalization of $1.054T USD. The company has a dividend yield of 0.04% and a price-to-earnings ratio (TTM) of 221.67. The basic earnings per share (TTM) is $1.94.

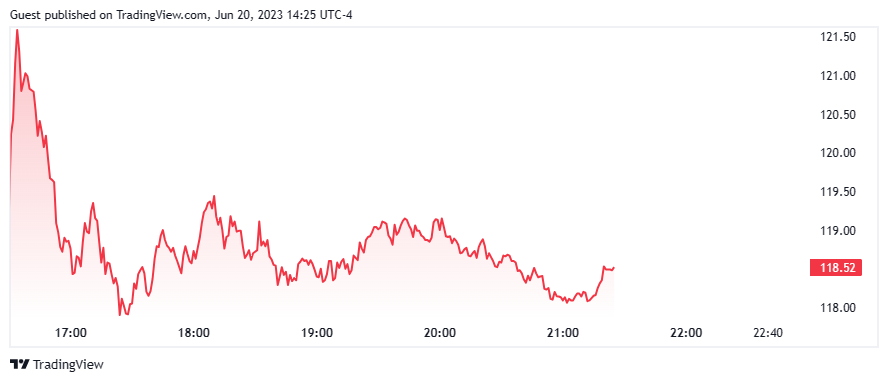

Source: TradingView

As you can see in the chart above, Advanced Micro Devices Inc (AMD) is currently trading at $91.09 per share with a market capitalization of $193.372 billion. The company has no dividend yield and a price-to-earnings ratio (TTM) of 515.09. The basic earnings per share (TTM) is $0.24.

C. Is Nvidia A Direct Competitor To AMD?

Nvidia Competitors

AMD Competitors

As the second largest discrete GPU manufacturer behind Nvidia, AMD competes primarily with Nvidia in the graphics card market, although Intel and others are emerging as competitors in certain segments.

AI: Nvidia has established itself as a leader in AI with its powerful GPUs optimized for AI workloads. Its Tensor Cores and software frameworks offer high-performance computing for AI training and inference. On the other hand, AMD has been expanding its presence in AI with its Instinct accelerators and CDNA architecture, aiming to provide competitive AI acceleration solutions. While Nvidia currently holds a significant market share in AI, AMD is actively working to strengthen its position.

Semiconductors: You see, Nvidia and AMD are prominent players in the semiconductor industry. Nvidia focuses on designing and manufacturing GPUs crucial for various applications such as gaming, data centers, and AI. Conversely, AMD is known for its CPUs and GPUs, offering gaming, data centers, and consumer electronics solutions. While there is overlap in their offerings, their product lines have distinct strengths and target different market segments.

Chips: Nvidia and AMD are direct competitors in the chip market, specifically in the graphics processing unit (GPU) space. Nvidia's GeForce GPUs are widely recognized for their superior gaming performance and advanced features, making them a preferred choice for gamers and professionals. AMD's Radeon GPUs offer competitive performance and value, attracting budget-conscious consumers. The Nvidia vs AMD competition is heating up in the GPU market, where both companies are constantly innovating to gain market share.

Graphics Card: Competition in the graphics card market continues to intensify between the two major discrete GPU manufacturers, AMD and Nvidia.

Radeon vs Nvidia

AMD Radeon graphics cards, such as the new RX 7900 XT and XTX models, are positioned to compete with Nvidia's GeForce offerings, including the recently announced RTX 40-series graphics cards. Both companies are touting major performance and efficiency gains with their latest GPU architectures, AMD RDNA 3 vs. Nvidia Ada Lovelace. Reviews will determine how these new AMD Radeon and Nvidia GeForce graphics cards compare head-to-head, but the increased competition should continue to drive innovation and benefits for enthusiasts and gamers looking for the best high-end graphics card. The new product releases from both AMD and Nvidia promise to push graphics performance to new heights.

