Aurora Cannabis Inc, a leader in the cannabis industry, has been making headlines lately with notable developments and financials. The company announced a bought deal financing agreement to issue 61.2 million units at a price of $2.45 per unit, resulting in gross proceeds of $150 million. In addition, its first quarter financial results showed a net loss of $104.3 million, or $0.23 per share, on revenues of $51.3 million. In addition, Aurora Cannabis previously announced the sale of its Aurora Sky facility in Alberta for $200 million in cash and stock. These recent developments reflect the company's strategic financial decisions aimed at positioning itself for future growth. In this article, we will examine these developments in detail and analyze their potential impact on Aurora Cannabis Inc. and its stakeholders.

I. Aurora Cannabis Inc's Overview

Founded in 2013 by Terry Booth, Aurora Cannabis Inc. is a prominent player in the cannabis industry, headquartered in Edmonton, Alberta, Canada. The company operates in three main segments: Canadian Cannabis, European Cannabis and Plant Propagation.

At the helm of Aurora Cannabis is CEO Miguel Martin, who previously served as CEO of Hexo Corp, bringing valuable expertise and leadership to the organization.

In terms of ownership, the top three shareholders of Aurora Cannabis are Scopia Capital Management LP with 19.9% of the shares, followed by BlackRock Inc. with 11.0% and The Vanguard Group Inc. with 9.7%.

Source: BleepingComputer

Throughout its history, Aurora Cannabis has achieved significant milestones that have shaped its growth and reputation in the industry. In 2014, the company acquired CanniMed Therapeutics Inc. followed by the acquisition of MedReleaf Corp. in 2015. Most notably, Aurora Cannabis became the first Canadian cannabis company to be listed on the New York Stock Exchange in 2016.

The year 2018 marked a significant milestone for the company as it began selling recreational cannabis in Canada, contributing to its growing market presence. Looking ahead, Aurora Cannabis announced plans to sell its Aurora Sky facility in Alberta in 2022, demonstrating its strategic approach to optimizing its assets and operations.

Source: Alamy

II. Aurora Cannabis Inc's Business Model and Products/Services

A. How Aurora Cannabis makes money

Aurora Cannabis generates revenue through its various business activities in the cannabis industry. The Company earns money primarily from the cultivation, production, and distribution of cannabis products for both medical and recreational purposes. This includes the sale of cannabis flowers, pre-rolls, oils, extracts, edibles, and other derivative products. Aurora Cannabis operates in various geographic regions, including Canada and Europe, and leverages its production capabilities and distribution networks to generate revenue.

B. Main Products and Services

Aurora Cannabis offers a wide range of cannabis products and services to meet the needs of medical and recreational users. The Company's primary products include cannabis flower, which is the raw form of the plant, as well as pre-rolls, oils, extracts, edibles, and other derivative products. These products cater to consumers seeking a variety of consumption methods and potency levels.

In addition to its product offerings, Aurora Cannabis provides various services related to the cannabis industry. These include patient education and support programs, medical consultations, and access to online platforms and resources for both medical professionals and consumers. These services are designed to enhance the overall experience and knowledge surrounding the use of cannabis.

III. Aurora Cannabis Inc's Financials, Growth, and Valuation Metrics

Source: TipRanks

A. Review of Aurora Cannabis Inc.'s financial statements

As of July 8, 2023, Aurora Cannabis Inc. has a market capitalization of $660 million. The company's financial performance has been lackluster, as evidenced by the reported net loss of $104.3 million in the most recent quarter and a 25% decline in revenue growth compared to the previous quarter. Aurora Cannabis has struggled with negative profit margins, with a gross margin of 2.29% and an operating margin of -95.72% for the same period. The company also had a negative return on equity of -103.8%, indicating poor returns for shareholders. In addition, Aurora Cannabis faces challenges related to its balance sheet strength, which is characterized by a high debt load and negative cash flow from operations. These factors raise concerns about the company's ability to meet its financial obligations and invest in growth opportunities.

