- AMD showcases lead in adaptive computing, driving innovation across automotive, edge computing, and AI sectors.

- Revenue growth trajectory indicates a positive trend, with significant increases in Data Center and Client segment revenues.

- Strategic initiatives, partnerships, and product innovations bolster AMD's market expansion and competitiveness.

- Analyst sentiments reflect a majorly bullish outlooks with technicals suggesting a price target of $330 for 2024.

Advanced Micro Devices (NASDAQ:AMD) is progressing in automotive, edge computing, and artificial intelligence (AI). Collaborations with industry giants like Sony Semiconductor Solutions (SSS) propel AMD into automotive leadership, where adaptive computing fortifies the foundations of autonomous driving. Meanwhile, in the realm of edge computing, AMD's Spartan UltraScale+ FPGA family emerges as a cornerstone. Beyond tangible products, AMD's strategic initiatives, like strategic hiring endeavors and software ecosystem development, cement its position as a catalyst for transformative change and market valuation growth. Read more to learn about valuations and technicals.

AMD Stock Price Performance

In the shorter term, AMD's performance has also been impressive. Despite a slight decline over the past month (-10.79%), its 6-month and 1-year returns are robust, standing at 80.63% and 87.21%, respectively, outpacing the S&P 500's returns. This demonstrates AMD's potential for sustained growth even amid market fluctuations.

Source: tradingview.com

Over the past 10 years, AMD has exhibited extraordinary price performance, significantly surpassing the S&P 500 index. AMD's price return stands at an astounding over 4,400% compared to the S&P 500's 175.92% over the same period. This long-term trend underscores AMD's exceptional growth trajectory and its ability to generate substantial returns for investors.

AMD Strengths of Supporting Rapid Market Valuation Growth Potential

AMD has demonstrated several fundamental strengths through its recent developments and financial performance, indicating its potential for rapid growth.

Technological Innovation in Adaptive Computing

AMD's adaptive computing technology represents a significant strength driving its growth potential. The company's focus on developing cutting-edge solutions for various industries, including automotive, edge computing, and AI, positions it as a leader in technological innovation. Specific areas of strength include:

a. Automotive Industry Leadership:

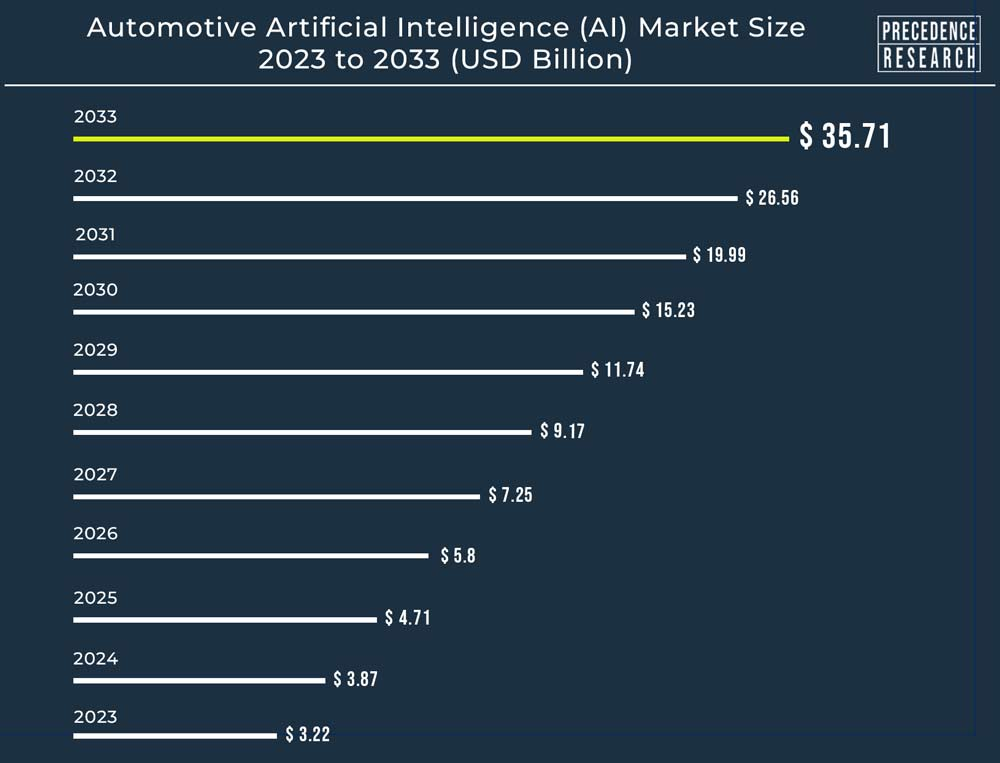

AMD's collaboration with Sony Semiconductor Solutions (SSS) to integrate adaptive computing technology into automotive LiDAR reference designs demonstrates its leadership in providing solutions for autonomous driving. The incorporation of AMD's adaptive computing technology enhances LiDAR systems' accuracy, data processing speed, and reliability, addressing critical safety concerns in autonomous vehicle development. AMD's expertise in developing scalable computing solutions optimizes LiDAR processing capabilities, contributing to high accuracy and reliability essential for automotive applications. The market demand provides solid topline growth opportunities for AMD over the decade (CAGR of 28% from 2024 to 2033).

