- Despite a 4% revenue decline year-over-year, Apple achieved all-time revenue records in services, indicating robust growth in this sector.

- The launch of Apple Vision Pro showcased the transformative potential of spatial computing, reflecting Apple's ambition to redefine user experiences.

- Apple's stock faced a downturn in Q1 2024, underperforming broader indices like the S&P 500 and NASDAQ, but the stock's 2024 outlook (technical) is bullish.

- Despite challenges, growth opportunities exist in segments like the smartphone market, consumer electronics, and services, supported by its strategic initiatives (like Gen AI).

I. Apple Q1 2024 Performance Analysis

A. Apple Key Segments Performance

Revenue reached $90.8 billion, marking a 4% decline year-over-year. Despite this, the company achieved all-time revenue records in services, indicating strong growth in this sector. Its net income stood at $23.6 billion, while earnings per share (EPS) hit a record high of $1.53, demonstrating solid profitability. Similarly, Operating cash flow remained robust at $22.7 billion, underscoring Apple's financial stability.

Source: Earnings Release

iPhone revenue faced a 10% decline year-over-year, primarily attributed to a challenging comparison due to a one-time impact from the previous year. However, iPhone models remained top-selling smartphones globally, with strong customer satisfaction levels. Mac revenue experienced a modest 4% growth, driven by the successful launch of new MacBook Air models powered by the M3 chip. The Mac installed base reached an all-time high, reflecting sustained customer loyalty. iPad revenue decreased by 17% year-over-year, attributed to tough comparisons with previous launches. Despite this, the iPad installed base continued to grow, reaching a new high.

Wearables, Home, and Accessories revenue dropped by 10%, mainly due to tough comparisons from previous product launches. However, the Apple Watch installed base reached a new high, indicating continued popularity among customers. Services revenue surged to an all-time high of $23.9 billion, growing by 14% year-over-year. This growth was driven by increased customer engagement, with paid subscriptions doubling over the past four years.

One of the key highlights was the launch of Apple Vision Pro, which demonstrated the transformative potential of spatial computing. This innovative product received enthusiastic feedback from users who experienced the magic of spatial computing firsthand. Apple's foray into this emerging technology signifies its ambition to redefine user experiences and unlock new possibilities across various industries.

B. Apple Stock Price Performance

Apple's stock faced a downturn during Q1 2024, with a market cap of $2.65 trillion. Opening and closing prices were $187.15 and $171.48, hitting highs and lows at $196.38 and $168.49. The stock witnessed a negative percentage change of -8.4%. Compared to broader indices like S&P 500 (SPX) and NASDAQ (NDX), Apple underperformed with SPX at 10.7% and NDX at 9.5%. This suggests Apple's stock experienced relative weakness compared to the overall market, possibly influenced by factors specific to the company or industry amidst broader market trends.