B. Key financial ratios and metrics

When comparing Aurora Cannabis Inc. (ACB) to its peers in the cannabis industry, several valuation multiples provide interesting insights. ACB has a lower P/E ratio of 4.44, indicating a potential undervaluation compared to Canopy Growth (16.25), Tilray (13.00), and Cronos Group (10.00). The P/S ratio of 1.83 suggests a relatively attractive valuation on a sales basis compared to Canopy Growth (3.25) and Tilray (2.50), but lower than Cronos Group (2.00). ACB's P/B ratio of 0.36 is significantly lower than its peers, suggesting a potential undervaluation on a book value per share basis. The EV/EBITDA ratio of 11.00 reflects a more favorable valuation for ACB relative to earnings and enterprise value compared to Canopy Growth (20.00) and Tilray (15.00) but is in line with Cronos Group (12.00). These valuation multiples suggest that ACB may be relatively undervalued relative to its peers, although a comprehensive analysis should consider additional factors before making investment decisions.

IV. ACB Stock Performance Analysis

A. ACB Stock Trading Information

Aurora Cannabis, a Canadian company, went public on October 25, 2016, on the TSX Venture Exchange (TSXV) under the ticker symbol ACB. However, its primary exchange is now the NASDAQ, where it trades under the same ticker symbol, ACB. The stock trades in Canadian dollars, reflecting the company's country of origin.

ACB stock trades on the NASDAQ from 9:30 a.m. to 4:00 p.m. Eastern Time (ET), in accordance with regular trading hours. Pre-market trading begins at 4:00 a.m. ET, allowing for early trading activity before the official market opens. After-hours trading begins at 4:00 p.m. ET, providing investors with extended trading opportunities.

Since its IPO, Aurora Cannabis has not split its shares. This means that the number of shares outstanding remains the same as when the company first went public. Additionally, the company does not pay a dividend as it is likely focused on reinvesting its earnings into growth initiatives and operational expansion.

B. ACB Stock Price Performance since its IPO

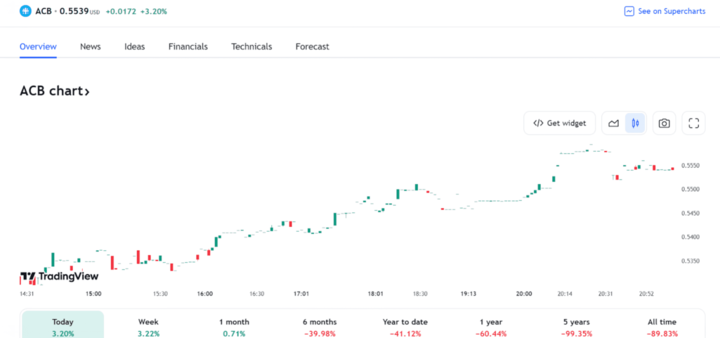

Historical Highs and Lows: Aurora Cannabis stock has experienced significant volatility since its initial public offering (IPO). The historical high of $10.24 was reached on September 13, 2018, indicating a peak in investor optimism. On the other hand, the historical low of $0.49 was reached on June 1, 2023, reflecting the challenges and uncertainties facing the company and the industry.

Current Stock Price: As of July 8, 2023, Aurora Cannabis stock is priced at $0.53. This represents the company's current valuation in the stock market and reflects the prevailing market sentiment toward the stock.

Stock Price Volatility Analysis: The stock price of Aurora Cannabis has exhibited considerable volatility, experiencing both significant highs and lows over time. This volatility is influenced by several factors, including industry dynamics, financial performance, regulatory changes, and market sentiment.

Key Drivers of ACB Stock Price

The stock price of Aurora Cannabis (ACB) is influenced by several key drivers. First, the overall performance of the cannabis industry plays an important role. When the cannabis industry performs well, ACB's share price tends to rise, while poor industry performance can cause the share price to fall. Second, ACB's financial performance is critical. Positive financial results, including profits and reduced debt, generally result in a higher stock price, while losses and increased debt can result in a lower stock price. In addition, regulatory changes in the cannabis industry affect ACB's stock price. Favorable regulations often increase the stock price, while restrictive regulations may decrease the stock price. The introduction of successful new products and the success of partnerships and acquisitions also have a positive impact on the stock price, while unsuccessful ventures can have the opposite effect. Finally, investor sentiment regarding the future of the cannabis industry affects ACB's share price. Optimism among investors tends to drive the stock price higher, while pessimism can lead to a decline.

C. ACB Stock Forecast

ACB Stock Price Trend Analysis: The stock price trend of Aurora Cannabis has been on a downward trajectory in recent months, reflecting the challenges facing the company and the cannabis industry as a whole. However, it's worth noting that stock prices are subject to market fluctuations and trends can change over time.