Source: globenewswire.com

b. Edge Computing and Industrial Applications:

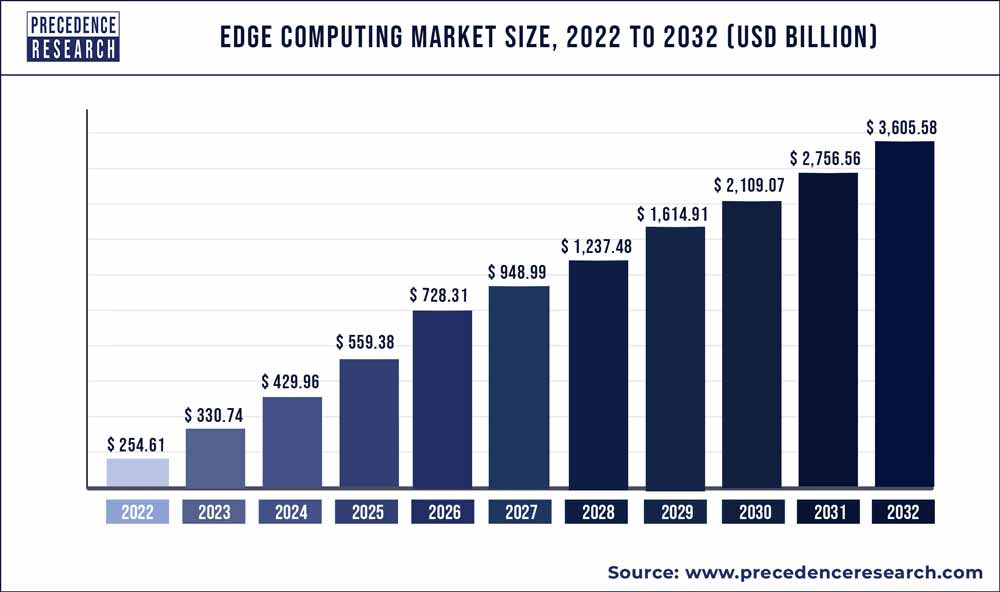

AMD's introduction of the Spartan UltraScale+ FPGA family extends its market-leading FPGA portfolio, catering to cost-sensitive edge applications in diverse industries such as healthcare, industrial networking, and robotics. The Spartan UltraScale+ FPGAs offer high I/O counts, power efficiency, and state-of-the-art security features, addressing the growing demand (at 30.4% CAGR from 2022 to 2032) for edge computing solutions with enhanced performance and reliability. These FPGAs provide flexible I/O interfacing and efficient integration with multiple devices or systems, empowering edge computing applications with seamless connectivity and adaptability.

Source: precedenceresearch.com

c. AI and Embedded Systems:

AMD's Embedded+ architecture combines Ryzen Embedded processors with Versal adaptive SoCs, offering scalable and power-efficient solutions for original design manufacturers (ODMs) targeting AI applications in medical, industrial, and automotive sectors. The integration of AI engines, adaptive computing, and Radeon graphics enables high-performance inferencing, sensor fusion, and AI capabilities in embedded systems, catering to the increasing demand for AI-driven solutions in diverse industries. In summary, AMD's focus on adaptive computing technologies across automotive, edge computing, and AI sectors underscores its technological prowess and positions the company for rapid growth in emerging markets.

d. Ongoing Strategic Hiring Initiatives:

Hiring industry veterans like Thomas Zacharia to lead strategic technology partnerships and public policy initiatives reflects AMD's focus on expanding its global footprint and leveraging expertise to fast-track the deployment of AMD-powered AI solutions worldwide. Zacharia's extensive experience in scientific research, technology development, and public policy positions AMD to capitalize on emerging opportunities in AI, HPC, and strategic AI deployments, bolstering the company's competitive advantage in key growth areas.

Revenue Growth and Market Position

AMD's revenue and market position demonstrate several fundamental strengths that support the company's rapid growth potential.

Revenue Growth Trajectory:

In the fourth quarter of 2023, AMD reported revenue of $6.2 billion, marking a 10% increase year-over-year. For the full year 2023, AMD's revenue stood at $22.7 billion, showcasing a year-over-year decline of 4%. Despite the annual decline, the fourth quarter's revenue growth indicates a positive trajectory for AMD's revenue, suggesting the potential for further growth in subsequent periods.