Source: tradingview.com

II. AAPL Stock Forecast 2024: Outlook & Growth Opportunities

A. Segments with Growth Potential:

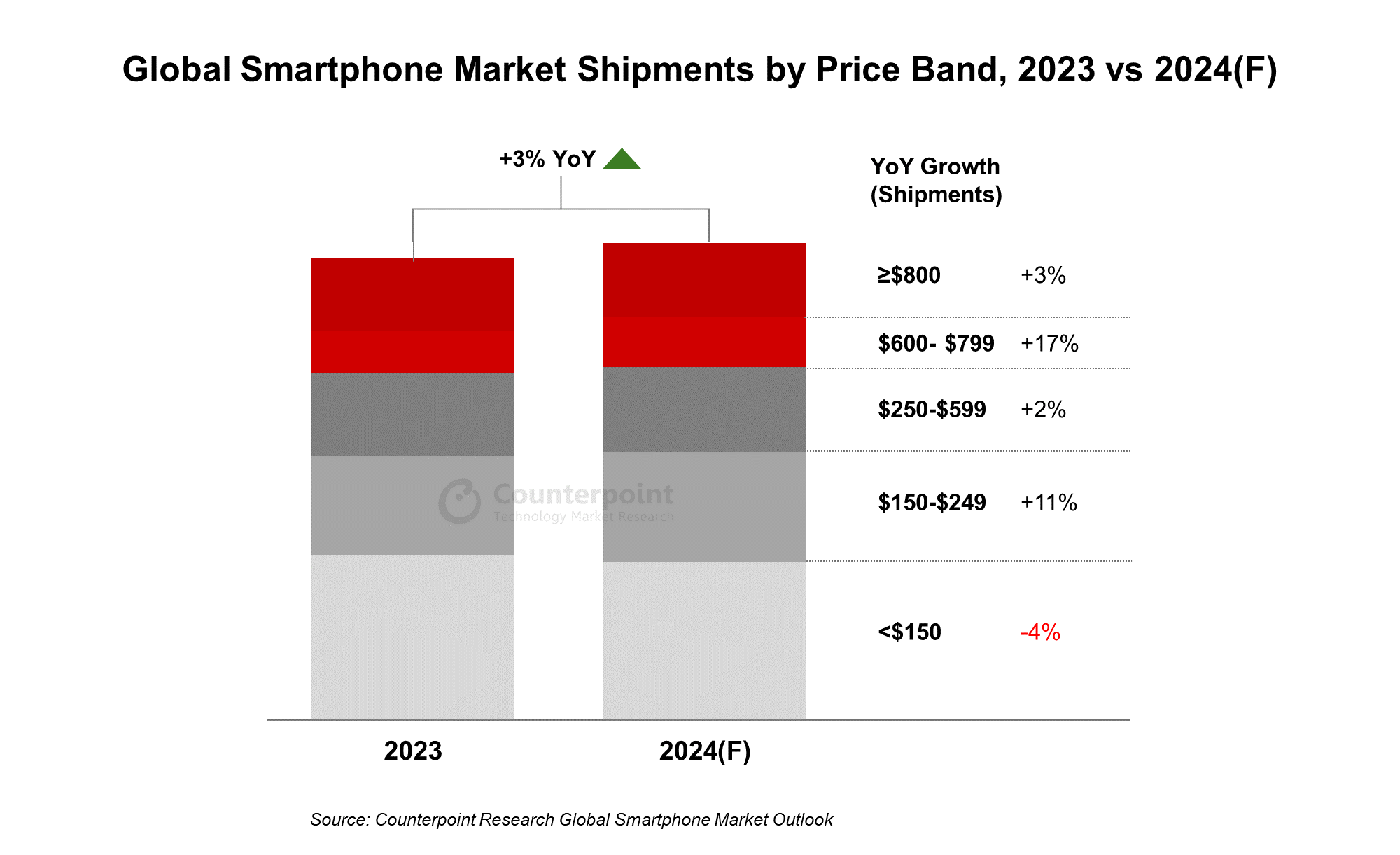

Smartphone Market: Despite a challenging 2023, the smartphone market is expected to rebound in 2024, with a projected 3% increase in global shipments, reaching 1.2 billion units. Notably, the premium segment ($600-$799) is anticipated to grow by 17% YoY, with Apple poised to benefit from this growth alongside Huawei.

Source: Counterpoint Research

Consumer Electronics Market: The consumer electronics market, particularly in segments like telephony, remains robust. In 2024, the global revenue in the consumer electronics market surpassed US$1 trillion, with significant contributions from countries like China. Per capita spending on consumer electronics is also expected to rise, indicating a growing market.

Services: Apple's services segment continues to show strong growth, setting an all-time revenue record with a 14% increase year-over-year. This growth is fueled by increased customer engagement and a growing installed base of active devices. Paid subscriptions are growing steadily, indicating a reliable revenue stream for Apple.

B. Expansions and Strategic Initiatives:

Research and Development Investments: Apple's focus on Generative AI reflects its strategic investment in cutting-edge technologies. By harnessing the power of Generative AI, Apple aims to drive innovation and differentiation in areas such as machine learning, natural language processing, and computer vision. These investments underscore Apple's commitment to staying at the forefront of AI development and leveraging it to enhance its products and services.

Product Diversification and Launches: Apple's recent product launches, such as the new MacBook Air powered by the M3 chip, highlight its strategy of diversification and innovation. The positive reception of these products indicates potential growth opportunities in segments beyond smartphones, such as laptops and tablets. Additionally, upcoming product announcements and events like the Worldwide Developers Conference indicate a continuous pipeline of innovative offerings, which could further boost revenue and market share.