A graphics processing unit (GPU) is the chip or processor that does the actual computing and graphics rendering. A graphics card is a complete product that includes the GPU as well as other components such as video memory, power circuitry, outputs, and cooling elements. The GPU is the engine within the graphics card that performs graphics-related operations. For example, Nvidia designs and manufactures GPU chips such as the RTX 4090, which are then placed on finished graphics card products from brands such as EVGA, Asus, MSI, etc. AMD does the same, making GPU chips that go into partners' Radeon graphics cards. So the GPU is a component of a video card, while the video card is the finished product that people put in their computers. Graphics cards give the GPU chipset a physical interface, cooling, power, and consumer customizations that allow users to take advantage of the GPU's capabilities.

D. How do Nvidia stock and AMD stock differ?

Market Position and Revenue Streams: Nvidia is primarily known for its dominance in the GPU market, particularly in gaming, data centers, and AI applications. As a result, a significant portion of Nvidia's revenue is derived from these sectors. On the other hand, while AMD also competes in the GPU market, it has a broader revenue stream, including CPUs, semi-custom chips for gaming consoles, and other embedded solutions. This diversified revenue base can affect the performance and stability of individual stocks.

Financial Performance: Nvidia has a history of strong financial performance, consistently delivering impressive revenue growth and profitability. The company's innovations in GPU technology and its presence in high-growth markets have contributed to its financial success. AMD has also demonstrated notable financial improvements in recent years, driven by its Ryzen CPUs and Radeon GPUs, leading to increased market share and revenue growth.

Market Perception and Investor Sentiment: Nvidia stock is often perceived as a growth stock, attracting investors seeking exposure to innovative technologies like AI, autonomous vehicles, and data centers. The company's reputation for cutting-edge technology and its partnerships with industry leaders contribute to positive investor sentiment. On the other hand, AMD stock is often seen as a value-oriented investment, appealing to investors looking for competitive alternatives in the CPU and GPU markets. AMD's focus on providing cost-effective solutions has gained attention and increased investor interest.

Price Volatility and Risk Factors: Nvidia stock and AMD stock can experience price volatility due to various factors, such as market trends, competition, and global economic conditions. However, Nvidia stock has historically exhibited higher volatility, influenced by factors like its exposure to cryptocurrency mining demand and reliance on specific industry sectors. While still subject to market fluctuations, AMD stock may carry relatively lower volatility than Nvidia's.

III. AMD vs Nvidia: Performance Comparison

AMD vs Nvidia: Stock performance Comparison

1. Overview of the Past Five Years

Over the past five years, Nvidia stock has experienced significant growth and outperformed many other tech stocks. The company's focus on cutting-edge GPU technology, dominance in gaming, and expansion into emerging areas like AI and data centers have fueled investor enthusiasm. Nvidia's stock price surged during this period, reflecting its consistent financial performance and market leadership.

Nvidia stock performance over the past five years. (Source: Investopedia)

On the other hand, AMD stock has been one of the best-performing stocks in the market over the past five years. According to Capital.com, the value of AMD stock has surged about 656% since 2017. AMD has been on a tear in recent years, delivering trailing returns of 48.4% over the last 10 years, outperforming the industry's 20.38%. In 2022, AMD's stock price rose by 60%, and it has continued to climb in 2023, with a 25% increase so far.

The company's strong financial performance has been driven by the continued growth of the PC and gaming markets, as well as the ongoing chip shortage, which has led to higher prices for its products. AMD is expected to continue to grow in the future, driven by the growth of these markets, as well as its investments in new growth areas, such as the data center and automotive markets.

AMD stock performance over the past five years. (Source: Investopedia)

2. Comparison of Current Stock Performance

As of June 20, 2023, NVIDIA's stock price is $426.92 and AMD's stock price is $118.34. That's a pretty big difference! NVIDIA has a higher stock price than AMD. However, AMD has been able to capitalize on the growing demand for CPUs and GPUs and has been able to maintain its position as a leader in the industry. Both NVIDIA and AMD have been top performers on the stock market this year, with the shares of both high-flying chipmakers crushing the broader market easily.