Segment Performance:

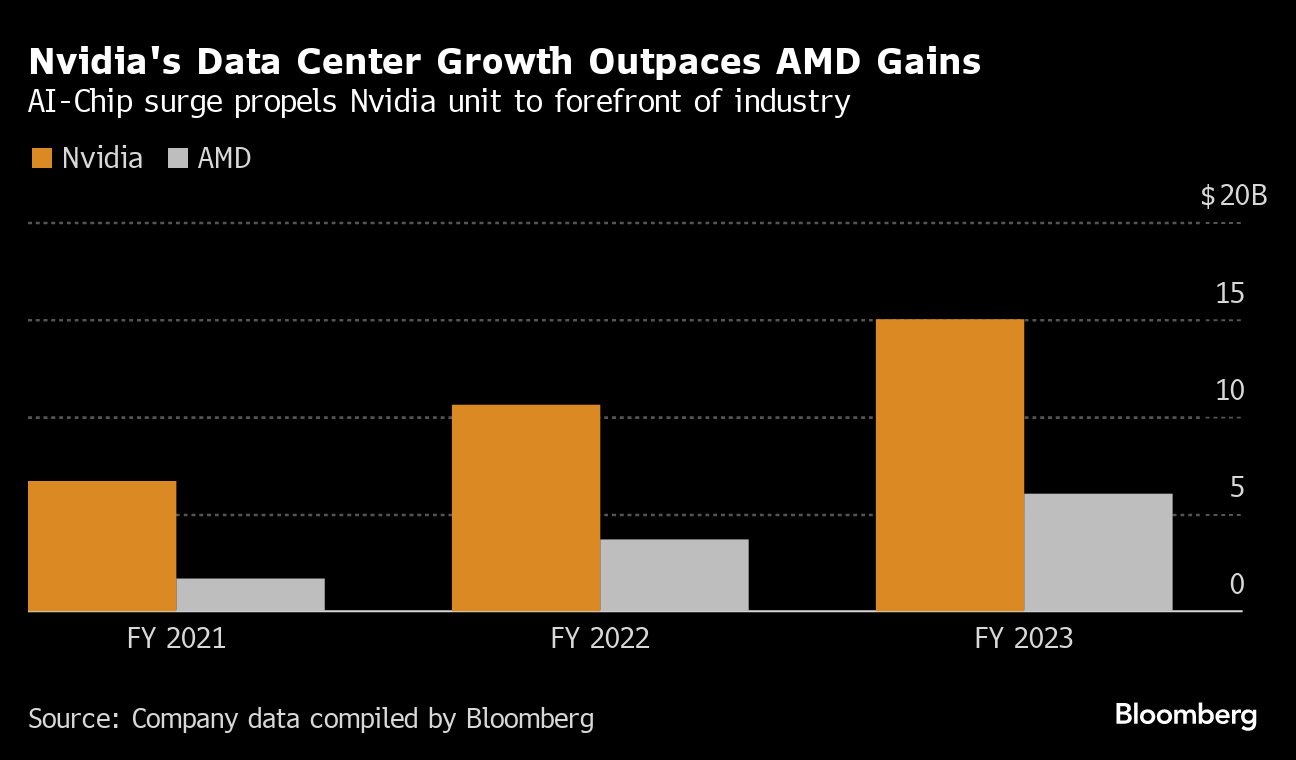

Data Center segment revenue experienced significant growth, reaching $2.3 billion in the fourth quarter of 2023, representing a remarkable 38% year-over-year increase and a 43% sequential increase. At the competitive level, AMD has room to grow its data center revenue. If AMD can match the segment’s top line growth with that of Nvidia (NASDAQ:NVDA), its consolidated financial performance and valuation may deliver a solid boost.

Source: Bloomberg.com

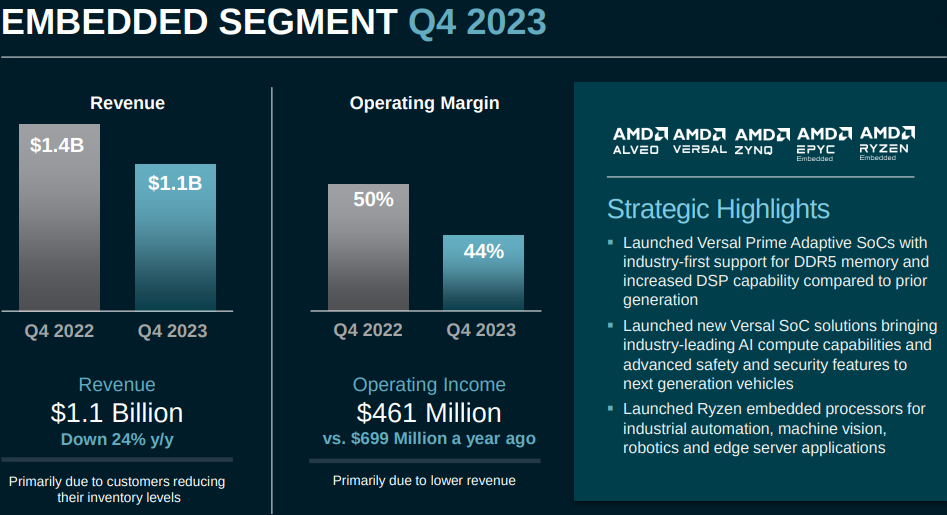

Client segment revenue also exhibited robust growth, reaching $1.5 billion, marking a substantial 62% year-over-year increase. However, it remained flat sequentially. Although Gaming segment revenue declined by 17% year-over-year and 9% sequentially, it still contributed significantly to AMD's overall revenue. Embedded segment revenue faced challenges, declining by 24% year-over-year and 15% sequentially due to customers reducing their inventory levels.