Partnerships and Collaborations: Collaborations with enterprise clients like Epic Systems demonstrate Apple's efforts to expand its presence in non-consumer markets. These partnerships open avenues for Apple to penetrate industries like healthcare, leveraging its technology to drive productivity and innovation. Such collaborations enhance Apple's ecosystem and revenue streams beyond traditional consumer markets.

Environmental Initiatives: Apple's commitment to environmental sustainability, including its goal of being carbon-neutral across all products by 2030. This aligns with growing consumer preferences for eco-friendly brands. This focus on sustainability could attract environmentally-conscious consumers and drive long-term brand loyalty and revenue growth.

III. Apple Stock Price Prediction 2024

A. Apple Stock Forecast: Technical Analysis

The average price target of Apple stock by the end of 2024 is projected at $215.00, with an optimistic target of $228.00. The primary support level is at $180.70, while resistance levels are set at $194.74 and $213.12 in case of heightened volatility.

Source: tradingview.com

AAPL stock is currently trading at $182.40, with a sideways trend indicated by the modified exponential moving average at $178.86, slightly above the baseline of $179.34. The Relative Strength Index (RSI) stands at 54.77, indicating moderate bullish sentiment with bullish divergence in current swing.

However, the Moving Average Convergence/Divergence (MACD) trend is bearish, with decreasing strength (based on the histogram). This is indicated by the MACD line at -1.71, below the signal line at -0.973.

Source: tradingview.com

B. Apple Stock Prediction: Fundamental Analysis

In terms of fundamental analysis, Apple's financial ratios suggest a slightly higher valuation compared to the sector median. The P/E ratio (Forward) is at 27.62, indicating a 16.99% premium over the sector median. Meanwhile, the PEG ratio (Forward) stands at 2.58, suggesting a 33.92% premium. Other metrics such as EV/EBITDA and Price/Book also indicate premiums compared to sector medians. However, the Price/Cash Flow ratio is slightly below the sector median, indicating a potential undervaluation by this metric.

Source: Analyst's Compilation

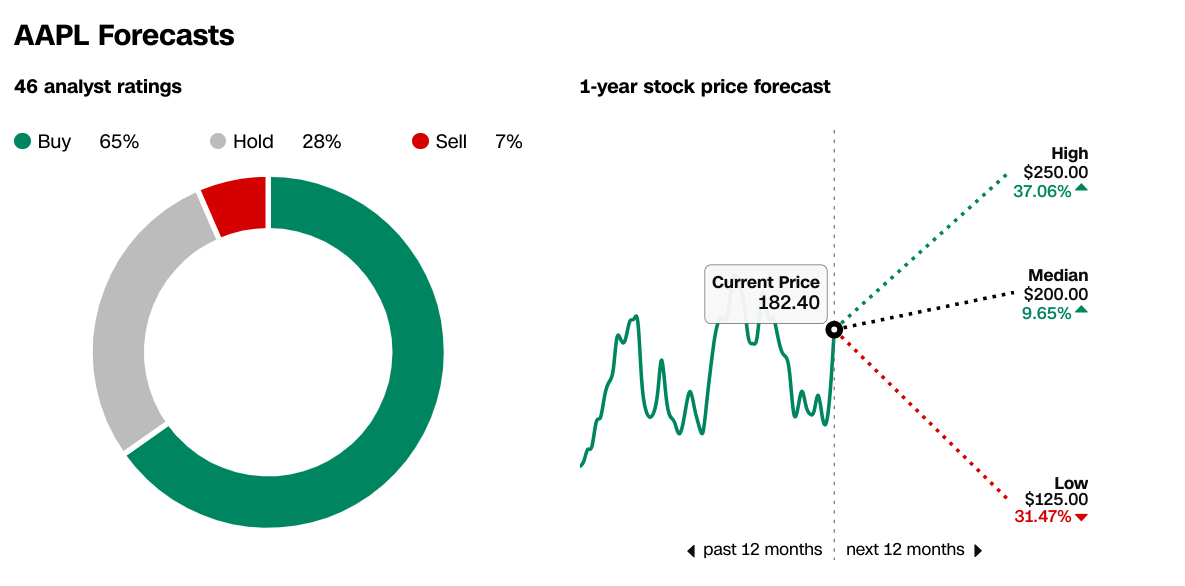

AAPL Price Target

Analyst recommendations and price targets vary, with a majority of analysts maintaining a "Buy" or "Hold" stance. The high Apple price target stands at $250.00, the median at $200.00, and the low at $125.00, with an average of $201.40.