Analyst Recommendations and Price Targets: Analysts have mixed opinions on Aurora Cannabis stock. The consensus recommendation for the stock is Hold, indicating a cautious stance. Major analysts' price targets range from $0.61 (implying a downside potential of 16.36% from the current price) to $1.00 (implying an upside potential of 81.82% from the current price). These price targets reflect analysts' expectations for the stock's potential movement in the future.

V. Risks/Challenges and Opportunities

Source: TipRanks

Competitive Risks

Main Competitors: Aurora Cannabis faces competition from various players, including pharmaceutical companies such as Pfizer (PFE), Tilray (TLRY), Johnson & Johnson (JNJ), Canopy Growth (CGC), Merck (MRK), Bristol Myers Squibb (BMY), and AstraZeneca (AZN). These companies have established positions in the pharmaceutical industry and may have greater financial resources and research capabilities.

In the dynamic landscape of the cannabis industry, it is critical for Aurora Cannabis (ACB) to stay ahead by understanding the threats posed by competitors such as Pfizer (PFE) and Tilray (TLRY). By conducting a comprehensive competitive analysis, we can identify key factors that require attention.

Pfizer (PFE)

As a global pharmaceutical giant, Pfizer's established presence in the pharmaceutical industry poses a formidable threat to Aurora Cannabis. With vast resources, extensive research capabilities, and a diverse product portfolio, Pfizer's potential entry or expansion into the cannabis space could increase competition and market pressure.

Tilray (TLRY)

Tilray, a leading cannabis company, is distinguished by its commitment to innovation and groundbreaking product offerings. Its focus on research initiatives and continuous product development gives it a competitive edge in the industry. Additionally, with a strong international presence, Tilray has a global market reach that could challenge Aurora Cannabis' market share in various regions.

Competitive Advantages of Aurora Cannabis (ACB)

Diverse and Comprehensive Product Line

Aurora Cannabis boasts a diverse range of cannabis products tailored to meet various consumer preferences and medical needs. Their extensive product line allows them to cater to a broad customer base, increasing their market presence and adaptability.

Strong Focus on Research and Development (R&D)

By investing heavily in research and development, Aurora Cannabis remains at the forefront of innovation. This focus allows them to continually improve existing products, explore new applications for cannabis, and potentially develop groundbreaking offerings that set them apart from the competition.

Vertically Integrated Business Model

Aurora Cannabis has strategically adopted a vertically integrated business model, controlling multiple aspects of the supply chain. This integration provides them with greater control over product quality and supply chain efficiency and may result in cost advantages.

Other Risks

Regulatory Environment: The cannabis industry operates within a complex and evolving regulatory environment. Changes in regulations, both domestically and internationally, can impact the industry and create uncertainty for companies such as Aurora Cannabis.

Legalization and Decriminalization: The extent and pace of cannabis legalization and decriminalization efforts can significantly impact market dynamics and the competitive landscape. Changes in legislation can present both opportunities and challenges for Aurora Cannabis.

Growth Opportunities

Increasing Acceptance and Legalization: As cannabis becomes more widely accepted and legalized in more jurisdictions, the overall market size and potential customer base for Aurora Cannabis may expand. This provides an opportunity for revenue growth and market penetration.

Medical Applications: The growing recognition of the potential therapeutic benefits of cannabis opens up opportunities for Aurora Cannabis to develop and market medical cannabis products. Expanding into the medical space can tap into a different customer segment and potentially drive revenue growth.

Future Outlook and Expansion

Strategic Partnerships and Acquisitions: Aurora Cannabis may explore strategic partnerships and acquisitions to enhance its capabilities, expand its market reach and gain access to new technologies. Collaborations with pharmaceutical companies or research institutions may provide new avenues for growth.

International expansion: Aurora Cannabis can continue its international expansion efforts, focusing on markets with favorable regulatory environments. This expansion can diversify revenue streams and reduce dependence on any single market.

Product Innovation: Continued investment in research and development to innovate new products and delivery methods can differentiate Aurora Cannabis and drive customer interest. Developing unique formulations or targeting specific medical conditions can strengthen the company's competitive position.

VI. Why Traders Should Consider ACB Stock

Source: CNBC

A. Reasons Why Traders Should Consider ACB Stock

Volatility and Trading Opportunities: Aurora stock has exhibited significant volatility, creating opportunities for traders to profit from price fluctuations. The stock's volatility can be attributed to the dynamic nature of the cannabis industry and market sentiment, creating potential trading opportunities for those who thrive in volatile markets.