Strategic Initiatives And Market Share Expansion:

AMD gained server CPU revenue share in the fourth quarter, driven by significant double-digit percentage growth in 4th Gen EPYC Processor revenue. The company's strong performance in Cloud and Enterprise segments indicates its increasing penetration and competitiveness in these lucrative markets.

AMD's strategic initiatives, such as the launch of AMD Instinct MI300X accelerators and EPYC processors, have contributed to its revenue growth. Partnerships with major cloud providers like Amazon, Alibaba, Google, Microsoft, and Oracle have expanded AMD's market reach and product adoption, particularly in the cloud computing space. The development of the ROCm 6 software suite and collaboration with AI ecosystem leaders like Databricks, Essential AI, Lamini, and OpenAI signify AMD's focus on fostering an extensive AI software ecosystem.

Moreover, the introduction of new product lines, such as the AMD Ryzen 8040 Series mobile processors with integrated neural processing units (NPUs) and the AMD Ryzen 8000G Series desktop processors with dedicated AI NPUs, demonstrates AMD's focus on innovation to address evolving market demands. The ongoing development of next-generation processors, like the Turin family of EPYC Processors, underscores AMD's focus on technological advancement and performance leadership.

AMD Market Outlook

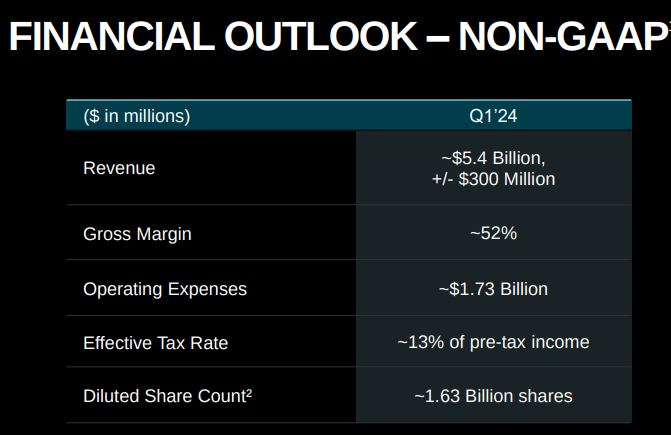

AMD's outlook for the first quarter of 2024 anticipates revenue of approximately $5.4 billion, with expectations for sequential growth in Data Center GPU revenue. Strong customer demand for AMD's products, particularly in the Data Center segment, and expanded engagements with key partners bode well for future revenue growth and market expansion.

