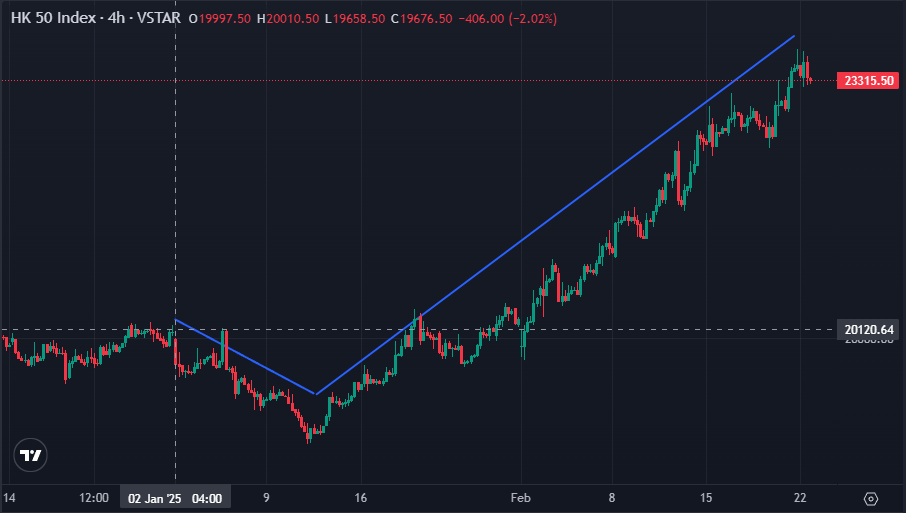

Entering 2025, the Hang Seng Index (HSI) continues to rise strongly, showing a trend that amazes investors and market analysts. From the end of 2024 to the beginning of 2025, the Hang Seng Index once broke through the 23,000-point mark, setting a new high in nearly three years. As the Hong Kong stock market continues to rise, the "surge" of the Hang Seng Index has attracted widespread attention. So, what are the deep-seated reasons behind this wave of rise? Is there a bubble behind the surge? How should we view the future trend of the Hang Seng Index?

Behind the surge of the Hang Seng Index: the interweaving of multiple factors

China's economic recovery exceeds expectations

Since the second half of 2024, China's economy has shown a recovery momentum that exceeds market expectations. In particular, the Chinese government has introduced a series of policy stimulus measures, including increasing infrastructure investment, reducing taxes and fees, and strengthening support for the manufacturing and consumer sectors. The strong recovery of the Chinese economy has boosted market confidence in China's A-shares and the Hong Kong stock market. Chinese stocks in Hong Kong stocks account for most of the weight of the Hang Seng Index. As the Chinese economy recovers, the performance of the Hong Kong stock market has been strongly supported.

Global funds flow into the Hong Kong market

In the global capital market, the Hong Kong stock market has always been regarded as an important bridge connecting the Chinese and Western markets. In the second half of 2024, a new trend in global capital flows emerged, and foreign capital poured into the Hong Kong market, especially when the interest rate hike cycle of the US and European central banks was nearing its end and market risk appetite rebounded, Hong Kong became an important destination for attracting foreign capital. Capital inflows not only drove the rise of the Hong Kong stock market, but also strengthened the market's confidence in the future performance of the Hang Seng Index.

Strong rebound in technology stocks

The technology sector in the Hang Seng Index, especially leading technology stocks such as Tencent, Alibaba, JD.com, and Baidu, achieved a strong rebound in 2024 and early 2025. The profit performance of Chinese technology companies exceeded expectations, especially in the field of technological innovation dominated by AI, cloud computing, e-commerce and new energy, which has become a hot spot favored by capital. Compared with US technology stocks, the valuation of the Hong Kong market is relatively low, which makes investors optimistic about the long-term development of Hong Kong technology stocks, thus driving the continued rise of the Hang Seng Index.

Gradual recovery of the real estate market

After years of downturn, Hong Kong's real estate market began to show signs of recovery in 2024. With the recovery of the Chinese economy and the stimulus of local policies, the demand for Hong Kong's property market has rebounded, and stocks in the real estate sector have also risen, further boosting the performance of the Hang Seng Index. Although the real estate market is still facing pressure from policy regulation and rising capital costs, its gradual recovery has provided additional impetus for the Hang Seng Index to rise.