Source: WSJ.com

Source: CNN.com

C. Apple Stock Predictions: Market Sentiment

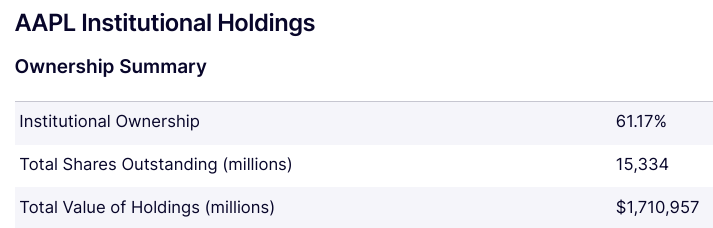

Investor confidence remains high, with institutional holdings accounting for 61.17% of total shares outstanding, reflecting significant confidence from large investors. However, short interest has decreased slightly from 108,782,648 to 101,912,593 shares, indicating a potential decrease in bearish sentiment. But it covers less than 2 days of daily shares volume, thus the market's bearish stance is insignificant as of April 2024.

Source: Nasdaq.com

Source: Nasdaq.com

IV. Apple Stock Forecast 2024: Challenges & Risk Factors

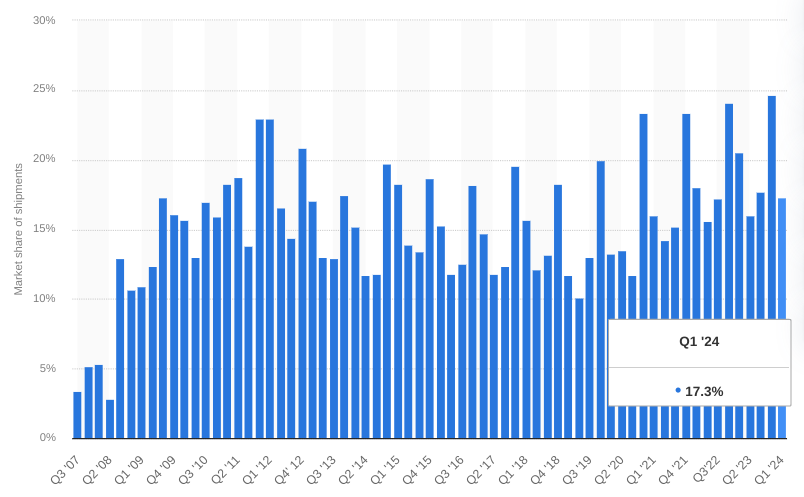

Apple's market share declined to 17.3%, trailing behind Samsung, which holds 20.8%. Apple competitors like Samsung, Xiaomi, Oppo, and Transsion have gained ground, posing a threat to Apple's dominance. Samsung and Apple continue to dominate the smartphone market, but the emergence of new competitors and shifts in consumer preferences could impact Apple's position.

iPhone unit shipments as share of global smartphone shipments from 3rd quarter 2007 to 1st quarter 2024

Source: statista.com

Moreover, Apple faces regulatory challenges, particularly in the EU, related to compliance with the Digital Markets Act (DMA). Changes to iOS, the App Store, and Safari are intended to comply with DMA obligations, but these efforts face challenges from regulatory bodies and private litigants. Antitrust investigations and litigation in various jurisdictions also pose risks to Apple's business practices and could result in significant fines and changes to operations.

Notably, Apple is subject to civil antitrust lawsuits in the U.S. and investigations in Europe regarding App Store terms and conditions. Adverse outcomes in these legal proceedings could lead to fines and further changes in business practices, impacting Apple's reputation, operations, and financial condition. Despite setting revenue records and achieving strong performance in services, Mac, and iPad, certain product categories like iPhone and Wearables, Home, and Accessories experienced declines. While Apple remains optimistic about its future, challenges in specific product categories may affect overall revenue growth.