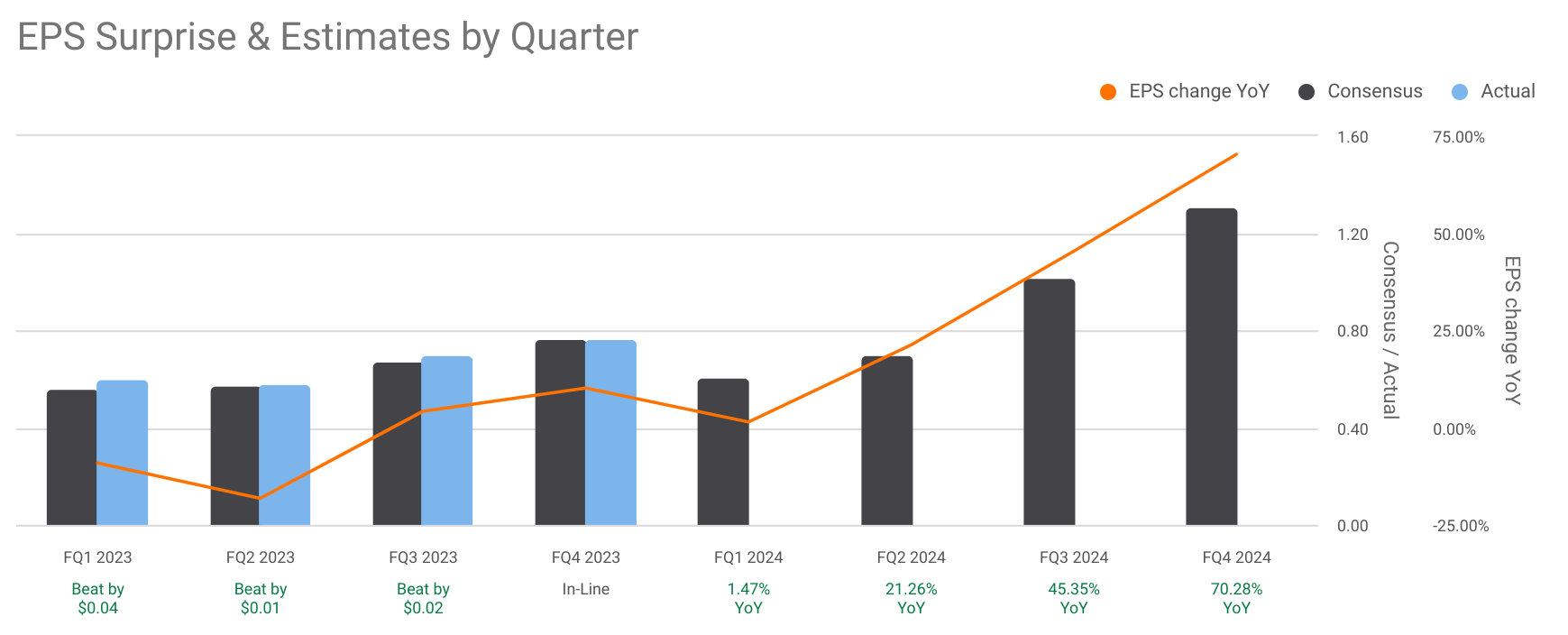

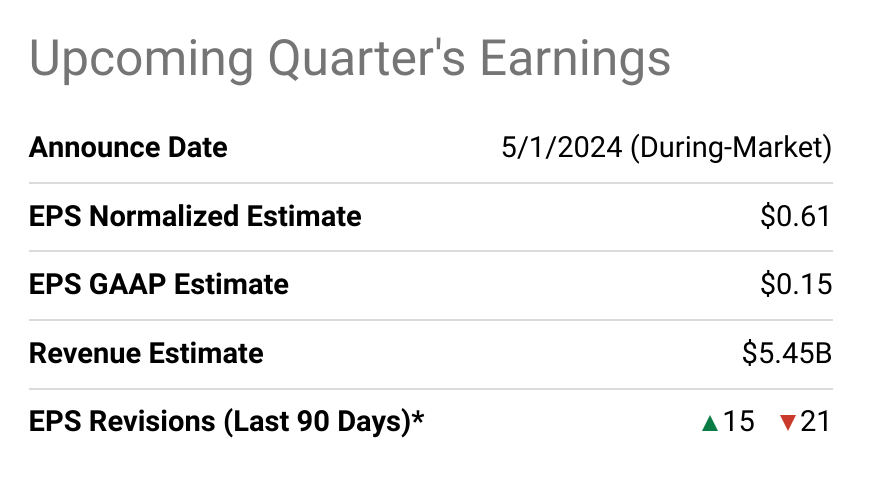

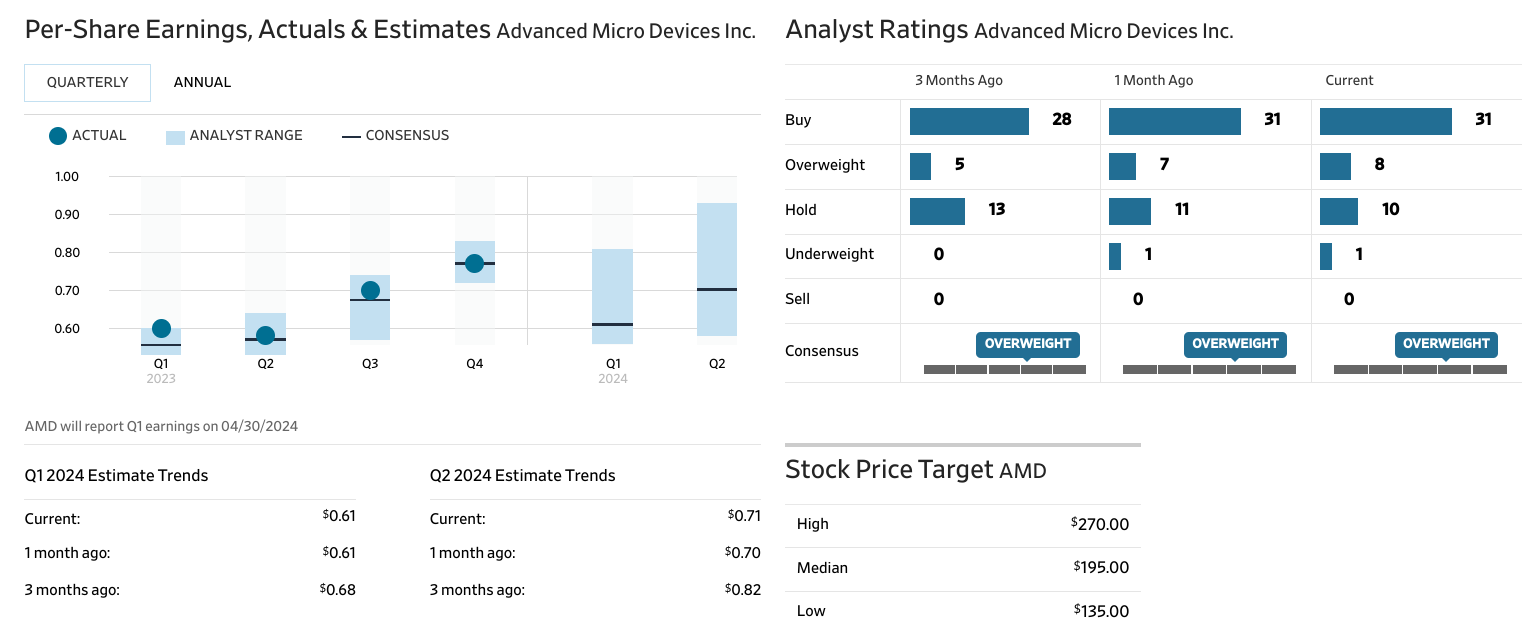

AMD, a leading semiconductor company, has shown impressive growth trends in both earnings per share (EPS) and revenue estimates. Beginning with EPS estimates, AMD's performance showcases consistent improvement. In FQ1 2024, the EPS estimate was $0.61, with a year-over-year (YoY) growth rate of 1.47%. Subsequently, in FQ2 2024, there was a significant surge to $0.70, marking a substantial 21.26% YoY growth. This trend continued with even more impressive growth rates, reaching $1.87 in FQ3 2026, representing a remarkable 27% YoY growth. However, it's noteworthy that the number of analysts covering AMD reduced drastically from 36 in FQ1 2024 to just 3 in FQ3 2026, which could affect the reliability of estimates.

Source: seekingalpha.com

Similarly, AMD's revenue estimates have shown impressive growth patterns. Starting from $5.45 billion in FQ1 2024, with a YoY growth rate of 1.80%, revenue estimates steadily climbed, reaching $10.00 billion in FQ3 2026, reflecting an 18.48% YoY growth. It's noteworthy that despite the growth trajectory, there's a fluctuation in the number of analysts covering revenue estimates, dropping from 37 in FQ1 2024 to just 3 in FQ3 2026. This could indicate increased volatility or uncertainty in the market perception.

Source: AMD financial results

Source: seekingalpha.com

AMD Valuations

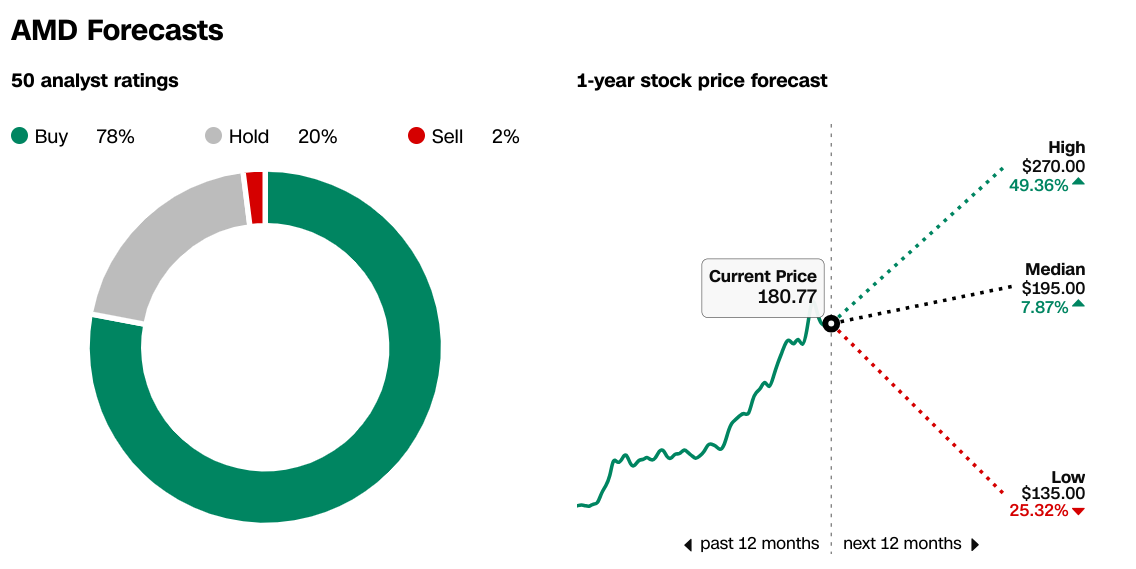