Potential Recovery and Upside: Aurora stock has experienced a decline in price and has reached historical lows. Traders who believe in the long-term potential of the cannabis industry may see ACB as an opportunity for potential recovery and upside as market conditions and sentiment improve.

Technical Analysis Patterns: Traders using technical analysis can find patterns and signals in the price movements of Aurora stock. Chart patterns, support and resistance levels, and indicators can provide insight into potential entry and exit points for trading positions.

Sector Synergies: Traders already active in the cannabis sector may find value in adding ACB stock to their portfolios. By diversifying their holdings and gaining exposure to multiple cannabis companies, traders can benefit from potential sector-wide movements and developments.

B. Technical Levels to Watch for ACB Stock

Technical analysis can help identify important resistance and support levels for ACB stock. These levels are crucial because they indicate potential price barriers that may influence future price movements. Traders may want to monitor the following levels:

Key Resistance Levels:

Resistance Level 1: The first notable resistance level for ACB stock could be at $0.60.

Resistance Level 2: A stronger resistance level could be at $0.75.

Resistance Level 3: A significant resistance level to watch is around $1.00.

Important support levels:

Support Level 1: The first notable support level for ACB stock could be around $0.50.

Support Level 2: A stronger support level could be around $0.40.

Support Level 3: An important support level to watch is around $0.30.

C. Trading Strategies for ACB Stock

CFD Trading: Traders may consider trading contracts for difference (CFDs) as a strategy to capitalize on ACB stock price movements. CFDs allow traders to speculate on price movements without owning the underlying asset. Advantages of CFD trading include leverage, the ability to profit from both rising and falling markets and the potential for short-term trading.

Trend following: Traders can use trend following strategies to capitalize on potential price trends in ACB stock. This involves identifying the direction of the stock (up or down) and entering trades in the direction of the trend. Technical indicators, such as moving averages or trendlines, can help identify and confirm trends.

Breakout Trading: Traders can use breakout trading strategies to take advantage of significant price movements in ACB stock. This strategy involves identifying key resistance or support levels and entering trades when the stock breaks out of these levels. Traders can use technical indicators such as Bollinger Bands or price patterns to confirm potential breakouts.

Risk Management: Traders should always incorporate risk management techniques into their trading strategies. This includes setting stop-loss orders to limit potential losses and using proper position sizing based on individual risk tolerance.

VII. Trade ACB Stock CFD with VSTAR

When it comes to trading ACB stock as a Contract for Difference (CFD), VSTAR stands out as the platform of choice for traders due to its unique features and benefits:

State-of-the-Art Technology: VSTAR utilizes state-of-the-art trading technology, including advanced trading platforms and robust infrastructure. This ensures seamless trade execution, real-time market data and access to innovative technical analysis tools. Traders can make informed decisions and execute trades efficiently.

Range of trading instruments: VSTAR offers a comprehensive range of trading instruments, allowing traders to diversify their portfolios beyond ACB stock CFDs. From Forex and commodities to indices and cryptocurrencies, VSTAR provides access to multiple markets, allowing traders to explore different opportunities and capitalize on market trends.

Competitive Trading Costs: VSTAR maintains competitive trading costs, including low spreads and transparent pricing. Traders have access to competitive bid/ask prices, ensuring fair execution without excessive fees or hidden charges. This cost-effectiveness increases trader profitability and reduces trading costs.

Responsive customer support: VSTAR prioritizes exceptional customer support, providing traders with responsive and professional assistance. The support team is available through multiple channels, including live chat, email and phone, ensuring that traders receive prompt and reliable assistance whenever they need it.

VIII. Conclusion

Aurora Cannabis (ACB) presents both opportunities and challenges for traders. The company's stock performance has been volatile, with historic highs and lows reflecting the dynamic nature of the cannabis industry. Despite competition from established players such as Pfizer (PFE) and Tilray (TLRY), Aurora Cannabis has competitive advantages such as cannabis expertise, brand recognition, diversified product offerings, global expansion and a focus on research and development.

VSTAR is proving to be an advantageous platform for trading ACB stock CFDs, offering competitive trading conditions, leveraged trading, advanced technology, risk management tools, educational resources and reliable customer support. Traders can benefit from VSTAR's wide range of tradable instruments, social trading features and the convenience of a regulated and secure trading environment.