3. Nvidia vs AMD: Stock Forecast

According to a recent article by The Motley Fool, both NVIDIA and AMD have been top performers on the stock market this year, with shares of both high-flying chipmakers crushing the broader market easily.

Morgan Stanley has named Nvidia its new "top pick," taking that moniker away from the previous holder, rival chip stock AMD. The analysts said Nvidia has more near-term upside, predicting it could jump 15% as demand has surged for artificial intelligence.

And that's not all. According to CNN Business, 45 analysts offering 12-month price forecasts for Nvidia stock have a median target of 460.00, with a high estimate of 600.00 and a low estimate of 175.00.

For AMD, the stock forecast suggests a more optimistic outlook. The company has been able to capitalize on the growing demand for CPUs and GPUs and has been able to maintain its position as a leader in the industry. AMD's focus on innovation and research and development has helped it stay ahead of the competition and maintain its position as a leader in the industry. The 38 analysts offering 1-year price forecasts for AMD stock have a max estimate of 200 and a min estimate of 80.

AMD vs Nvidia: Financial Performance Comparison

- Revenue:

Both Nvidia and AMD have experienced notable revenue growth in recent years. Nvidia's revenue growth has been particularly strong, driven by its dominance in the gaming and data center markets and its focus on AI and autonomous vehicles. While also demonstrating revenue growth, AMD has a more diversified revenue stream, including CPUs, GPUs, and semi-custom chips for gaming consoles.

- Profit Margins:

Nvidia generally maintains higher profit margins compared to AMD. This can be attributed to Nvidia's premium positioning in the GPU market, which commands higher prices and enjoys better profitability. While improving in recent years, AMD's profit margins tend to be more competitive due to its focus on cost-effective solutions and intense competition in the CPU and GPU markets.

- Net Income:

Nvidia consistently reports higher net income compared to AMD. This is primarily due to its stronger revenue streams and more favorable profit margins. Nvidia's continued growth in high-demand sectors like gaming and data centers and AI advancements contribute to its robust net income figures. AMD's net income has shown improvement in recent years, benefiting from its competitive product offerings and market share gains.

- Balance Sheet Strength and Implications:

Both Nvidia and AMD have maintained relatively strong balance sheets. Nvidia's consistent revenue growth, profitability, and ample cash reserves reinforce its financial stability. This positions the company well for capital expenditures, research and development, and potential acquisitions. While AMD also has a strong balance sheet, it may have relatively less cash reserves than Nvidia due to its diverse product portfolio and ongoing investments in research and development.

- Market Capitalization Trends:

Nvidia's market capitalization has grown substantially in recent years, reflecting its strong market position and investor confidence. The company's gaming, data centers, and AI advancements have fueled its market value. AMD's market capitalization has also experienced growth, driven by its improved performance and competitiveness in the CPU and GPU markets. However, Nvidia's market capitalization tends to be higher than AMD's, reflecting its broader market appeal and higher investor expectations.

Factors that have affected their performance

The ability to introduce cutting-edge products and solutions that meet customer demands and industry trends is crucial to the performance of Nvidia and AMD. Breakthroughs in GPU architectures, AI acceleration, and high-performance computing have significantly impacted their market positions.

The ability to develop and deliver high-performance, energy-efficient, and cost-effective CPUs and GPUs determines their success. These segments ' market share gains or losses can directly impact their financial performance and stock prices.

Gaming-related revenue contributes a substantial portion of their overall earnings. Factors such as new gaming console launches, consumer preferences, demand for high-resolution graphics, and eSports's growth directly influence gaming-related revenue and profitability.

The growth of AI, machine learning, and big data analytics has driven the need for powerful GPUs and CPUs in these sectors. The ability to provide efficient, scalable, and high-performance solutions for data centers directly affects their revenue and market positions.

Macroeconomic conditions can impact the performance of Nvidia and AMD. Economic downturns or uncertainties may affect customer purchasing behavior and corporate spending, which, in turn, can influence the demand for their products and services.