AMD stock forecast, as per CNN, indicates a bullish sentiment among analysts. With 78% of analysts rating the stock as a "Buy," the consensus suggests positive market sentiment. The 1-year stock price forecast offers a wide range, from a low of $135.00 to a high of $270.00, with a median estimate of $195.00. This range signifies varying degrees of optimism among analysts, with the potential for significant growth but also acknowledging possible fluctuations.

Source: CNN.com

AMD has recently experienced a surge in analyst activity, shedding light on the prevailing market sentiment and potential trajectory of the company's stock. Among these recent analyst actions, notable insights emerge from key data and examples. For instance, C J Muse of Cantor Fitzgerald maintains a bullish outlook on AMD, reiterating a "Buy" rating and modestly raising the price target to $190 on March 11, 2024. This adjustment suggests a potential upside of 5.11%.

In a similar vein, Ben Reitzes from Melius Research expresses a strong bullish sentiment by maintaining a "Strong Buy" rating and significantly raising the price target from $192 to $265 on March 8, 2024. This substantial adjustment implies a noteworthy upside potential of 46.60%, indicating heightened confidence in AMD's future performance. Additionally, Vijay Rakesh at Mizuho remains optimistic, maintaining a "Strong Buy" rating and increasing the price target from $200 to $235 on March 7, 2024. This adjustment reflects a positive outlook with a 30.00% upside potential.