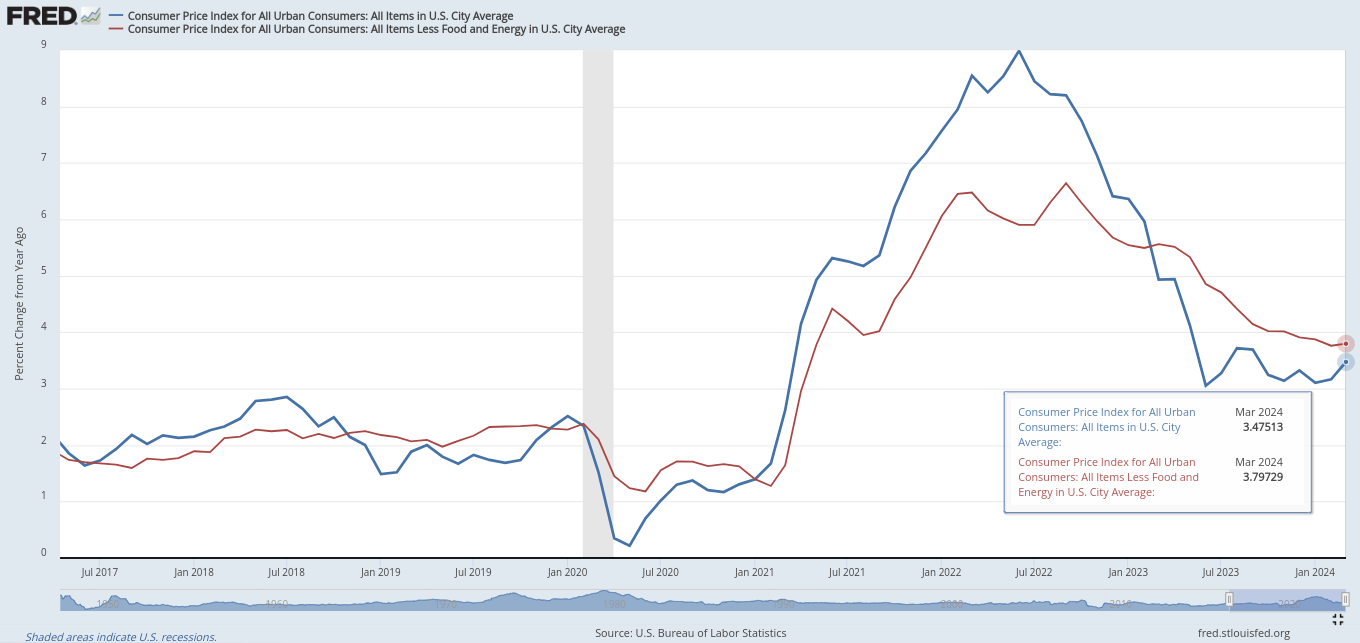

Finally, under current high interest and inflation, Apple operates in an uneven macroeconomic environment. This impacts consumer spending and demand for its products (luxury category). Economic uncertainties in 2024 may continue to affect Apple's performance and growth projections.

Source: fred.stlouisfed.org

In conclusion, Apple delivered a mixed performance in Q1 2024. Despite a slight revenue decline, its profitability remained robust, particularly driven by the services segment. iPhone sales faced challenges, but other segments like Mac and services showed resilience and growth. Apple stock experienced relative weakness compared to broader market indices, possibly influenced by company-specific factors or broader market trends.

Looking ahead, Apple remains positioned to benefit from growth opportunities in the smartphone and consumer electronics markets, alongside its expanding services segment. Strategic initiatives like AI research investments, product diversification, and partnerships indicate potential avenues for growth. However, challenges such as intensifying competition, regulatory pressures, and market performance fluctuations pose risks.

In terms of investment recommendations, considering strong fundamentals, growth potential, and market sentiment, Apple stock is a cautious buy for long-term investors. Short-term traders might leverage platforms like VSTAR for CFD trading, capitalizing on market volatility with proper risk management.