Both companies have experienced supply chain challenges that have affected their performance. Factors such as semiconductor shortages, manufacturing constraints, and geopolitical tensions can disrupt the supply of critical components, impacting their ability to meet customer demand and fulfill orders.

Collaborations with technology companies, software developers, and industry leaders have helped expand their market reach, access new technologies, and strengthen their competitive positions.

AMD vs Nvidia: Are These Two AI Stocks Fairly Valued?

Nvidia's P/E Ratio: Nvidia has historically commanded higher P/E ratios than AMD. This is due to Nvidia's strong market position, consistent financial performance, and investor confidence in its future growth prospects. A higher P/E ratio suggests that investors are willing to pay a premium for Nvidia's earnings, indicating a potentially higher valuation.

AMD's P/E Ratio: AMD typically has lower P/E ratios than Nvidia. This can be attributed to several factors, including the intense competition in the CPU and GPU markets, AMD's ongoing efforts to regain market share, and its relatively lower profit margins. A lower P/E ratio may suggest that investors are assigning a lower valuation to AMD's earnings, potentially indicating a more attractive valuation for investors.

Relative Valuation: If Nvidia's P/E ratio is significantly higher than AMD's, it suggests that Nvidia's stock is relatively more expensive or valued higher in the market. Conversely, if AMD's P/E ratio is lower than Nvidia's, it may indicate a relatively more favorable valuation for AMD.

Comparison of their dividend yields to evaluate their income potential

According to the latest data, NVIDIA's dividend yield is 0.04%. On the other hand, AMD's current dividend yield is 0.00%. Therefore, NVIDIA has a higher income potential than AMD when it comes to paying dividends.

IV. Is Nvidia Or AMD A Better Buy?

A. AMD vs Nvidia: Analysis of the growth potential of Nvidia and AMD

- Current Market Standings:

Nvidia is dominant in the gaming and data center markets, leveraging its advanced GPU architectures and expertise in AI. Conversely, AMD has made significant strides in the CPU and GPU markets, gaining market share with its competitive product offerings.

- Future Developments:

Nvidia is expanding its presence in emerging technologies such as autonomous vehicles, edge computing, and AI applications. The company's acquisition of ARM Holdings also opens up new opportunities for growth in the semiconductor space. AMD invests in research and development to enhance its CPU and GPU architectures, targeting advancements in high-performance computing, AI, and cloud technologies.

- Technological Advancements:

Nvidia's focus on developing state-of-the-art GPUs and AI technologies positions it well to cater to the increasing demand for high-performance computing and data processing. AMD's commitment to improving its CPUs and GPUs, particularly in terms of power efficiency and performance, strengthens its competitiveness in the market.

- Market Expansion:

Nvidia's presence in the gaming industry provides a strong foundation, while its data center solutions cater to the growing demand for AI and cloud computing. AMD's partnerships with major technology companies and its increasing market share in CPUs and GPUs position it for further growth in gaming, data centers, and PCs.

- Industry Trends:

Nvidia and AMD are well-positioned to benefit from the rising adoption of AI, machine learning, and data-intensive applications. As these technologies become more pervasive across industries, the demand for high-performance computing solutions is expected to increase, presenting growth opportunities for both companies.

B. The industry trends that could affect their performance in the future

AI and Machine Learning: Demand for high-performance GPUs and CPUs for AI applications is expected to rise, driving revenue growth.

Cloud Computing and Data Centers: Nvidia's GPUs are sought after for data processing, while AMD's CPUs are gaining popularity for server deployments, opening avenues for revenue expansion.

Gaming and eSports: Nvidia's dominance in gaming GPUs and AMD's competitive offerings position both companies for revenue growth in this sector.

C. AMD vs Nvidia: Potential Risks and Opportunities

Supply Chain Disruptions: Both Nvidia and AMD face risks related to global supply chain disruptions, such as semiconductor shortages and geopolitical tensions. Such disruptions can impact production capabilities and limit revenue growth.