However, not all analysts share an equally bullish sentiment. Ingo Wermann of DZ Bank downgraded AMD from "Strong Buy" to "Hold" on March 7, 2024, maintaining a price target of $200. This move suggests a more cautious stance, acknowledging potential risks and uncertainties in AMD's future performance, despite a still positive upside potential of 10.64%. Similarly, Tom O'Malley of Barclays reaffirms a "Buy" rating and raises the price target from $200 to $235 on March 4, 2024, indicating a 30.00% upside potential. This adjustment aligns with a positive sentiment, yet reflects a slightly more conservative approach compared to some other analysts.

According to data from The Wall Street Journal, analyst ratings for AMD have remained relatively stable over the past three months. As of the current period, 31 analysts rate AMD as a "Buy," consistent with the ratings from one month ago and showing an increase from 28 analysts three months ago. Additionally, there has been a slight increase in the number of analysts rating AMD as "Overweight," rising from 5 to 8 over the past three months. Conversely, the number of analysts rating AMD as "Hold" has decreased slightly from 13 to 10, indicating a modest shift towards more bullish sentiments.

Furthermore, there is consistency in the absence of any analysts rating AMD as "Underweight" or "Sell" throughout the observed period. This data suggests a prevailing positive sentiment among analysts towards AMD's stock, with a majority endorsing a "Buy" or "Overweight" rating, potentially reflecting confidence in the company's performance and future prospects.

Source: WSJ.com

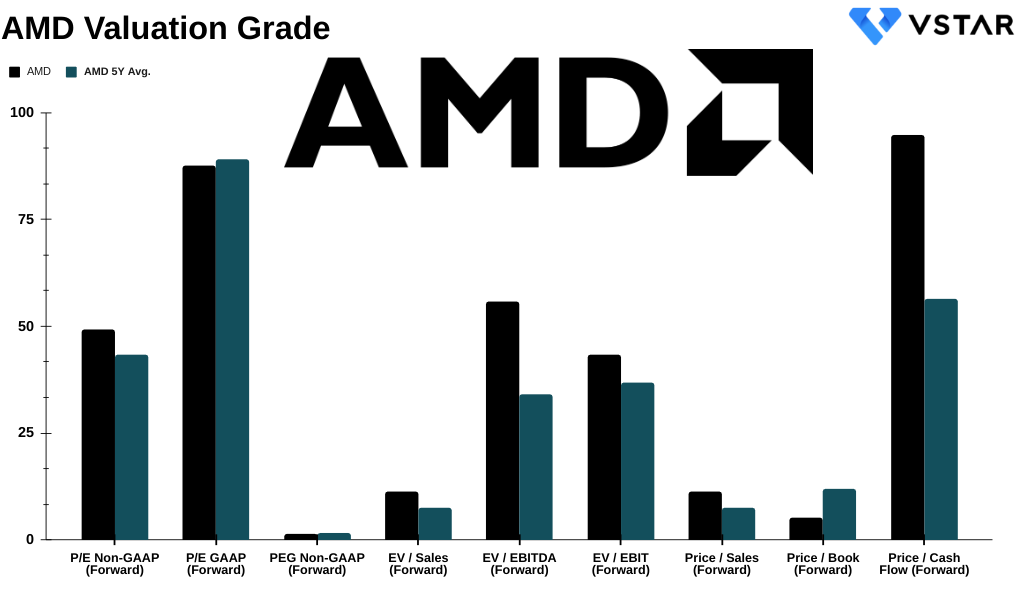

AMD is evaluated through various metrics which shed light on its financial health and growth prospects.

- Price-to-Earnings (P/E) Ratio:

AMD's P/E ratios (both GAAP and non-GAAP forward) are higher than its 5-year average, indicating potentially overvalued stock.For instance, AMD's non-GAAP forward P/E stands at 49.02, surpassing its 5-year average of 43.08.

- Price/Earnings Growth (PEG) Ratio:

AMD's PEG ratio (non-GAAP forward) is lower than its 5-year average, suggesting a relatively better valuation in terms of growth potential.The current PEG ratio of 1.1 is lower compared to the 5-year average of 1.46.

- Enterprise Value (EV) Ratios:

EV/Sales, EV/EBITDA, and EV/EBIT ratios (forward) indicate AMD's stock might be overvalued compared to its historical performance.For instance, AMD's EV/Sales (forward) is 11.08, higher than its 5-year average of 7.3.

- Other Metrics:

Price/Book and Price/Cash Flow ratios (forward) suggest mixed signals regarding valuation.While Price/Book is lower than the 5-year average, indicating potential undervaluation, Price/Cash Flow is higher, indicating possible overvaluation.

Source: Analyst Compilation

AMD Weakness Analysis: Embedded Segment

The Embedded segment's revenue experienced a decline of 24% year-over-year and 15% sequentially.

Despite the overall revenue growth in other segments, the Embedded segment's performance stands out negatively due to the decline in revenue. This decline can signal a fundamental weakness within AMD's strategy or market presence in the embedded solutions domain.