Stability of Hong Kong's financial market

In recent years, the stability of Hong Kong's financial market has continued to improve. The transparency of financial regulatory policies has increased and the openness of the capital market has increased, which has attracted more and more overseas investors. Especially in 2024, the Chinese government has strengthened financial reform measures in Hong Kong, further enhancing Hong Kong's status as an international financial center. This also provides external environmental support for the rise of the Hang Seng Index.

Market concerns after the surge: bubbles and risks

Although the surge in the Hang Seng Index has brought a positive market atmosphere, there are also many risks and uncertainties behind this sharp rise.

Increasing valuation pressure

The continued rise of the Hang Seng Index since the second half of 2024 has brought investors' confidence in the short term, but it has also caused the overall market valuation to rise. In particular, the valuations of some technology stocks and real estate sectors are close to historical highs. According to traditional valuation indicators such as price-to-earnings ratio (P/E) and price-to-book ratio (P/B), the valuations of some leading companies have approached or even exceeded the levels during the bull market in 2018, which may mean that the market's bubble risk is gradually rising.

Macroeconomic uncertainty

Although China's economic recovery has exceeded expectations, the overall trend of the global economy is still uncertain. The United States and other developed economies may face the risk of slowing economic growth, global inflationary pressures still exist, and monetary policy uncertainty may lead to turbulence in the capital market. In addition, fluctuations in global energy prices and geopolitical tensions may become potential risk factors in the market.

Sustainability of capital inflows

Although the Hong Kong stock market has attracted a large amount of foreign capital inflows, the sustainability of this capital inflow is still in doubt. With the changes in global interest rate policies, especially the Federal Reserve and other central banks may continue to raise interest rates or adopt tightening policies, the pace of foreign capital inflows may slow down, and there may even be capital outflows. If capital inflows slow down or reverse, the upward momentum of the Hang Seng Index may encounter significant pressure.

Risk of regulatory policy changes

Hong Kong's financial markets and stock markets face the risk of policy regulation, especially in the real estate and technology sectors. The Chinese government's regulatory policies on the real estate market and its regulatory policies on Internet companies may have an impact on the Hong Kong stock market. If there are major changes in policies, it may suppress the stock prices of some industries, thereby affecting the overall performance of the Hang Seng Index.

Forecast of subsequent trends: mild correction and shock consolidation

Considering that the current valuation level of the Hang Seng Index is already high and some risk factors in the market are gradually emerging, we make the following predictions for the future trend of the Hang Seng Index:

Maintain shock consolidation in the short term

Since the market's surge has brought higher valuations in the short term, it is expected that the Hang Seng Index may enter a stage of shock consolidation. Even if the Chinese economy continues to recover, the market has digested many good news, and there may be limited room for a sharp rise in the short term. The speed of capital inflow may also slow down, causing the Hang Seng Index to fluctuate within a certain range.

Mid-term risk alert

Entering the middle of 2025, if the global economy slows down or interest rates continue to rise, it may bring certain downward pressure on the Hang Seng Index. In particular, if foreign capital inflows slow down or withdraw, the valuation bubble of the Hang Seng Index may encounter challenges and may experience a certain degree of correction.

Long-term optimism about the opportunities brought by China's economic development

Although there may be adjustments in the short term, in the long run, with the continued development of China's economy, especially the advancement of technological innovation and consumption upgrading, the Hang Seng Index still has strong growth potential. In particular, if China makes breakthroughs in areas such as technological innovation and energy transformation, the Hong Kong market may usher in new growth momentum.

Summary

The surge in the Hang Seng Index in early 2025 is the result of the interweaving of multiple factors, with the strong support of China's economic recovery, as well as the promotion of global capital inflows and the stability of Hong Kong's financial markets. However, with the continuous rise in market valuations and the uncertainty of the macroeconomic environment, the Hang Seng Index may face certain adjustment pressures. In the short term, the Hang Seng Index is expected to enter a period of shock consolidation, but if the Chinese economy continues to recover, the potential in areas such as technology stocks and consumer upgrades is still worthy of investors' attention. In the coming period, investors should pay attention to global economic trends, capital flows, and policy changes to make more prudent investment decisions.

*Disclaimer: The content of this article is for learning only, does not represent the official position of VSTAR, and cannot be used as investment advice.