Competitive Landscape: Market share gains or losses can impact revenue and profitability.

Technological Advancements: Innovations in GPU and CPU architectures, AI acceleration, and energy efficiency will be crucial for maintaining a competitive edge.

D. AMD vs Nvidia: Which is the Better Buy?

Nvidia: Nvidia's strong market position in gaming, data centers, and AI, along with its consistent financial performance, makes it an attractive investment for those seeking exposure to these high-growth sectors. However, Nvidia stock may have a higher valuation, affecting potential returns.

AMD: AMD's competitive product offerings, growing market share, and expanding partnerships make it an appealing choice for investors. Its lower valuation than Nvidia might be advantageous, providing potential upside opportunities.

V. So, Why Should You Trade Nvidia Stock Or AMD Stock CFD at VSTAR?

VSTAR strives to provide you with an exceptional trading experience that sets VSTAR apart from other trading platforms. With industry-leading tight spreads starting from 0.0 pips, VSTAR ensures ultra-low trading costs to maximize your profit potential. VSTAR's commitment to top-tier deep liquidity guarantees that your orders are matched with the best prices in the market. And with lightning-fast order execution, you can seize opportunities and avoid unnecessary losses.

Take each position with the flexibility of up to 1:200 leverage. VSTAR offers competitive spreads from 0.0 pips, ensuring you get filled at the best market prices within milliseconds. Your trading needs are a priority, and VSTAR supports you with fast and reliable service.

Registering with VSTAR is easy, thanks to our easy 2-step registration procedure. VSTAR's fast KYC (Know Your Customer) process for applications and approvals means you can get started quickly. And rest assured, live support is available 24/7 during market hours to assist you every step of the way.

When it comes to security, VSTAR has got you covered. As a multi-regulated and reliable broker, VSTAR is authorized and regulated by CySEC (Cyprus Securities and Exchange Commission) under license number 409/22. VSTAR is also a proud member of the Cyprus Investor Compensation Fund, ensuring your funds are protected. Operating under the European Regulatory Framework of MiFID II, VSTAR adheres to stringent industry standards.

VSTAR's trading app is designed to cater to traders of every kind. With an easy-to-use interface and a mobile-enhanced trading experience, you can focus purely on trading and make the most of your opportunities. Explore "Popular Markets" to easily catch potential trades and stay ahead of the game.

Practice and refine your trading skills with a risk-free demo account. In just 10 seconds, you can access real trading conditions and test your strategies in a live environment without the risk of loss. Experience VSTAR's institutional-grade trading services and familiarize yourself with our platform before diving into live trading.

At VSTAR, we are committed to providing you with the best trading experience possible. Join VSTAR today and unlock the potential of your trading journey using reliable and innovative services.

VI. Conclusion

While industry trends, risks, and opportunities shape the performance of Nvidia and AMD stocks, the decision of which stock to buy ultimately rests on an investor's analysis and investment objectives. Conducting thorough research, considering financial indicators, and seeking professional advice can help investors make informed decisions and optimize their potential returns in this dynamic technology sector.

FAQs

1. Which is better, AMD or Nvidia?

Nvidia and AMD have different strengths and weaknesses. AMD often offers better value, while Nvidia leads in high-end performance.

2. Why is AMD so much cheaper than Nvidia?

AMD GPUs are cheaper because they focus more on value and mainstream performance. Nvidia focuses on premium performance and charges higher prices.

3. Is Nvidia faster than AMD?

Nvidia GPUs are generally faster, especially at the high end. But AMD competes well in the mid-range and offers good performance per dollar.

4. Why is AMD lagging behind Nvidia?

AMD lags behind Nvidia in market share and mindshare because Nvidia put more resources into GPU development and marketing earlier. But AMD remains competitive.

5. What is the AMD equivalent to GTX?

AMD's Radeon RX series is equivalent to Nvidia's GeForce GTX series in terms of market positioning. For example, the RX 580 competes with the GTX 1060.