Compared with the Data Center and Client segments, which saw significant revenue growth, the Embedded segment's decline is notable. While Data Center segment revenue grew by 38% year-over-year and 43% sequentially, and Client segment revenue increased by 62% year-over-year, the Embedded segment's performance is starkly different. Such a contrasting performance indicates a disparity in market demand or competitive positioning for AMD's embedded solutions compared to its other offerings.

The revenue decline in the Embedded segment is primarily attributed to customers reducing their inventory levels. This reduction implies that either demand for AMD's embedded solutions decreased or customers shifted their preferences towards competitors' offerings. The fact that customers are reducing inventory levels could suggest challenges in the market acceptance or adoption of AMD's embedded products.

While the Embedded segment revenue declined in the specified quarter, the full-year revenue for 2023 indicates a growth of 17% compared to the prior year. However, this growth appears modest when contrasted with the Data Center segment's 7% year-over-year increase and the Client segment's 25% decline in revenue for the same period.Despite the yearly growth, the Embedded segment's performance seems relatively subdued compared to other segments.

Source: AMD financial results

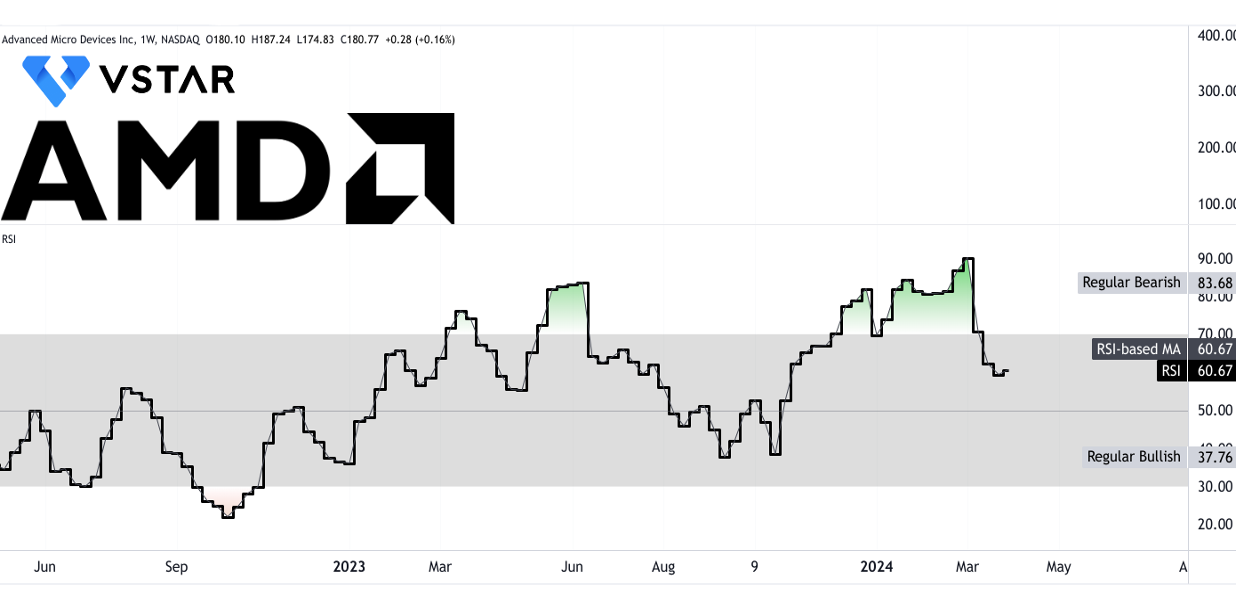

AMD Stock Forecast Technical Take: Advanced Micro Devices (NASDAQ:AMD)

By the end of 2024, AMD stock price may hit $330. The revised projection is based on the current momentum of change in polarity projected over Fibonacci retracement and extension levels.

After the recent corrections, the price is at the immediate resistance zone ($191.15 to $186.15). The resistance zone is very strong. To breach it, the price may retest the pivot ($151.80) in search of vital support and be in line with the fundamental fair valuation (forward basis). The price may require large upside moments to provide a proper close over the resistance zone.

On the upside, $276 is major resistance for the stock to be dealt with. The trend line (purple line), which is a modified exponential moving average, will serve as dynamic support for the uptrend and at the same time, any close below this line may serve as a signal for the conclusion of the ongoing markup phase.

Source: tradingview.com

Looking at the RSI at 60, there is still a solid upside. It is due to the fact that the current price correction is not supported by bearish divergence. Therefore, RSI can still reach an overbought trajectory above 70, as can the stock price.

Source: tradingview.com

In summary, AMD showcases robust fundamentals with a focus on adaptive computing, evident through its leadership in automotive, edge computing, and AI sectors. Despite challenges in the Embedded segment, revenue growth in Data Center and Client segments, coupled with strategic initiatives and market share expansion, bode well for future growth. Analyst sentiment remains largely positive, with a majority rating AMD as a "Buy" or "Overweight." However, valuation metrics suggest potential overvaluation (in absolute terms), particularly in P/E ratios. Finally, technical analysis indicates a bullish trajectory, with a projected stock price of $330 by the end of 2024, supported by momentum.